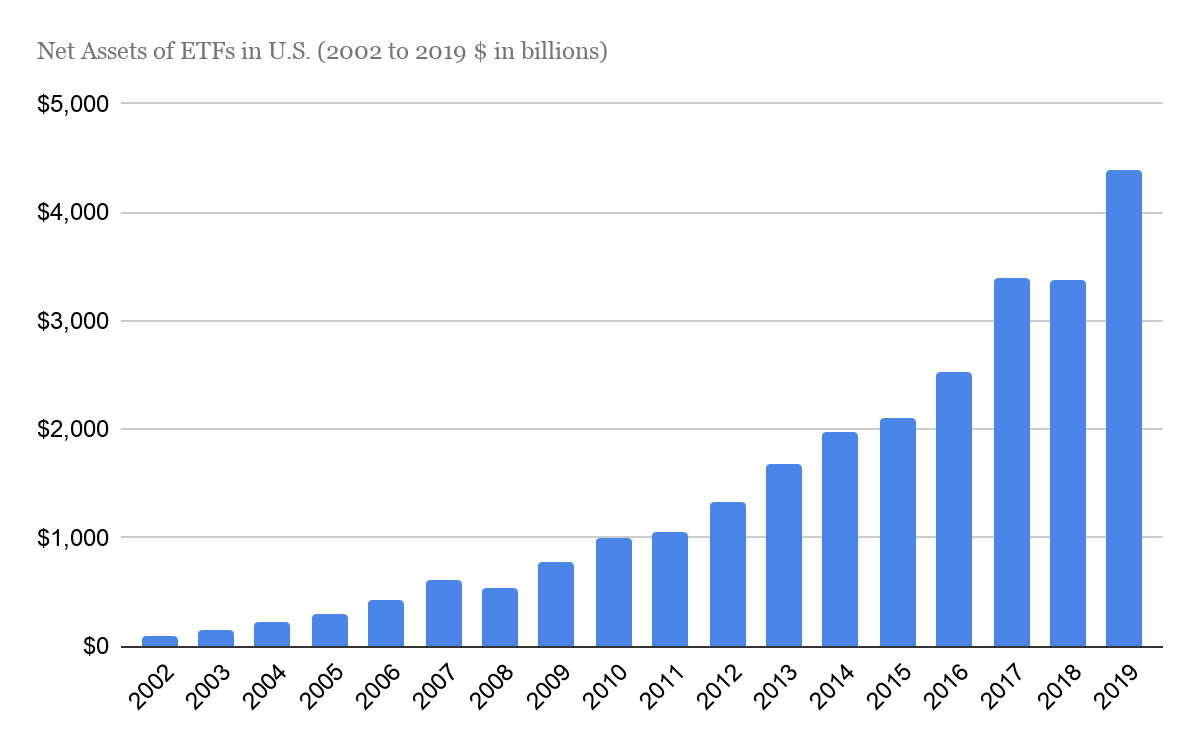

Investing in Exchange-Traded Funds (ETFs) has become increasingly popular among investors looking for a diversified and cost-effective way to access various asset classes.

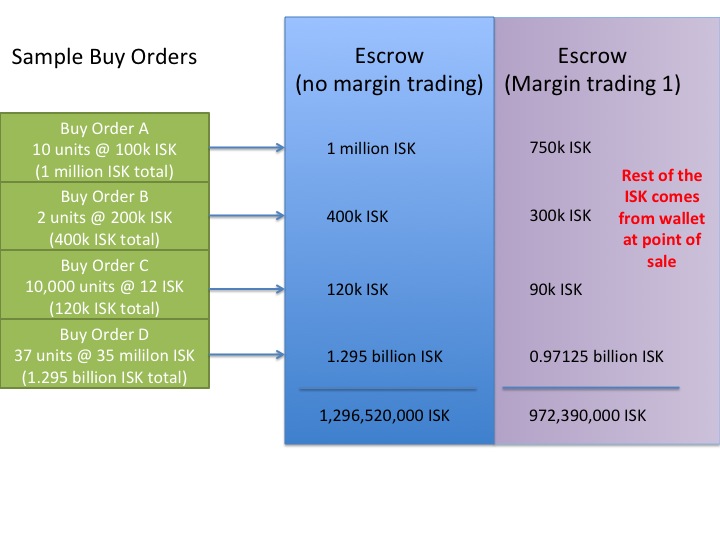

But what if you could potentially amplify your returns by buying ETFs on margin? Margin trading is a practice that allows investors to borrow funds from their brokerage firm to buy more securities than they could with just their own capital.

In this article, we will explore the pros and cons of buying ETFs on margin, factors to consider before taking this approach, strategies for safe margin trading, and examples of successful and unsuccessful cases. So, let’s dive into the world of buying ETFs on margin.

Understanding ETFs and Margin Trading

Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges that aim to track the performance of a specific index, sector, or commodity. They offer investors exposure to a diversified portfolio of assets while providing the flexibility and liquidity of individual stocks.

Margin trading allows investors to borrow money from their brokers to purchase additional securities beyond their available cash balance. By leveraging existing investments as collateral, investors can increase the size of their investment position.

However, it’s important to note that margin trading amplifies both gains and losses, and careful consideration of risk tolerance is necessary before engaging in this strategy.

ETFs provide diversification by investing in a wide range of securities within a particular index or sector. They also offer transparency through daily disclosure of holdings. Margin trading with ETFs can be a powerful tool for experienced investors but requires thorough assessment of risk tolerance and financial situation.

The Pros and Cons of Buying ETFs on Margin

When buying ETFs on margin, there are advantages and disadvantages to consider. By utilizing borrowed funds, you have the potential for higher returns if the underlying assets’ prices rise significantly. This leverage can amplify gains compared to investing with only your own capital.

Additionally, buying ETFs on margin allows for further diversification of your portfolio without tying up all available cash.

However, there are risks involved. If the underlying assets’ prices decline, losses can be magnified due to the borrowed funds. Interest expenses and potential margin calls add additional costs and obligations.

Moreover, margin trading introduces emotional stress and psychological pressure, which can lead to impulsive decision-making driven by fear or greed.

In summary, buying ETFs on margin offers increased potential for higher returns and diversification benefits but comes with increased risks, interest costs, potential margin calls, and added emotional stress. It is important to carefully assess risk tolerance before engaging in margin trading.

Factors to Consider Before Buying ETFs on Margin

When buying ETFs on margin, it’s crucial to evaluate your risk tolerance, understand the specific ETF you want to buy, and evaluate market conditions and trends. Assessing your risk tolerance helps determine how comfortable you are with potential losses and if you have the financial stability to handle adverse outcomes.

Thoroughly researching the specific ETF is essential, considering its underlying assets, expense ratios, historical performance, and associated risks. Evaluating market conditions and trends involves analyzing interest rates, economic indicators, sector performance, and overall market sentiment to make well-informed investment decisions.

By considering these factors together, you can minimize risks and make more informed decisions when buying ETFs on margin.

Strategies for Safe Margin Trading with ETFs

Margin trading with ETFs involves higher risks and potential rewards. To ensure a safe approach, consider the following strategies:

-

Set clear investment objectives and timeframes to align margin trading decisions with long-term goals.

-

Establish a well-diversified asset allocation plan to spread risk effectively across different sectors or asset classes.

-

Implement risk management techniques like setting stop-loss orders to mitigate potential losses in volatile markets.

-

Monitor and adjust leverage levels regularly to maintain a balanced and safe margin trading strategy.

-

Regularly review and rebalance your portfolio to adapt to changing market conditions and keep your investment strategy aligned with objectives.

By incorporating these strategies, investors can navigate margin trading with ETFs more safely while maximizing potential returns.

Tips for Successful Margin Trading with ETFs

When engaging in margin trading with ETFs, it’s crucial to conduct thorough research before making any investment decisions. Evaluate the fundamentals of the underlying assets within the chosen ETF, analyze historical performance, assess market conditions, and stay up-to-date with relevant news or events that may impact your investment.

Monitor your investments regularly and be prepared to adjust your positions accordingly. Stay informed about market developments, evaluate the performance of your holdings, and align your positions with your investment objectives.

Set realistic expectations and practice effective risk management techniques. Understand the potential downsides of margin trading and establish disciplined approaches such as setting stop-loss orders and diversifying your portfolio.

Educate yourself on financial markets, investment principles, and risk management strategies. Consider seeking professional advice from experienced professionals who can provide tailored insights to help you navigate the complexities of margin trading with ETFs.

By following these tips, you increase your chances of successful margin trading with ETFs while minimizing unnecessary risks.

Examples of Successful (and Unsuccessful) Cases of Buying ETFs on Margin

Investing in ETFs on margin can be a risky endeavor, but it can also lead to significant gains. Let’s explore two real-life examples to understand the outcomes and lessons learned.

John carefully monitored the energy sector and identified favorable market conditions for potential growth. He used margin trading to amplify his investment in an energy sector ETF when prices were low. As the sector experienced a significant boom, John’s position resulted in substantial gains, outperforming if he had only used his own capital.

Jane believed that the technology sector would continue its upward trajectory indefinitely and bought a technology sector ETF on margin at its peak. Unfortunately, her timing was poor as the sector experienced a sharp downturn. Her amplified losses accentuated the decline, resulting in significant financial setbacks.

These examples demonstrate that careful strategy, timing, and thorough research are crucial when engaging in margin trading with ETFs. While success can bring substantial gains, failure can lead to significant losses.

By learning from both successful and unsuccessful cases, investors can make more informed decisions and navigate the complexities of margin trading with greater confidence.

Common Mistakes to Avoid When Buying ETFs on Margin

When it comes to buying ETFs on margin, there are several common mistakes that investors should be aware of in order to protect their financial well-being. One of the most critical errors is borrowing more than you can afford to lose.

It is essential to exercise caution and only borrow funds that you are comfortable losing without jeopardizing your overall financial stability.

Another mistake to avoid is not fully understanding the risks and costs involved in margin trading. Before engaging in this approach, it is crucial to thoroughly educate yourself about the potential risks and costs associated with it.

By understanding these factors, you will be able to make informed decisions and effectively manage your investments.

Furthermore, it is important not to be influenced by short-term market fluctuations when buying ETFs on margin. Making impulsive decisions based solely on temporary market movements can have detrimental effects on your investment strategy. Instead, maintain a long-term perspective and stick to your predetermined investment plan.

This will help you stay focused and prevent you from being swayed by short-term noise or volatility.

In summary, avoiding certain mistakes when buying ETFs on margin is vital for successful investing. By only borrowing what you can afford to lose, understanding the risks involved, and maintaining a long-term perspective, you can mitigate potential pitfalls and increase the likelihood of achieving your investment goals.

Remember that careful planning and informed decision-making are key when engaging in margin trading with ETFs.

| Common Mistakes | Impact |

|---|---|

| Borrowing more than you can afford to lose | Jeopardizes financial well-being |

| Not understanding the risks and costs involved | Makes informed decisions difficult |

| Being influenced by short-term market fluctuations | Hinders long-term investment strategy |

(Note: The table above provides a concise overview of the common mistakes discussed in this section.)

Conclusion

[lyte id=’Jn0nZkAivfY’]