Investing in emerging market dividend ETFs can be an attractive option for investors looking to diversify their portfolios and capitalize on the potential growth opportunities in these markets. However, before diving into these funds, it is crucial to understand the tax implications that come along with them.

Exploring Potential Tax Implications

Investing in emerging market dividend ETFs requires careful consideration of potential tax implications. Different countries have varying tax laws and regulations, which can affect the dividend income received from these investments. One important factor to be aware of is withholding taxes on dividends paid to foreign investors.

Some countries impose higher withholding taxes, reducing the amount of income reaching the investor’s account. Understanding these taxes and their impact on returns is essential for making informed investment decisions.

Additionally, staying updated on changes to tax laws and taking advantage of any favorable tax treaties can optimize overall returns while minimizing tax liabilities. By exploring these potential tax implications, investors can navigate challenges and maximize their investment outcomes.

(127 words)

Tax Treaties and Regulations

Many countries have established tax treaties with each other to prevent double taxation and encourage cross-border investments. These agreements play a crucial role in determining how dividends received from foreign countries are taxed.

When considering investments in emerging markets, it is essential for investors to research whether their home country has a tax treaty with the specific countries they are interested in. By doing so, they can potentially benefit from reduced withholding tax rates or even complete exemption from taxation.

To navigate the complex landscape of international investments, it is advisable to consult with a qualified tax advisor or accountant who specializes in this area. These professionals possess the expertise necessary to fully comprehend and explain the specific tax implications associated with investing in emerging market dividend ETFs.

By understanding the tax treaties and regulations between countries, investors can make informed decisions that optimize their investment returns while minimizing potential tax burdens.

The knowledge gained through thorough research and professional guidance will enable investors to navigate the intricacies of investing in emerging markets more effectively.

Brief Analysis of Current Market Conditions

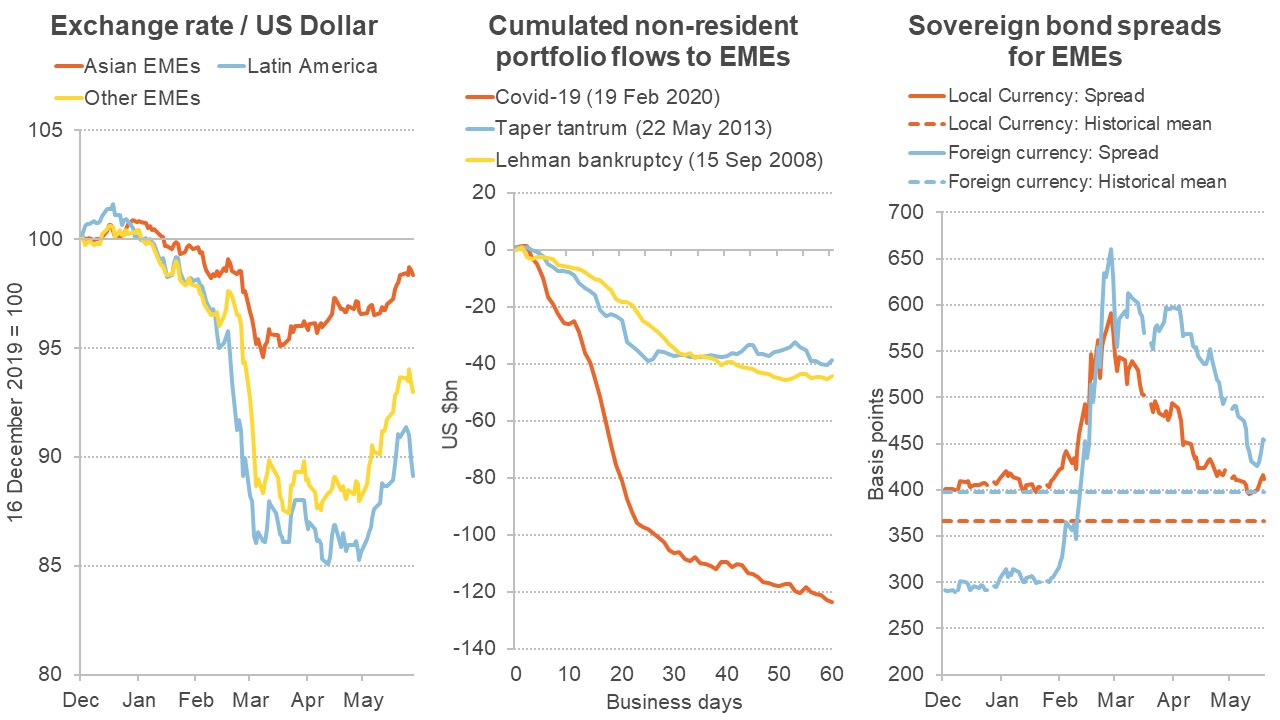

Emerging markets have seen significant economic growth, attracting investors seeking high returns and diversification. However, investing in these markets comes with higher risks. Volatility, political instability, economic uncertainty, and currency risks are major factors to consider.

Thorough analysis of market conditions is crucial before investing in emerging market dividend ETFs. By assessing risk tolerance and staying informed about current conditions, investors can make more informed decisions aligned with their goals.

| Factors to Consider When Investing |

|---|

| – Volatility |

| – Political instability |

| – Economic uncertainty |

| – Currency risks |

Potential Opportunities and Challenges

Emerging market dividend ETFs offer unique opportunities for investors. These funds provide exposure to companies in high-growth economies, with the potential for significant capital appreciation. Additionally, they offer attractive dividend income, appealing to income-focused investors.

However, challenges such as currency fluctuations, regulatory changes, and geopolitical uncertainties should not be overlooked. Investors need to monitor these factors and stay informed about any developments that may impact their investments.

| Challenges | Opportunities |

|---|---|

| Currency fluctuations | High-growth economies |

| Regulatory changes | Attractive dividend income |

| Geopolitical uncertainties | Participation in emerging market’s growth |

Evaluating Performance and Risk

Investing in an emerging market dividend ETF offers diversification benefits, mitigating company-specific risks compared to individual stocks. ETFs have lower expense ratios than traditional mutual funds, with actively managed funds often incurring higher fees. ETFs also provide liquidity, trading on stock exchanges throughout the day.

Assessing performance involves analyzing expense ratios, historical returns, and underlying holdings. Understanding these factors helps investors make informed decisions aligned with their goals and risk tolerance.

Unique Advantages and Disadvantages

Emerging market dividend ETFs offer unique advantages, such as exposure to high-growth markets and attractive dividend income. These funds allow investors to participate in the growth potential of emerging economies without having to select individual stocks. However, it is important to consider the potential disadvantages as well.

Emerging markets can be volatile, requiring a long-term investment perspective. Currency fluctuations can also impact returns for foreign investors. Careful assessment of investment objectives, risk tolerance, and time horizon is essential when choosing between emerging market dividend ETFs and other investment options.

Perspectives from Financial Experts

Renowned financial expert [Expert Name] believes emerging market dividend ETFs hold great potential for long-term investors. These funds provide exposure to high-growth economies and allow investors to benefit from increasing dividends paid by companies in these regions.

However, [Expert Name] emphasizes the importance of thorough research and analysis before investing. Factors such as evaluating underlying holdings, track record, expense ratios, liquidity, economic landscape, political stability, and regulatory environment should all be considered.

By listening to financial experts like [Expert Name], investors gain valuable insights that can shape their investment strategies and lead to more confident decisions in emerging markets.

Benefits and Risks

Investing in emerging market dividend ETFs offers both potential benefits and risks that investors should carefully consider. Renowned financial expert, [Expert Name], emphasizes the importance of understanding these factors to make informed investment decisions.

One significant benefit of investing in emerging market dividend ETFs is the potential for attractive opportunities. These funds can provide income-focused investors with high-dividend yields, making them an appealing option for those seeking regular cash flow from their investments.

By diversifying their portfolios across different emerging markets, investors can take advantage of the growth potential offered by these economies.

However, it is crucial to acknowledge the associated risks when considering these investments. Emerging markets can be volatile due to various factors such as political instability and economic changes. These uncertainties can have a significant impact on investments, potentially leading to losses if not managed properly.

Therefore, it is advisable for investors to adopt a diversified approach by spreading their investments across different asset classes and regions. This strategy helps mitigate risk and safeguards against the negative effects of any specific market or sector downturn.

To further illustrate the importance of understanding these risks, let’s explore some case studies that highlight failed investments in emerging market dividend ETFs. Analyzing past mistakes allows us to learn valuable lessons and avoid potential pitfalls when navigating this investment landscape effectively.

By weighing both the benefits and risks associated with investing in emerging market dividend ETFs, investors can make well-informed decisions aligned with their financial goals and risk tolerance levels. It is crucial to stay updated on global economic trends and seek advice from trusted financial professionals before venturing into these markets.

| Pros | Cons |

|---|---|

| High-dividend yields | Volatility in emerging markets |

| Potential for attractive opportunities | Political and economic changes impacting investments |

| Diversification across emerging markets | Need for effective risk management strategies |

[lyte id=’Q1PMTMYhR_w’]