International Index ETFs, or exchange-traded funds, offer investors exposure to a diverse range of international stocks. These funds aim to replicate the performance of specific indices, providing instant diversification across various countries and sectors.

Investors can easily buy or sell shares throughout market hours, benefiting from liquidity and convenience. International index ETFs also have the potential for capital appreciation and often come with lower expense ratios compared to actively managed funds. Overall, they provide a convenient and cost-efficient way to access global stock markets.

How do they work?

International index ETFs track the performance of a specific index by holding a selection of stocks that mirror its composition and weighting. They use strategies like full replication or sampling to achieve their investment objective.

Investors can buy and sell shares of these ETFs on stock exchanges throughout the trading day, providing liquidity and flexibility in managing their investments. International index ETFs offer diversification across countries and sectors, lower expenses compared to actively managed funds, and an easy way to gain exposure to global markets.

Benefits of Investing in International Index ETFs

Investing in international index ETFs offers several key benefits for investors.

Diversification: By gaining exposure to a wide range of countries and industries, international index ETFs allow investors to diversify their portfolios and reduce risk.

Lower Costs: Compared to actively managed mutual funds, international index ETFs typically have lower expense ratios. This cost advantage can lead to higher returns over the long term.

Ease of Access: International markets can be complex and costly for individual investors. Investing in international index ETFs provides an easy and cost-effective way to access global markets without requiring extensive knowledge or large capital.

Transparency: International index ETFs regularly disclose their holdings, giving investors confidence in knowing where their money is invested.

In summary, investing in international index ETFs offers diversification, lower costs, ease of access to global markets, and transparency – all valuable advantages for investors seeking growth and stability in their portfolios.

Why Diversification is Key in Investing

Diversification is essential in investing. By spreading investments across different assets, you can reduce risks and potentially achieve more stable returns. It involves investing in various asset classes, such as stocks, bonds, real estate, and commodities.

This strategy helps to minimize the impact of any single investment’s performance on your overall portfolio. With diversification, you can manage specific risks associated with individual companies or industries while also taking advantage of global opportunities.

By creating a balanced and diversified portfolio, you increase your chances of success in the ever-changing world of investing.

How International Index ETFs Provide Diversification

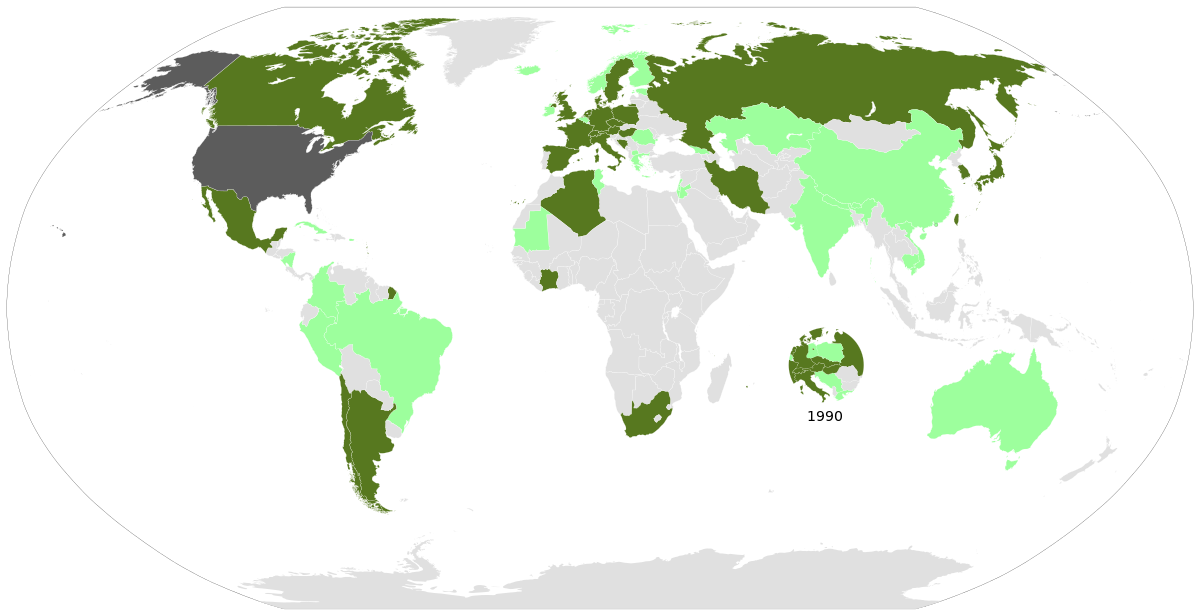

Investing in international index ETFs is an efficient way to achieve diversification in your investment portfolio. These funds hold hundreds or even thousands of stocks from various countries, sectors, and market capitalizations, providing exposure to a wide range of international stocks.

By investing in a single international index ETF, you can benefit from the performance of multiple markets and industries without having to select individual stocks yourself.

International index ETFs help spread risk by reducing exposure to any one particular company or country. This broad diversification minimizes the impact of underperforming stocks or sectors on the overall portfolio, reducing volatility and protecting against substantial losses during market downturns.

Additionally, these funds allow investors to take advantage of global economic growth trends. By diversifying across different regions and sectors, investors can potentially benefit from positive market movements while mitigating risks associated with any individual market or industry.

In summary, international index ETFs offer an effective way to achieve diversification by providing exposure to a diverse selection of international stocks. With reduced risk through broad diversification and opportunities for global growth, these funds can enhance your investment strategy.

Examples of Successful Diversification through International Index ETFs

Investors looking to diversify their portfolios across different sectors and markets often turn to international index ETFs. These investment vehicles offer a convenient way to achieve broad geographic diversification without extensive research or the risk associated with individual company selection.

For example, instead of researching and selecting technology companies from different countries, investors can invest in an international index ETF that tracks a global technology index. This provides instant diversification across multiple developed and emerging markets within the technology sector.

Another scenario is when investors want exposure to both developed and emerging markets but lack specific knowledge about individual companies in those markets. By investing in an international index ETF that covers a broad range of countries, they can achieve geographic diversification without needing to research each market individually.

In summary, successful diversification through international index ETFs offers investors a convenient way to gain exposure to various sectors across different markets. By investing in these diversified funds, investors can reduce company-specific risks while benefiting from broader market movements.

XYZ Global Equity Fund: Unmatched Performance and Global Exposure

The XYZ Global Equity Fund has a track record of consistently strong performance, outperforming its benchmark index by a significant margin. It capitalizes on market trends and global opportunities to generate attractive returns for investors.

With broad exposure to global equity markets, the fund’s diversified portfolio includes companies from various sectors and countries. This ensures investors can benefit from global economic growth while minimizing risk.

The XYZ Global Equity Fund is an excellent choice for those seeking unmatched performance and global exposure in their investment portfolio.

ABC World Opportunities Fund: Capturing Emerging Markets’ Potential

The ABC World Opportunities Fund is renowned for its ability to tap into the potential of emerging markets. With a proven track record, it identifies promising companies in sectors like e-commerce, healthcare, and renewable energy.

The fund’s active management approach allows investors to participate in the rapid development of emerging economies, offering the possibility of strong returns.

By leveraging their expertise and local market knowledge, the fund’s experienced team ensures that investors can seize growth opportunities while minimizing risks associated with unfamiliar territories.

The ABC World Opportunities Fund is an excellent choice for those seeking exposure to high-growth regions and wanting to capitalize on the economic transformation happening in emerging markets.

[lyte id=’4e8YHjcPs38′]

%2C_Germany_PP1342032030.jpg/120px-Airbus_A321-231_Atlasjet_TC-ETF%2C_DUS_Düsseldorf_(Duesseldorf_International)%2C_Germany_PP1342032030.jpg)