Investing in emerging markets has become an increasingly attractive option for investors looking to diversify their portfolios and capitalize on high-growth opportunities. As the global economy evolves, these markets present a wealth of untapped potential that can yield substantial returns.

However, before embarking on this exciting journey, it is crucial to understand the risks and rewards associated with investing in emerging markets.

Why Investing in Emerging Markets is a Wise Choice

Investing in emerging markets offers higher returns and diversification benefits. These dynamic economies, experiencing rapid growth, provide opportunities for significant profits. Operating independently from developed economies, they are less affected by global events, reducing overall portfolio risk.

Additionally, investments contribute to innovation and economic development. While risks exist, thorough research and a long-term perspective can lead to success in these promising markets.

Understanding the Risks and Rewards of Investing in Emerging Markets

Investing in emerging markets offers significant rewards but comes with inherent risks. Political instability, economic volatility, currency fluctuations, inadequate regulations, and liquidity constraints are some key risk factors to consider.

Political instability can lead to sudden policy or regulatory changes that negatively impact investments. Economic volatility arises from factors like inflation, interest rate fluctuations, or natural disasters. Currency fluctuations can erode returns when converting back to the investor’s home currency.

Despite these risks, many investors are attracted to emerging markets for their growth potential. By carefully assessing and managing risks through research and diversification strategies, investors can benefit from these opportunities.

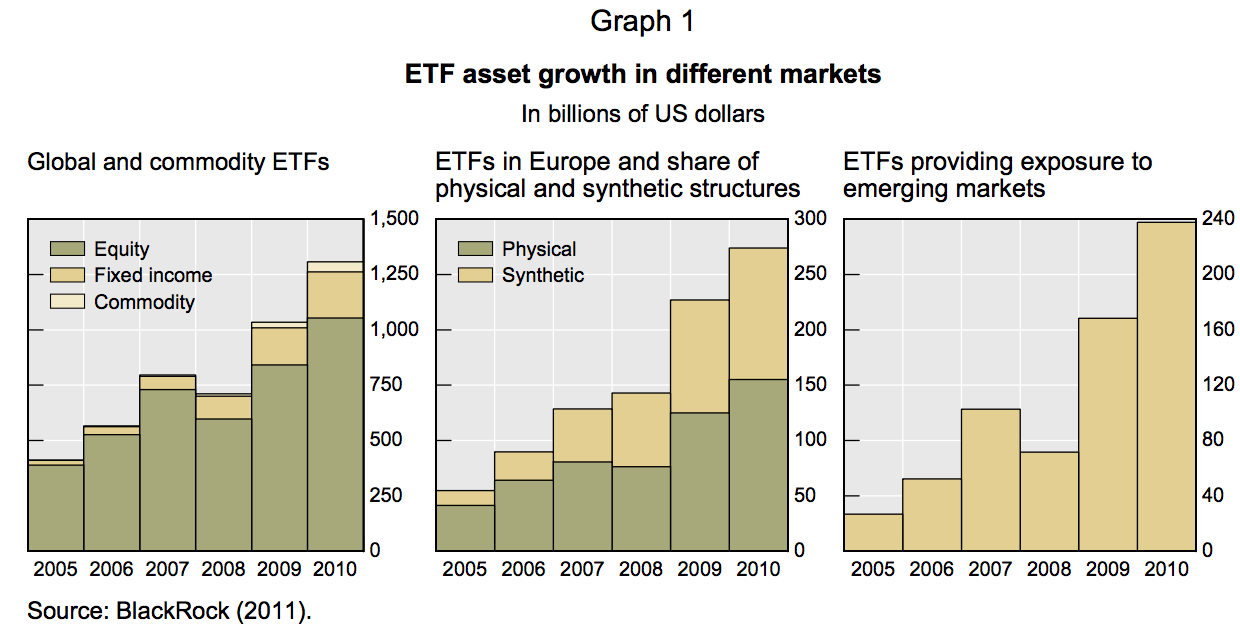

Exchange-Traded Funds (ETFs) have gained popularity as a tool for investing in emerging markets due to their flexibility, diversification benefits, and cost-effectiveness. ETFs allow investors exposure to a basket of securities representing specific markets or sectors.

In summary, while investing in emerging markets holds potential rewards, it is crucial to understand and manage the associated risks. By staying informed and employing sound investment strategies such as ETFs, investors can navigate these markets effectively and capitalize on growth opportunities.

What are ETFs and why they are popular among investors

Exchange-Traded Funds (ETFs) have become increasingly popular among investors for several reasons.

Firstly, ETFs offer liquidity by being traded on stock exchanges throughout the day. This means investors can buy or sell shares at market prices whenever they want, providing them with easy access to their investments.

Secondly, ETFs provide cost-effective exposure to a wide range of asset classes. Compared to actively managed funds, which often come with higher expenses and fees, ETFs tend to have lower costs, making them an attractive option for both retail and institutional investors.

Additionally, ETFs offer transparency as most providers disclose their holdings daily. This allows investors to see exactly what assets they own within the fund, enabling more informed portfolio decisions.

Lastly, ETFs provide specialized investment opportunities by focusing on specific sectors or themes that may be difficult or costly to access through other vehicles. This allows investors to align their portfolios with specific strategies or trends without investing directly in individual companies.

Overall, the liquidity, cost-effectiveness, transparency, and specialized offerings of ETFs have contributed to their growing popularity in the investment landscape.

Benefits of using ETFs to invest in emerging markets

Investing in emerging markets through Exchange-Traded Funds (ETFs) offers several advantages. ETFs provide instant diversification across multiple countries and sectors within those markets.

They simplify the investment process by eliminating the need for extensive research and analysis, as they are managed by professionals who carefully select the underlying securities.

ETFs also offer transparency and flexibility, allowing investors to track their investments and adjust portfolio allocations based on market conditions or personal goals.

With the benefits of diversification, professional management, cost-effectiveness, and flexibility, investing in emerging markets through ETFs is an appealing option for both novice and experienced investors.

In the next section, we will explore top ETFs for investing in emerging markets, examining their characteristics and performance history to help investors make informed decisions.

[lyte id=’Q1PMTMYhR_w’]