Investing in stocks can be a thrilling and potentially lucrative venture. While many investors focus on high-priced and well-established companies, there is another realm of opportunities waiting to be explored – stocks under $5.00.

These low-priced stocks often fly under the radar but can hold significant potential for investors looking to make a splash in the market.

Introduction to Stocks Under $5.00

Stocks under $5.00, also known as penny stocks or micro-cap stocks, are shares of smaller, lesser-known companies that trade at relatively low prices per share. These stocks attract adventurous investors seeking growth opportunities and the potential for significant gains.

While investing in stocks under $5.00 can offer affordability and access to emerging industries, it is crucial to conduct thorough research and exercise caution due to higher risks associated with these investments. Diligence and understanding of market dynamics are key when venturing into this segment of the stock market.

Why stocks under $5.00 can be appealing to investors

Investing in stocks priced below $5.00 can be enticing for investors due to the potential for significant returns. Even a small increase in value can result in substantial percentage gains. For example, if a stock priced at $2.00 rises to $3.00, investors will experience a 50% return.

Low-priced stocks often have room for rapid growth compared to higher-priced alternatives that may have already peaked. Investing in these hidden gems allows individuals to get in on the ground floor of emerging companies with promising prospects.

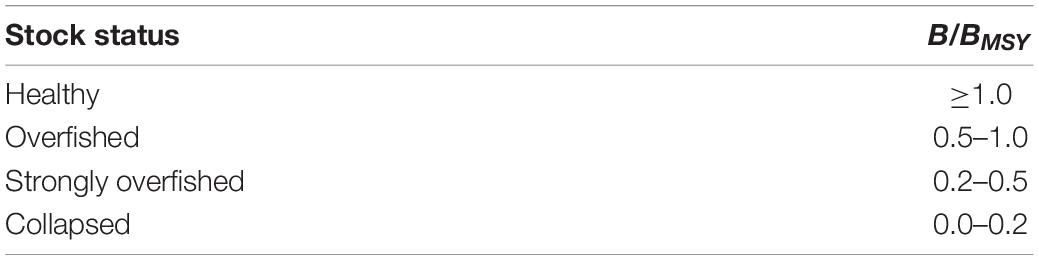

However, it’s important to understand the risks involved when investing in stocks under $5.00. These stocks tend to be more volatile and susceptible to market fluctuations due to their smaller market capitalization and potentially limited financial resources.

Thorough research and analysis are essential before investing in any stock, regardless of its price range. Examining the company’s financials, management team, industry trends, and competitive landscape is crucial when evaluating the potential risks and rewards of low-priced stocks.

In summary, while stocks under $5.00 offer appealing opportunities for substantial returns and rapid growth potential, investors must exercise caution and conduct thorough due diligence to make informed investment decisions aligned with their goals and risk tolerance.

Explaining the Potential for High Returns

Investing in low-priced stocks offers the potential for significant returns, making it an attractive option for many investors. By identifying companies with strong fundamentals and growth prospects early on, you have the opportunity to see your investment multiply as the stock price rises.

The lower entry point for these stocks also allows investors with limited capital to build a diverse portfolio, increasing the chances of hitting it big if one or more of them experience significant growth.

However, it is important to conduct thorough research and analysis to mitigate any potential risks associated with investing in smaller companies with less established track records. Overall, investing in low-priced stocks can provide an exciting avenue for achieving high returns.

Discussing the Inherent Risks Involved

Investing in low-priced stocks, particularly those under $5.00, can offer the allure of high returns. However, it is crucial to acknowledge and carefully consider the inherent risks associated with these investments. Low-priced stocks are known for their volatility, making them susceptible to sudden price swings that can catch investors off guard.

One of the key factors to be aware of when dealing with low-priced stocks is their vulnerability to manipulation by market participants. Due to their lower trading volumes and less stringent regulatory scrutiny compared to larger stocks, these smaller companies can be more easily influenced by external factors.

This susceptibility increases the likelihood of price manipulation by unscrupulous individuals or groups seeking short-term gains at the expense of unsuspecting investors.

To navigate these risks successfully, investors must conduct thorough due diligence before investing in low-priced stocks. A comprehensive analysis of a company’s fundamentals is essential, including an examination of its financials, management team, and industry position.

By understanding these aspects, investors can gain valuable insights into a company’s potential for long-term growth and stability.

Moreover, it is vital to exercise caution when considering low-priced stocks as they often carry higher levels of risk compared to more established and higher-priced options. Careful research and consideration are necessary to avoid falling prey to risky or fraudulent investments that may result in significant financial losses.

Researching the Company’s Fundamentals

When evaluating stocks under $5.00, thorough research and analysis of a company’s fundamentals are essential. This includes examining financial statements, revenue growth trends, profitability margins, debt levels, competitive position within the industry, and any recent developments or news that could impact future prospects.

By assessing these factors, investors can make more informed decisions based on solid analysis rather than relying solely on price fluctuations or short-term market trends.

Analyzing Market Trends and Industry Performance

Analyzing market trends and industry performance is crucial for investors interested in low-priced stocks. By monitoring broader market trends, investors gain insights into potential opportunities or risks. Understanding how specific sectors are performing helps gauge growth prospects and identify investment opportunities.

Market dynamics and industry performance impact the success of low-priced stocks, so staying informed allows for better decision-making. Utilizing tools like financial news platforms and industry reports helps paint a comprehensive picture of the market’s current state.

Overall, analyzing market trends and industry performance guides investors towards more informed decisions in the low-priced stock segment.

Stock 1: Company Name, Background, and Recent Developments

[Company Name] is a standout player in the [industry/sector], with a strong background and recent developments that make it an intriguing stock to consider. Their consistent revenue growth, impressive earnings per share (EPS), and positive cash flow demonstrate their financial stability and potential for future success.

Expert opinions from industry insiders further validate [Company Name]’s promising outlook. With a solid foundation and a keen eye on market trends, [Company Name] is positioned for continued growth in the [industry/sector].

Stock 2: Company Name, Background, and Recent Developments

[Company Name] is a low-priced stock that stands out from others in its category due to its unique characteristics and recent developments. Understanding the company’s background and growth prospects is essential for evaluating this investment opportunity.

Examining [Company Name]’s history, management team, industry positioning, and competitive advantages provides valuable insights into its stability and future growth potential.

Recent milestones like product launches, partnerships or acquisitions, market expansions, or technological advancements impact the company’s financial performance and signal opportunities for investors.

Analyzing key financial metrics such as revenue growth, profitability ratios, cash flow generation, and debt levels helps assess [Company Name]’s financial health and growth trajectory.

Identifying distinctive aspects that differentiate it from other low-priced stocks, such as innovative products or disruptive business models, gauges its competitive advantage.

Including expert opinions and recommendations provides a well-rounded perspective on this investment opportunity. Insights from analysts or industry experts validate analysis and offer guidance on growth prospects and risks associated with [Company Name].

Thorough research is necessary to make informed decisions about [Company Name]. While low-priced stocks offer unique opportunities, they also come with inherent risks. Mitigating these risks while maximizing returns requires diligence and strategic decision-making.

[lyte id=’Sbp3p_F5ggs’]