Investing in the energy sector can offer lucrative opportunities for investors seeking high returns. However, navigating the complexities of the market and identifying profitable investments can be challenging. This is where leveraged energy ETFs come into play, providing investors with a unique and potentially rewarding investment avenue.

In this article, we will explore the world of leveraged energy ETFs and uncover their benefits, top options in the market, factors to consider before investing, tips for successful investing, common mistakes to avoid, and conclude with a reminder about the power and potential risks associated with these investments.

So whether you’re an experienced investor or just starting out, get ready to dive into the exciting world of leveraged energy ETFs.

Introduction to Leveraged Energy ETFs

Exchange-traded funds (ETFs) have become increasingly popular among investors due to their ability to provide diversification benefits and exposure to various sectors and asset classes. However, for those looking to further enhance their investment potential, leveraged ETFs offer a unique opportunity.

Leveraged energy ETFs take the concept of traditional ETFs one step further by utilizing financial derivatives and debt instruments to amplify exposure to their underlying indexes or assets. These instruments enable leveraged ETFs to magnify returns on both upward and downward movements in the market.

For instance, a 2x leveraged energy ETF aims to generate twice the daily return of its underlying index or asset, while a 3x leveraged energy ETF targets three times the daily return. This leverage allows investors to capitalize on market upswings but also increases the risk of higher losses during downturns.

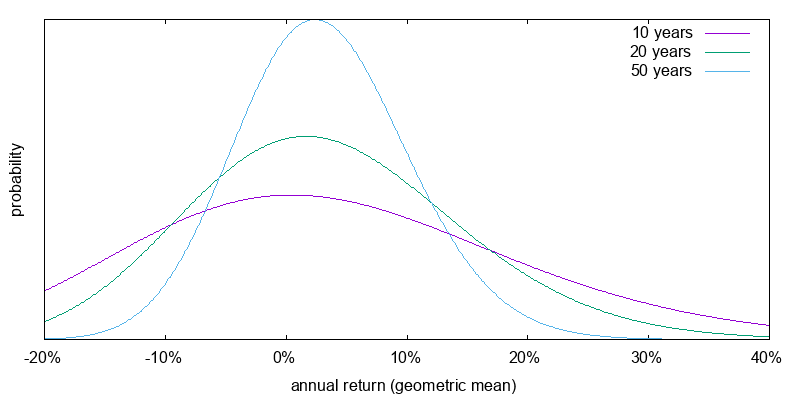

It is important to note that leveraged ETFs are designed with daily objectives in mind and may not perfectly track the long-term returns of their underlying indexes due to compounding effects and volatility. Therefore, they are best suited for short-term trading strategies rather than long-term investment goals.

By providing amplified exposure, leveraged energy ETFs allow investors to potentially achieve higher returns within a shorter timeframe. However, it is crucial for investors to thoroughly understand the risks involved and carefully consider their risk tolerance before incorporating these types of investments into their portfolio.

Benefits of Investing in Leveraged Energy ETFs

Investing in leveraged energy ETFs offers several benefits. Firstly, they provide the potential for higher returns compared to traditional ETFs by amplifying exposure and multiplying gains when the market moves favorably.

Secondly, leveraged energy ETFs allow for diversification within the energy sector, spreading out risk and capturing broad market trends. Additionally, these funds enable investors to amplify market trends and capitalize on short-term trading opportunities.

They can be used to hedge existing positions or speculate on price fluctuations with flexibility and agility. It is important, however, to approach leveraged energy ETFs with a comprehensive understanding of their unique characteristics and associated risks.

[lyte id=’ZPtZjOd5gi4′]