Investing in the energy sector has always been a lucrative opportunity for investors. However, with the growing concern for sustainability and environmental impact, there has been a significant shift towards clean and renewable energy sources. One such emerging technology that is gaining popularity among investors is blue gas technology.

In this article, we will explore the rise of blue gas technology companies and their potential in the energy sector.

Overview of Blue Gas Technology and Its Potential in the Energy Sector

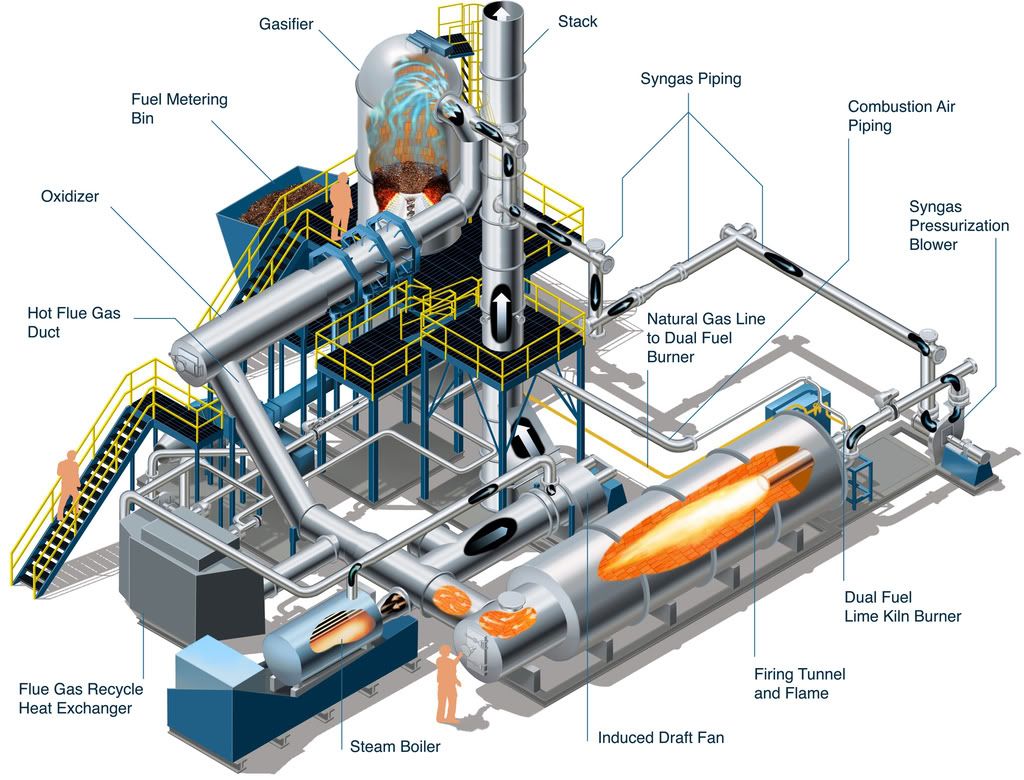

Blue gas technology is an innovative approach to clean energy production that converts natural gas or biomass into synthetic natural gas (SNG) or other liquid fuels. It offers a sustainable alternative to traditional fossil fuels while reducing carbon emissions.

The potential of blue gas technology lies in its ability to address two major challenges faced by the energy sector: reducing greenhouse gas emissions and diversifying energy sources. By utilizing abundant feedstocks and converting them into cleaner fuels, blue gas technology presents a promising solution for achieving a greener future.

It also offers economic growth opportunities and job creation while contributing to global efforts to combat climate change. Embracing blue gas technology can pave the way for a more sustainable and resilient energy landscape.

Why Blue Gas Technology Companies Are Popular Among Investors

Investors are increasingly drawn to blue gas technology companies for several reasons. Firstly, the market demand for cleaner energy sources is growing, leading governments and industries worldwide to prioritize sustainable solutions. Blue gas technology companies are at the forefront of meeting this demand.

Additionally, these companies offer high potential returns on investment as blue gas technology gains traction in the market. The increasing adoption of cleaner fuels and the need for sustainable energy solutions present attractive opportunities for investors.

Moreover, blue gas technology companies constantly innovate and develop new technologies to improve efficiency and reduce costs. These advancements indicate long-term growth potential, further attracting investors.

In summary, blue gas technology companies’ popularity among investors can be attributed to the growing market demand for cleaner energy, high potential returns on investment, and ongoing technological advancements within the industry.

The Impact of Blue Gas Technology on the Environment and Sustainability

Blue gas technology companies have gained popularity due to their significant positive impact on the environment. By converting feedstocks into cleaner fuels, these companies play a crucial role in reducing greenhouse gas emissions and improving air quality.

This transformation is vital in combating climate change and ensuring a healthier future for our planet.

What sets blue gas technology apart is its ability to provide a sustainable solution. These companies utilize abundant feedstocks that are often considered waste or by-products of other industries. By doing so, they not only reduce dependency on finite resources but also promote circular economy practices.

This innovative approach helps minimize waste and maximize resource efficiency, contributing to long-term environmental sustainability.

The potential of blue gas technology to create a more sustainable energy sector has caught the attention of both investors and environmental advocates. Investing in these companies means actively supporting a greener future while also reaping financial benefits.

As demand for clean energy continues to rise, blue gas technology presents an enticing opportunity for investors who want to make a positive impact on the environment while securing their financial interests.

Revolutionizing the Energy Landscape with Blue Gas

Company A, founded in [year], is revolutionizing the energy sector through its groundbreaking work in blue gas technology. Their cutting-edge solutions, including advanced methanol fuel cells and efficient conversion processes, have improved the viability and scalability of blue gas technology.

By commercializing their innovations and forming strategic partnerships, Company A has achieved success across various sectors, reducing carbon emissions while meeting energy demands. Their commitment to innovation and sustainability positions them as leaders in driving positive change within the industry.

Company B: Pioneering Sustainable Energy Solutions with Blue Gas

Company B is leading the way in sustainable energy solutions through their innovative blue gas technology. Committed to reducing carbon emissions and providing cleaner alternatives, they have developed breakthrough systems for producing synthetic natural gas and methanol.

With advanced integration capabilities, they seamlessly incorporate blue gas technology into existing infrastructure. Collaborations with industry leaders and recognition for their contributions further strengthen their position in the market.

Investing in blue gas technology companies offers exciting opportunities for environmentally conscious investors looking to support sustainable initiatives while maximizing returns.

The Potential for High Returns on Investment in the Blue Gas Technology Sector

The rising demand for clean energy solutions presents an excellent opportunity for investors seeking high returns. Governments worldwide are encouraging the adoption of sustainable technologies, which benefits companies in the blue gas technology sector.

Investors are attracted to blue gas technology because it offers reduced greenhouse gas emissions and improved energy efficiency. Additionally, governments provide support through regulations, subsidies, and tax incentives, reducing investment risks and fostering growth.

Technological advancements further enhance the potential returns on investment in this sector. Ongoing research aims to improve efficiency and reduce production costs for hydrogen and other renewable gases. As these advancements progress, economies of scale will drive even more attractive returns.

The increasing consumer preference for cleaner energy alternatives also drives investor interest in blue gas technology. Companies operating in this sector have a significant opportunity to disrupt traditional energy markets as the demand for sustainable solutions continues to grow.

Successful investments require thorough due diligence, focusing on companies with strong business models, expert management teams, solid financials, and a clear competitive advantage. Scalability and potential commercialization should also be considered.

In summary, the blue gas technology sector offers compelling investment opportunities due to growing global demand for clean energy solutions and favorable market conditions supported by governments, technological advancements, and changing consumer preferences.

Careful analysis of individual companies is essential to maximize returns while managing risks effectively.

Key Factors to Consider Before Investing in Blue Gas Technology Companies

Investing in blue gas technology companies requires careful consideration of several key factors. Firstly, analyzing the market potential and growth prospects of the target company is crucial. This involves evaluating market trends, competition, regulatory environment, and future projections.

Secondly, assessing the expertise and track record of the management team is vital. Investors should evaluate their experience, ability to execute strategies, and past achievements. Lastly, analyzing the competitive advantage and market positioning of the target company is essential.

Understanding their unique selling proposition and technological advancements can significantly impact their growth potential.

By considering these key factors before investing in blue gas technology companies, investors can make informed decisions that maximize their chances for success. It is important to conduct due diligence and weigh the risks associated with such investments to ensure a well-rounded investment strategy.

Regulatory Challenges and Government Policies Affecting the Industry

The regulatory environment greatly impacts blue gas technology companies. Government policies, subsidies, and regulations can create uncertainties for investors and affect market conditions. Compliance with environmental regulations is a key challenge, as governments implement policies to reduce carbon emissions.

Changes in government incentives and subsidies can impact profitability, while energy-related policies influence market demand. Operating across borders adds complexity due to varying regulations. Staying informed about evolving government policies is crucial for adapting strategies and maintaining competitiveness.

| Regulatory Challenges and Government Policies Affecting the Industry |

|---|

| – Compliance with environmental regulations |

| – Impact of government incentives on profitability |

| – Influence of energy-related policies on market demand |

| – Complexity of operating across borders with varying regulations |

[lyte id=’2EA4tDYwNYo’]