In today’s digital age, investing has become more accessible than ever before. With a plethora of investment options available at the touch of a button, it’s easy to overlook some of the more traditional avenues for financial growth. One such avenue is investing in paper stocks.

While many may view this as an outdated practice, paper stocks still hold relevance and can offer unique opportunities for investors.

Investing in Paper Stocks

Investing in paper stocks means buying shares of companies involved in producing and distributing various paper products. These companies specialize in mass-market printing papers, specialty papers used in packaging or textiles, and more.

There are benefits and drawbacks to consider when investing in paper stocks. On one hand, they can provide stable long-term returns and allow investors to participate in company growth. On the other hand, the decline of print media and digital alternatives have impacted the industry, requiring careful analysis.

Despite digital advancements, paper remains essential in areas like packaging and industrial applications. Some sectors prioritize physical documents for security or legal reasons, creating a demand for high-quality paper products. Certain companies within the industry continue to thrive despite digital advancements.

Investing in paper stocks offers potential for stable returns. However, it requires staying informed about market trends and evaluating individual company performance to make informed decisions within this evolving industry.

The Leading Paper Companies to Invest In

To make wise investment decisions in the paper industry, it’s crucial to focus on the leading companies in the market. These companies have proven themselves as industry leaders and offer potential opportunities for investors.

By analyzing their financial performance, investors can assess stability, growth potential, and market position. Key metrics like revenue, profitability, and debt levels provide valuable insights for informed decision-making.

Consideration of a company’s market position is essential. A strong presence indicates resilience and sustainable returns amid competition.

Product diversification reduces risk associated with demand fluctuations or changing consumer preferences.

Sustainability practices are increasingly important. Investing in companies with sustainable sourcing, recycling programs, and energy efficiency enhances brand reputation and consumer trust.

Choosing the right paper company to invest in requires thorough research on factors such as financial health, market position, product diversification, and sustainability practices. This analysis minimizes risks while identifying promising opportunities aligned with investor goals.

International Paper: A Global Investment Opportunity

International Paper stands out as a lucrative investment opportunity in the global paper industry. As one of the largest paper companies worldwide, it has established a strong presence across multiple continents, solidifying its position as a significant player in the market.

When analyzing International Paper’s financial performance, investors gain valuable insights into its stability and growth potential. By closely examining revenue trends, profit margins, and market share, individuals can gauge the company’s competitiveness within the industry.

This data-driven approach allows for informed decision-making and helps identify opportunities for potential returns on investment.

Investors should consider several key factors when contemplating an investment in International Paper. Firstly, evaluating macroeconomic conditions affecting the paper industry is crucial to understand its overall trajectory and potential challenges or opportunities that may arise.

Additionally, understanding regulatory environments across different regions is essential to assess how these factors may impact International Paper’s operations and profitability.

Furthermore, assessing any potential risks associated with international operations is vital. This includes considering geopolitical factors, currency fluctuations, and trade policies that could affect the company’s performance on a global scale.

Conducting thorough due diligence on these aspects provides investors with a comprehensive understanding of both the rewards and risks before making their investment decisions.

Investing in Schweitzer-Mauduit: A Lucrative Opportunity in Specialty Papers

Schweitzer-Mauduit is a renowned specialty paper manufacturer with a strong focus on producing papers for various industries, including tobacco packaging and filtration systems. With its expertise and dedication to innovation, investing in Schweitzer-Mauduit presents unique opportunities within the niche specialty paper market.

One of the key factors that make Schweitzer-Mauduit an attractive investment option is its consistent financial performance and significant market opportunities. Through a thorough analysis of its financial records and market position, potential investors can assess the company’s potential for growth within the specialty paper industry.

What sets Schweitzer-Mauduit apart from its competitors is its unwavering commitment to developing innovative products. By keeping up with changing industry demands, the company has managed to stay ahead of the curve. This adaptability not only ensures its sustainability but also positions it as a leader in the specialty paper market.

Investing in Schweitzer-Mauduit means joining forces with a company that prioritizes research and development. By continuously enhancing their product offerings and exploring new avenues, they consistently meet customer needs while staying ahead of emerging trends.

This approach not only strengthens their foothold in existing markets but also opens doors to new business opportunities.

Furthermore, Schweitzer-Mauduit’s ability to cater to diverse industries like tobacco packaging and filtration systems provides investors with a diversified revenue stream. Such diversification shields the company from overreliance on any single market, reducing risks associated with economic downturns or shifts in consumer behavior.

Resolute Forest Products: Sustainable Investment Options

Resolute Forest Products is an appealing choice for environmentally conscious investors seeking sustainable options. With a commitment to responsible forest management and transparent reporting, investing in Resolute aligns with socially responsible principles.

By analyzing its financial performance alongside sustainability efforts, investors can understand potential returns and environmental impact. This investment not only supports positive change within the paper industry but also contributes to social value through community engagement.

Resolute Forest Products offers a compelling opportunity to align financial goals with sustainable practices.

Strategies for Successful Paper Stock Investments

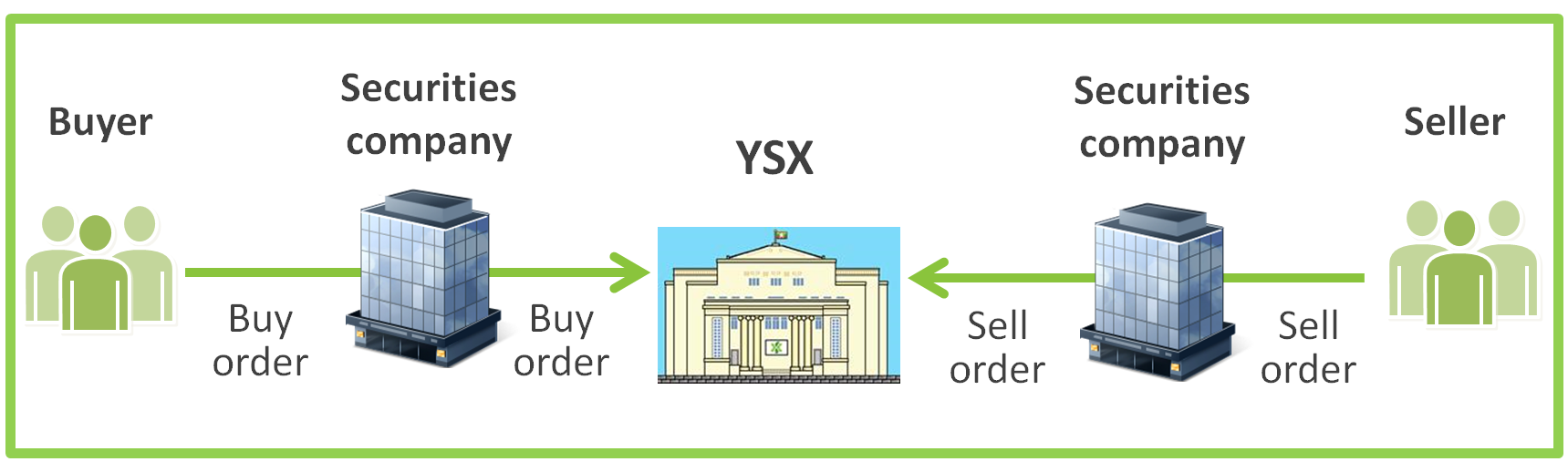

Investing in paper stocks requires strategic decision-making to maximize returns and mitigate risks. Two key strategies are diversifying investments across different paper companies and weighing the pros and cons of long-term versus short-term investing.

Diversification helps spread risks while allowing participation in various areas of the industry. Choosing the right investment timeframe aligns with individual goals and risk tolerance levels. Staying informed about market trends and news related to paper stocks enables timely decision-making based on up-to-date information.

These strategies can help investors navigate the paper stock market with confidence and increase their chances of success.

Common Mistakes to Avoid When Investing in Paper Stocks

Investing in paper stocks can be a lucrative venture if approached with caution and careful consideration. However, there are several common mistakes that investors should avoid to ensure they make informed decisions and maximize their potential returns.

A. Investing Without Research

One of the biggest mistakes investors make when venturing into the world of paper stocks is failing to conduct thorough research. It is essential to delve deep into the financials, market positioning, and growth prospects of the paper companies being considered for investment.

Without proper due diligence, investors risk making poor decisions based on incomplete or inaccurate information, which can lead to significant losses.

B. Impulsive Buying/Selling

Emotions have no place in the realm of investing, especially when it comes to paper stocks. Allowing impulsive buying or selling decisions based on short-term market fluctuations or emotional responses can be detrimental to long-term success.

It is important to maintain a disciplined approach by sticking to an investment strategy based on sound analysis and logical reasoning rather than succumbing to momentary market volatility.

C. Ignoring Market Trends

Staying informed about market trends and adapting investment strategies accordingly is crucial in any investment endeavor, including paper stocks. Ignoring market trends can limit potential returns and expose investors to unnecessary risks.

By staying updated on industry developments, technological advancements, changing consumer preferences, and global economic factors that impact the paper industry, investors can position themselves advantageously and make more informed investment choices.

In summary, investing in paper stocks requires careful research, discipline, and awareness of market dynamics. By avoiding common mistakes such as neglecting research, making impulsive buying or selling decisions driven by emotions, and ignoring market trends, investors can enhance their chances of success in this competitive sector.

Conclusion: The Future Outlook for Paper Stocks

[lyte id=’wR384mibcDQ’]