Investing in the stock market can be a daunting task, especially when trying to navigate through the ever-evolving landscape of emerging industries. However, for those with a keen eye for opportunity, there is one sector that has been generating significant buzz and capturing the attention of investors worldwide – hydrogen.

Hydrogen, once considered a niche energy source, is now gaining recognition as a game-changer in the pursuit of clean and sustainable energy solutions. As governments and industries alike strive to reduce carbon emissions and combat climate change, hydrogen has emerged as a frontrunner in the race to decarbonize our planet.

In this article, we will delve into the world of investing in hydrogen stocks. From understanding the growing demand for hydrogen to uncovering the best companies in the sector, we will provide you with valuable insights and tips to make informed investment decisions.

So let’s dive in!

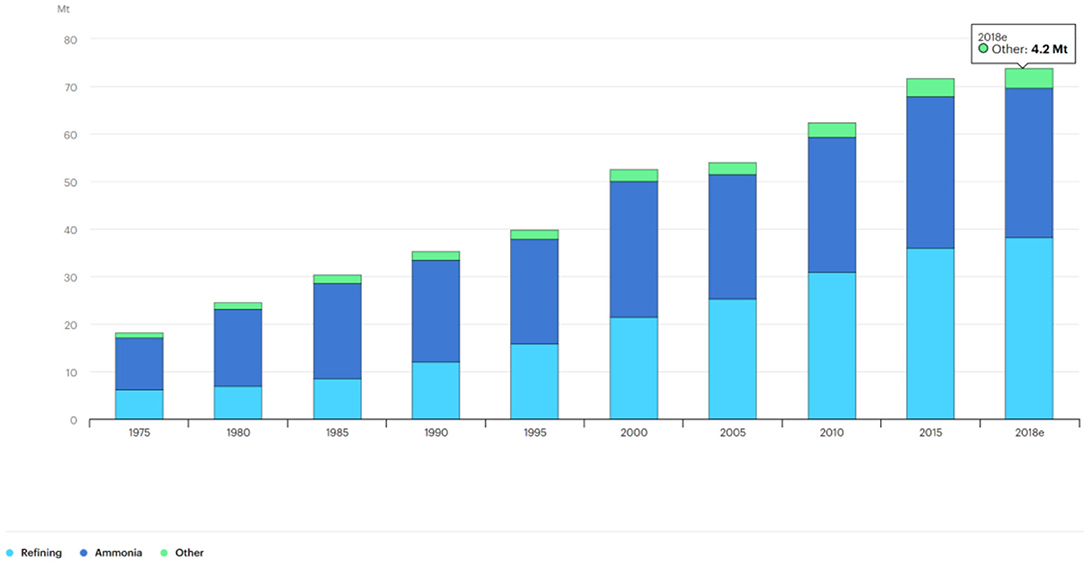

Exploring the Growing Demand for Hydrogen

Hydrogen is gaining increasing attention due to its ability to produce zero-emission energy, offering an environmentally friendly alternative to fossil fuels. Industries such as transportation, manufacturing, and power generation are turning to hydrogen to reduce their carbon footprints.

Governments worldwide are implementing policies and incentives to promote the use of hydrogen as part of their sustainable development efforts. With its versatility and economic benefits, hydrogen is poised to play a crucial role in our transition towards cleaner energy sources.

Understanding the Potential of Hydrogen as a Clean Energy Source

Hydrogen holds immense potential as a clean energy source. Unlike intermittent renewable energy sources like wind and solar power, hydrogen can be efficiently stored and transported. It can be produced through methods like electrolysis, utilizing excess renewable energy for later use.

Its versatility extends to transportation, industry, and grid management, offering solutions for low-emission vehicles, high-temperature processes, and balancing renewable energy supply. Moreover, hydrogen enables decentralized energy systems through local networks. Recognizing hydrogen’s potential is crucial for achieving a sustainable future.

Introduction to Investing in the Hydrogen Sector

Investing in the hydrogen sector is gaining momentum as countries worldwide focus on reducing carbon emissions and transitioning to renewable energy sources.

With the increasing demand for clean energy solutions, companies involved in green hydrogen production, fuel cell technology, and sustainable transportation solutions offer attractive investment opportunities.

Green hydrogen production utilizes renewable energy sources to produce hydrogen without emitting carbon. Companies at the forefront of this technology are poised to benefit from the global push for sustainability.

Fuel cell technology converts hydrogen into electricity through an electrochemical reaction, offering versatile applications in transportation, power generation, and portable devices. Investing in companies driving fuel cell advancements can yield significant returns.

Hydrogen-powered vehicles are becoming a viable option due to their zero-emission operation and fast refueling times. As governments implement stricter emission regulations, investing in companies developing hydrogen-fueled transportation solutions can be lucrative.

In summary, investing in the hydrogen sector allows investors to align their portfolios with sustainable investments while capitalizing on the growing demand for clean energy solutions.

By identifying companies leading in green hydrogen production, fuel cell technology, and sustainable transportation, investors position themselves for potential financial gains.

Unveiling the Best Stocks for Hydrogen: Our Top Picks

In the world of clean energy solutions, hydrogen is emerging as a promising alternative. Here are our top picks for stocks that are leading the way in harnessing hydrogen’s potential:

Company A is at the forefront of green hydrogen production. They develop advanced technologies to produce hydrogen through renewable sources like wind or solar power. With efficient electrolysis systems and strategic partnerships, they are well-positioned to capitalize on the increasing demand for clean energy solutions.

Company B is revolutionizing industries with their advancements in fuel cell technology. These cells convert hydrogen into electricity without harmful emissions, making them a viable alternative to traditional energy sources. Company B’s focus on efficiency, durability, and cost-effectiveness gives them a strong competitive advantage.

Company C is committed to leveraging hydrogen for sustainable transportation. They develop hydrogen-powered vehicles that offer zero-emission solutions. By addressing concerns related to range anxiety and infrastructure, they make hydrogen-powered vehicles more accessible and practical.

Investors should consider factors such as financial performance, market presence, competitive advantage, revenue diversification, growth prospects, and involvement in industry collaborations or government initiatives when evaluating these top picks.

These companies represent promising opportunities in the hydrogen sector and contribute to a greener future.

Navigating Risks and Challenges in the Hydrogen Market

Investing in the hydrogen market offers exciting opportunities, but it’s important to understand the potential risks and challenges. Regulatory hurdles can impact the adoption of hydrogen as an energy source, so staying informed about evolving regulations is crucial.

There are inherent risks associated with investing in hydrogen stocks, such as technology viability and competition from alternative energy sources. To mitigate these risks, diversification is key – spreading investments across different companies involved in the hydrogen value chain.

Staying updated on market trends and industry developments is also essential for successful navigation of the hydrogen market.

Expert Tips for Investing in Hydrogen Stocks

Investing successfully in the dynamic world of hydrogen stocks requires careful research, due diligence, and staying ahead of market trends. To avoid common mistakes, investors should steer clear of overreliance on short-term market hype and instead focus on assessing a company’s financial stability.

Additionally, it is crucial to consider the long-term potential of the hydrogen industry.

Thorough research and due diligence are paramount when selecting hydrogen stocks. Investors should delve into analyzing a company’s technology, patents, partnerships, financial statements, and regulatory compliance. By gaining a comprehensive understanding of these aspects, investors can make more informed decisions about their investments.

Understanding market trends and staying ahead of the curve is essential for success in hydrogen investing. This fast-paced industry requires investors to stay abreast of technological advancements, government initiatives, and industry collaborations.

By doing so, they can gain valuable insights that will aid them in making sound investment decisions.

By following these expert tips for investing in hydrogen stocks – avoiding common mistakes, conducting thorough research and due diligence, as well as understanding market trends – investors can position themselves strategically to capitalize on the opportunities offered by this emerging sector.

With careful consideration and proactive engagement with the market’s dynamics, investors can navigate the complexities of hydrogen investing with confidence.

Seizing Opportunities with Hydrogen Investments

Investing in hydrogen stocks offers immense potential for growth and environmental impact. As governments prioritize clean energy solutions, companies at the forefront of green hydrogen production, fuel cell technology advancements, and sustainable transportation present attractive investment opportunities.

By staying informed, diversifying portfolios, and embracing this rapidly evolving sector, investors can position themselves for success in this game-changing opportunity. Now is the time to explore investing in hydrogen – a sector poised for significant growth with promising returns.

[lyte id=’Dg0_wToswCY’]