Investing in rare earth metals has become an increasingly popular option for savvy investors looking to diversify their portfolios and capitalize on the growing demand for these valuable resources. Rare earth metals have unique characteristics that make them essential components in various industries, including technology and clean energy.

In this article, we will explore what rare earths are, the factors affecting their supply and demand, investment opportunities and strategies, how to invest in rare earths step-by-step, risks and challenges associated with investing in this sector, managing your investments, and why rare earth metals should be considered as a valuable addition to investment portfolios.

What are Rare Earths?

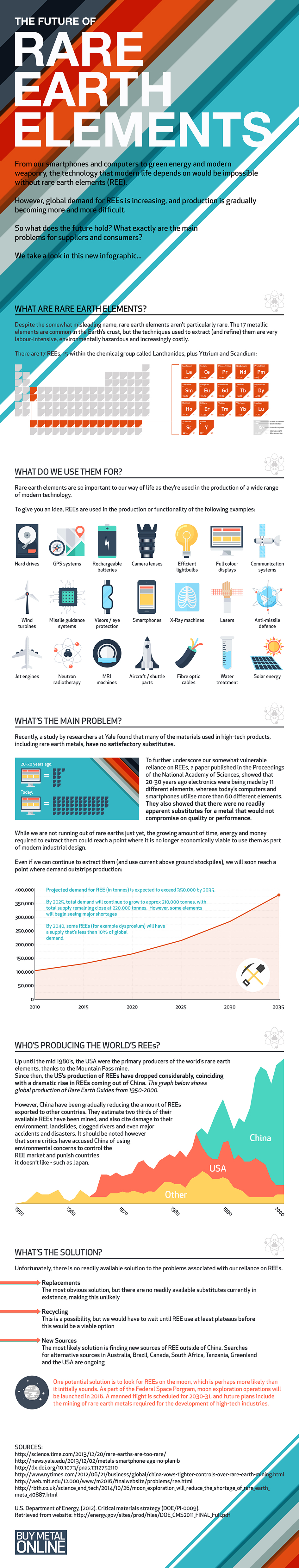

Rare earths are a group of 17 elements that can be found within the Earth’s crust. Despite their name, these metals are not actually rare, but rather sparsely distributed around the globe. They possess unique properties that make them essential components in various high-tech applications.

The term “rare earths” refers to a diverse range of elements including lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, lutetium, yttrium and scandium.

These elements hold significant importance due to their distinctive chemical properties and atomic structures.

Each rare earth metal has its own distinct characteristics and applications. They can be further categorized into two groups: light rare earths and heavy rare earths. The light rare earths include lanthanum to europium elements while gadolinium to lutetium fall under the category of heavy rare earths.

Light rare earth metals such as lanthanum and cerium are widely used in electronics industries for their excellent electrical conductivity and magnetic properties. Neodymium is highly valued for its strong magnetism and is extensively utilized in the production of powerful magnets found in electric vehicles and wind turbines.

On the other hand, heavy rare earth metals like gadolinium and dysprosium find application in defense technologies due to their ability to absorb neutrons. They also play a crucial role in healthcare systems as contrast agents for medical imaging procedures.

Overall, the significance of rare earth metals cannot be understated. Their unique properties make them indispensable in various industries ranging from electronics to renewable energy to defense and healthcare.

Understanding the diverse characteristics and applications of these elements allows us to appreciate their vital role in advancing technology and improving our daily lives.

Factors Affecting Supply and Demand for Rare Earths

The supply and demand for rare earth metals are influenced by various factors. China dominates the market, supplying over 80% of the world’s rare earth metals due to its abundant reserves. Extracting these metals is technically challenging and requires significant investments in infrastructure and advanced techniques.

The demand is driven by technology advancements and clean energy sectors, as well as emerging industries like robotics and aerospace. Understanding these factors is crucial for ensuring a sustainable supply chain of these valuable resources.

Investing in Rare Earths: Opportunities and Strategies

The demand for rare earth metals has been volatile, but experts predict steady growth due to technological advancements and sustainability initiatives. Investing in rare earths can diversify portfolios and provide long-term returns as global demand rises.

These metals play a crucial role in industries such as electric vehicles and renewable energy systems. The market for rare earths is relatively insulated from economic fluctuations, offering stability to investors. Understanding the supply chain dynamics and staying updated on industry trends are essential for successful investment strategies.

Overall, investing in rare earths presents opportunities for diversification and potential financial gains.

How to Invest in Rare Earths: Step-by-Step Guide for Investors

Investing in rare earths offers lucrative opportunities for diversifying portfolios. To make informed decisions, follow this step-by-step guide:

Gather information from reputable sources like industry reports, financial news outlets, and expert analysis. Analyze market trends, supply-demand dynamics, geopolitical factors, and technological advancements.

Consider direct investments through physical ownership or mining stocks for greater control but higher risks. Alternatively, invest in ETFs or mutual funds focused on rare earth metals to diversify risk across multiple companies.

Evaluate credibility, reputation, and track record when selecting a broker or dealer. Ensure transparency in pricing, fees, and available storage options that align with your investment goals.

By following this guide, investors can navigate the rare earths market effectively and potentially achieve long-term gains.

Risks and Challenges Associated with Investing in Rare Earths

Investing in rare earths carries risks and challenges. Political tensions and regulatory changes can disrupt supply chains and affect prices. Environmental concerns related to mining practices may lead to stricter regulations impacting production.

Market volatility and fluctuating prices are also inherent risks, influenced by global events and economic factors. Limited alternatives for rare earth metals further contribute to price instability. Investors must be prepared for sudden swings, monitor developments closely, and proactively manage risks in this complex industry.

Managing Your Rare Earth Investments

Investing in rare earth metals necessitates diligent management to maximize returns and mitigate risks. Stay informed about market updates and industry news by utilizing reliable sources for real-time information.

Understand key indicators impacting rare earth metals, such as geopolitical developments, technological advancements, and policy changes. Regularly review your investment portfolio to evaluate performance and consider adjusting asset allocation based on risk tolerance and objectives.

Make informed decisions by analyzing market trends, forecasts, and projections. Effective management of rare earth investments requires staying informed and proactive decision-making.

Conclusion: The Future of Rare Earth Metal Investments

[lyte id=’Nemy0YTIEkA’]