Investing in the stock market can be an exciting and profitable venture, especially when you uncover emerging trends and industries with significant growth potential. One such trend that has been making waves in recent years is genomics.

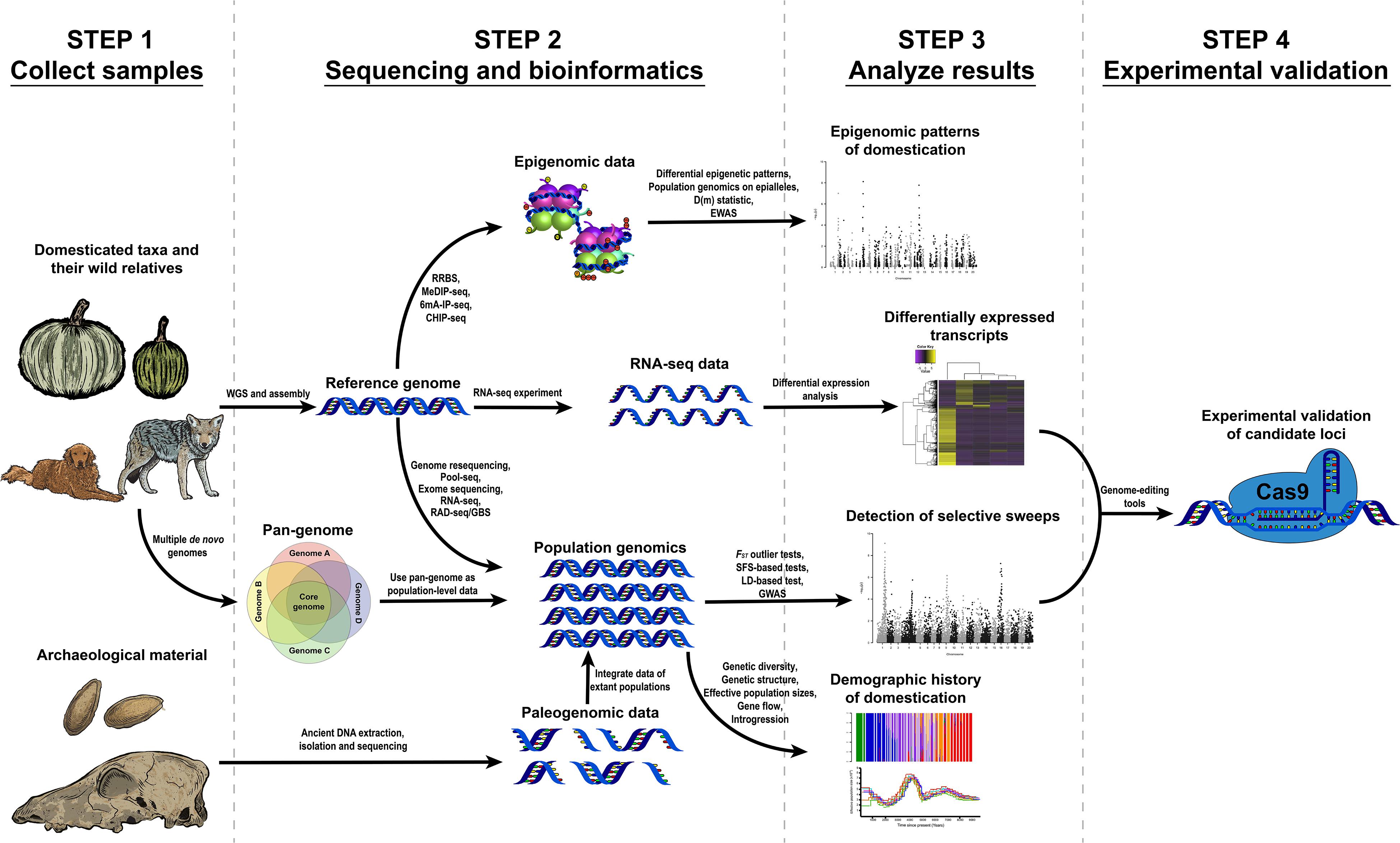

Genomics, the study of an organism’s complete set of DNA, has revolutionized various fields, including healthcare, agriculture, and even consumer products. The ability to analyze and understand genetic information has opened up a world of possibilities for scientists and researchers, leading to groundbreaking discoveries and advancements.

In the investment world, genomic stocks have become increasingly popular due to their potential for substantial returns. These stocks belong to companies that are at the forefront of genomics research and development, offering investors the opportunity to capitalize on the growing demand for genetic-based solutions.

Understanding Genomic Stocks

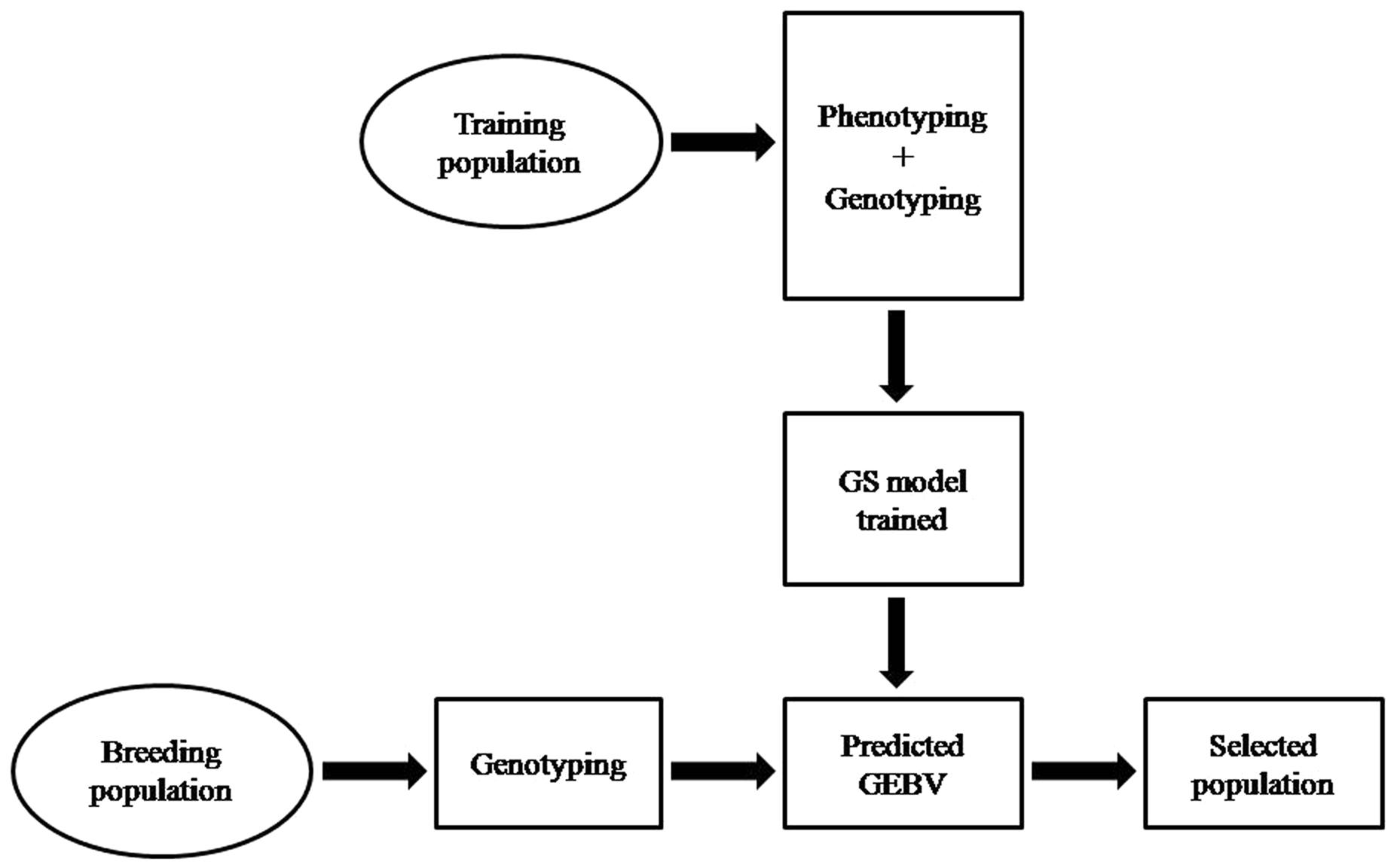

Genomic stocks differ from traditional biotech stocks by leveraging DNA sequencing and genetic analysis. They offer immense potential for disruption and benefit from ongoing technological advancements. Genomics plays a crucial role in personalized medicine and precision agriculture, two sectors expected to experience significant growth.

By investing in genomic stocks, investors position themselves ahead of the curve and potentially reap substantial rewards as these industries flourish. Thorough research is essential before investing in specific genomic companies, considering factors such as market competitiveness, regulations, and financial stability.

Genomic stocks present unique opportunities for innovation across various sectors.

Top Genomic Stocks to Watch

Investing in genomic stocks can offer exciting opportunities for growth. These stocks represent companies that are leading the way in genetic research and clinical applications. Here are three top players to keep an eye on:

Illumina is a pioneer in DNA sequencing technologies, setting the gold standard for genetic research and clinical applications. Their innovative platforms have reduced costs and time required for sequencing, enabling groundbreaking discoveries in cancer genomics and rare genetic diseases.

With strong financial performance, Illumina is well-positioned to maintain its leadership position.

Pacific Biosciences uses cutting-edge single molecule real-time (SMRT) technology for long-read sequencing, providing comprehensive insights into genomic data. They are at the forefront of uncovering structural variations within genomes, crucial for understanding complex diseases like cancer.

Despite recent challenges, they continue to make promising developments and offer long-term growth potential.

Exact Sciences is a leader in using genomics for cancer screening. Their flagship product, Cologuard, detects DNA markers associated with colorectal cancer without invasive procedures.

They are expanding precision medicine solutions beyond colorectal cancer and have impressive stock performance driven by growing demand for their innovative screening solutions.

By keeping an eye on these top genomic stocks – Illumina, Pacific Biosciences of California, and Exact Sciences – investors can stay informed about the latest advancements in genomics and potentially benefit from the future growth of this industry.

stocks requires careful consideration of several factors. The genomic industry has experienced significant growth in recent years, offering exciting opportunities for investors. However, before diving into this sector, it is crucial to evaluate various aspects that can impact the success of genomic stocks.

One important factor to consider is the current market trends driving the growth of the genomics industry. The increasing adoption of personalized medicine, advancements in gene editing technologies like CRISPR-Cas9, and growing demand for genetic testing all contribute to the potential growth of genomic stocks.

Understanding these trends can help investors assess the long-term prospects of companies operating in this sector.

Another critical aspect to evaluate is the regulatory environment surrounding genomic stocks. The genomics industry operates within a complex framework that involves regulations related to data privacy, genetic testing, and intellectual property rights. Changes in these regulations can significantly impact companies operating in this field.

Therefore, staying informed about any regulatory developments is essential for investors considering genomic stocks.

Like any investment, there are also potential risks associated with investing in this sector. Technological setbacks or failures can hinder the progress of genomic companies and affect their stock performance. Additionally, intense competition within the industry poses a risk to individual companies’ market share and profitability.

Moreover, ethical concerns surrounding genetic manipulation may impact public perception and investor confidence in certain genomic stocks.

In conclusion, investing in genomic stocks requires careful evaluation of market trends, regulatory challenges, and potential risks associated with this sector. By considering these factors, investors can make informed decisions that balance risks against potential rewards.

Staying updated on industry developments and conducting thorough research will help navigate the complexities of investing in genomic stocks effectively.

Tips for Successful Investing in Genomic Stocks

Investing in genomics can be lucrative with the right approach. Here are some tips to increase your chances of success:

-

Research companies thoroughly: Analyze their products, partnerships, and patents to gauge growth potential.

-

Diversify strategically: Invest in established companies and promising emerging players across different genomics subsectors.

-

Stay updated with industry news: Follow reputable sources for scientific advancements, regulatory changes, and market trends.

-

Monitor regulatory changes: Understand how regulations impact genomics stocks and identify potential risks or opportunities.

-

Seek expert guidance: Consider consulting specialists or financial advisors with genomics expertise to make informed decisions.

By following these tips, you can navigate the complexities of investing in genomic stocks and maximize your investment potential.

Case Study: Investing in Genomic Stocks

Investing in genomic stocks offers exciting potential in industries driven by genetic information. To illustrate this, let’s explore a case study of an investor who achieved significant profits from their investments in this sector.

Examining their journey, we’ll highlight their research process, risk management strategies, and staying informed about industry trends. We’ll also analyze successful genomic stocks, considering factors like revenue growth, market share expansion, partnerships, and regulatory approvals.

This case study provides actionable insights for readers to navigate the world of genomics investing successfully. Uncover the boundless possibilities that lie within genomic stocks and shape our future.

Conclusion

[lyte id=’2_9cEPa2lo8′]