Investing in the right opportunities can be a game-changer for those looking to grow their wealth. One such avenue that has gained significant attention is Cadre Opportunity Zones. These zones present an intriguing proposition for investors who are keen on exploring new avenues and maximizing their returns.

In this article, we will delve into the world of Cadre Opportunity Zones, understand their benefits, learn how to identify and evaluate investments, explore real-life success stories, and discuss the future outlook of this investment option.

Introduction and Overview

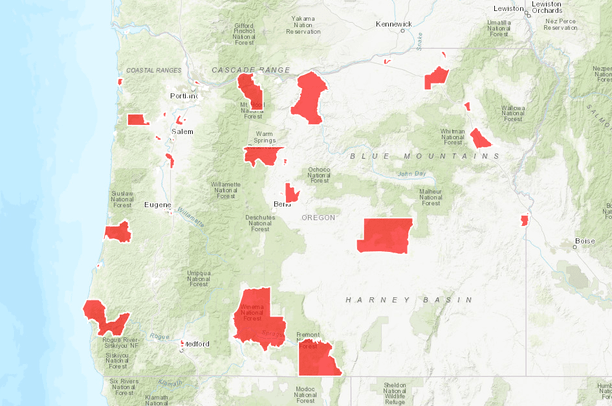

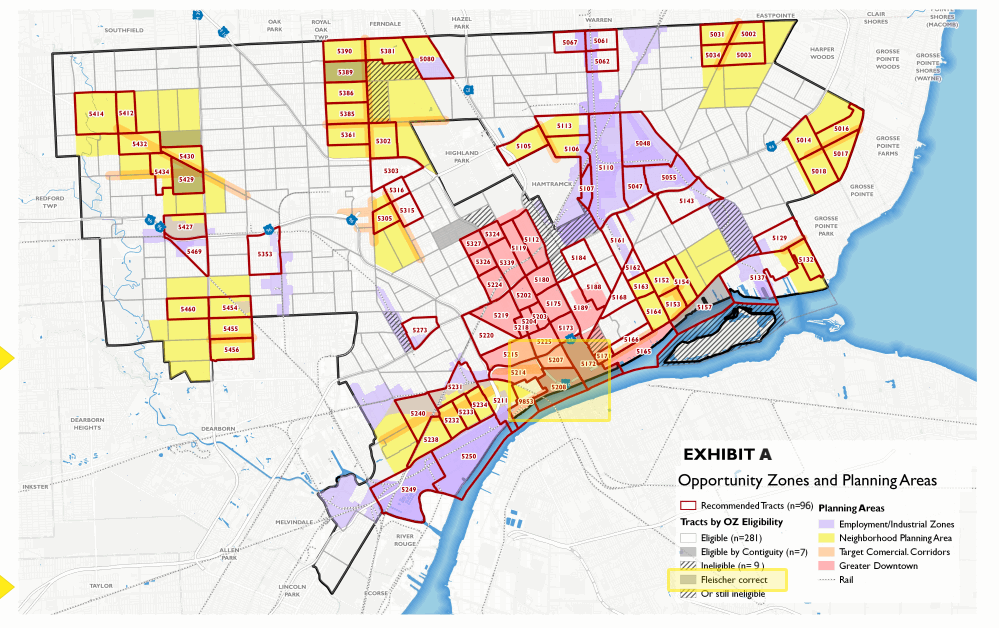

Opportunity Zones are designated areas that promote economic development through targeted investments. Investors who direct their capital gains into qualified projects within these zones can enjoy attractive tax incentives while revitalizing economically distressed communities.

Investing in Opportunity Zones supports community development and offers advantages such as deferring capital gains taxes, reducing tax liabilities on reinvested gains, and even eliminating taxes on new appreciation if held for a certain period.

This article explores the benefits of investing in Opportunity Zones and provides an overview of how they stimulate economic growth in underprivileged areas.

Understanding the Benefits of Cadre Opportunity Zones

Investing in Cadre Opportunity Zones offers unique advantages over traditional options. With carefully vetted projects that align with individual goals, investors can diversify their portfolios across multiple zones and leverage technology-driven processes for efficient project management.

By investing in economically distressed areas, investors contribute to job creation and economic growth.

In summary, Cadre Opportunity Zones provide targeted investments, portfolio diversification, efficient project management, and the opportunity for positive social impact.

How to Identify and Evaluate Cadre Opportunity Zone Investments

Cadre offers a meticulous process for identifying and evaluating Opportunity Zone investments. Their approach includes thorough research, careful project selection, risk assessment, investor alignment, and transparency.

Cadre begins by conducting extensive research to identify promising Opportunity Zones based on socioeconomic factors. They then carefully evaluate each project’s feasibility, market demand, development plans, and potential returns. Risk assessment is conducted to analyze regulatory hurdles and market volatility.

Investor alignment is a priority for Cadre as they ensure that investment opportunities match individual risk tolerance, financial objectives, and desired time horizon.

Transparency is maintained through detailed information provided about each investment opportunity including financial projections, property details, team credentials, and legal documentation.

Once registered on the Cadre platform, investors gain access to curated investment opportunities customized based on factors like risk profile, expected returns, time horizon, and personal preferences. Investors can review detailed profiles of each project before making informed decisions that align with their goals.

In summary, Cadre’s process involves research, project evaluation, risk assessment, investor alignment, and transparency. This comprehensive approach enables investors to make well-informed decisions regarding Opportunity Zone investments.

Case Studies: Successful Investments with Cadre

Cadre has a strong track record of successful investments, as demonstrated by their case studies. These real-life examples highlight the positive outcomes achieved when investing through Cadre’s platform.

One case study involves the transformation of a dilapidated neighborhood into a thriving business district through a commercial real estate development in an Opportunity Zone. This project not only provided attractive returns for investors but also revitalized the entire area.

Another case study focuses on Cadre’s facilitation of investments in affordable housing projects within Opportunity Zones. This initiative addresses the critical need for housing while generating steady rental income for investors.

Additionally, Cadre’s involvement in converting an old industrial building into a technology hub resulted in significant appreciation and attracted leading tech companies to the area.

Furthermore, mixed-use development projects combining residential and commercial spaces have successfully revitalized neglected neighborhoods, attracting new businesses and increasing property values.

These case studies showcase the diverse investment opportunities available through Cadre and its commitment to delivering profitable ventures with positive community impact.

Getting Started with Cadre Opportunity Zones: Fund Contact Information

To kickstart your journey into investing in Cadre Opportunity Zones, there are a few essential steps to follow. The first option is to visit Cadre’s user-friendly website, which provides a wealth of information on the investment process, eligibility criteria, and available opportunities.

With detailed explanations and helpful resources, the website serves as a comprehensive guide for potential investors.

For those who prefer a more personalized approach or have specific inquiries, reaching out to Cadre’s dedicated fund representatives is highly recommended. These knowledgeable professionals possess an in-depth understanding of the investment landscape and can provide tailored advice based on individual circumstances.

To contact the team at Cadre, simply refer to the following information:

| Contact Method | Details |

|---|---|

| Phone | [Phone Number] |

| [Email Address] | |

| Online Form | [Link to Online Contact Form] |

Whether you have questions about the investment process or require additional information regarding investing through Cadre’s platform, their team is readily available to assist you. Don’t hesitate to reach out via your preferred communication channel for prompt and reliable support.

By taking advantage of these resources provided by Cadre, individuals interested in exploring the potential of investing in Opportunity Zones can navigate the intricate landscape with confidence and make informed decisions that align with their financial goals.

Risks and Challenges Associated with Investing in Opportunity Zones

Investing in Opportunity Zones has inherent risks that investors should be aware of. Economic downturns can affect market conditions, regulatory changes may impact tax benefits, project delays or cost overruns can occur, and long-term investments may pose liquidity challenges. To mitigate these risks:

1. Diversify investments across different zones.

2. Conduct thorough due diligence on each project.

3. Stay informed about economic indicators and legislative changes.

These strategies help investors make informed decisions and minimize potential negative impacts on their investments. By carefully considering the risks associated with investing in Opportunity Zones, investors can navigate these challenges more effectively.

The Future Outlook for Investing in Cadre Opportunity Zones

Investing in Cadre Opportunity Zones is expected to gain popularity and success as more investors recognize the benefits of investing in economically distressed areas.

With continued government support, ongoing community development initiatives, and increasing interest from both individual and institutional investors, the future outlook for investing in these zones appears promising.

However, investments in Opportunity Zones are subject to external factors such as changes in legislation or economic conditions. Investors should stay informed about policy updates or shifts that may affect tax incentives, project financing, or overall market dynamics.

By remaining adaptable and proactive, they can navigate potential challenges and capitalize on emerging opportunities.

The Potential of Cadre Opportunity Zones

Investors today are constantly seeking opportunities that not only offer financial returns but also allow them to make a positive impact on society. In this regard, Cadre Opportunity Zones present a unique avenue for investors to achieve both objectives simultaneously.

These zones have been specifically designed to revitalize economically distressed communities and provide investors with a chance to contribute to their growth.

What sets Cadre Opportunity Zones apart is their ability to leverage the benefits offered by these designated areas while utilizing platforms like Cadre itself. By doing so, investors gain access to carefully selected projects that have substantial growth potential.

This combination of targeted investment opportunities and a streamlined platform makes investing in Cadre Opportunity Zones an enticing proposition.

It’s important to acknowledge that investing always carries some level of inherent risk. However, thorough due diligence, diversification strategies, and staying informed can help mitigate these risks.

Investors who take the time to thoroughly research and analyze potential projects within Cadre Opportunity Zones will be better equipped to make informed decisions.

By exploring the investment options available in Cadre Opportunity Zones, investors can unlock tremendous potential for financial growth while making a positive social impact. These zones provide an opportunity for individuals or companies looking to align their investment goals with their desire to revitalize struggling communities.

The potential for both financial return and social good makes investing in Cadre Opportunity Zones an attractive proposition.

In summary, Cadre Opportunity Zones offer a pathway towards achieving financial goals while contributing positively towards the revitalization of disadvantaged communities.

With careful consideration, thorough due diligence, and utilizing platforms like Cadre, investors can embark on a journey towards financial growth while making a lasting difference in society.

[lyte id=’4Opg1fzTc3w’]