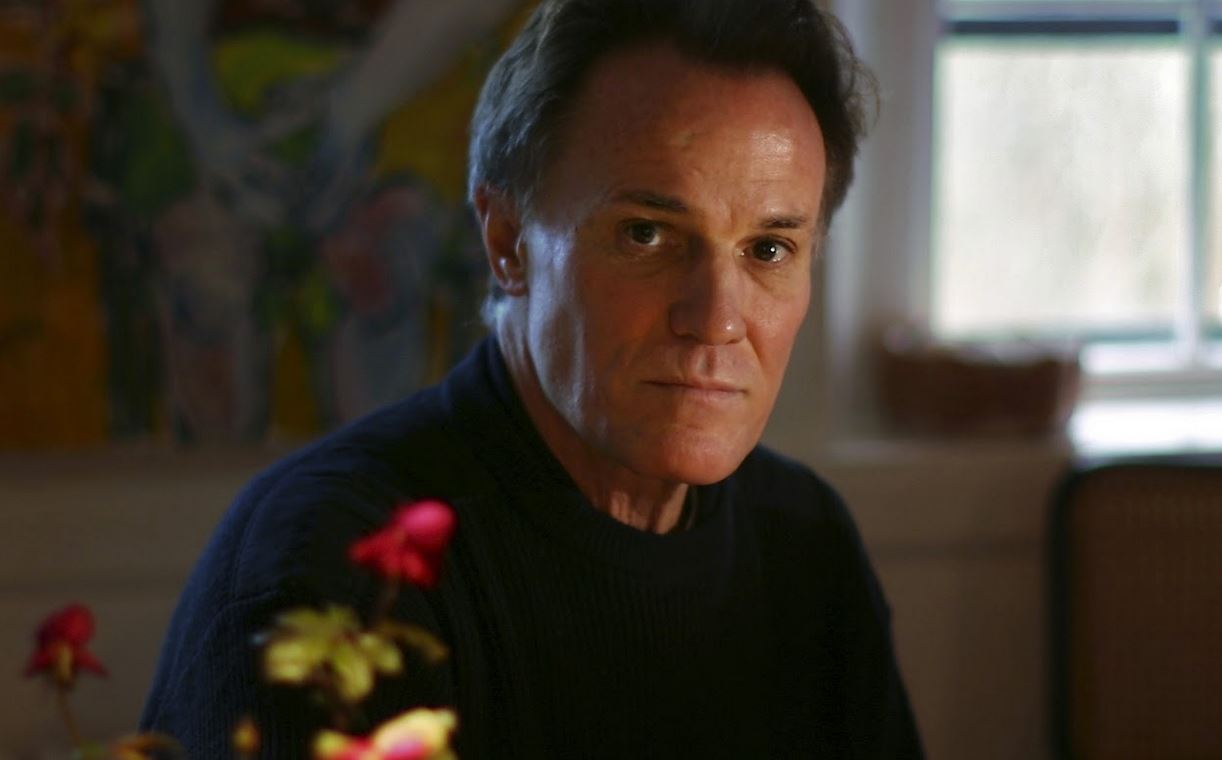

Bernie Schaeffer is a renowned figure in options trading, with over four decades of experience. Starting his career as an accountant, he quickly discovered a passion for investing and developed innovative strategies that set him apart from traditional traders.

With his deep understanding of market dynamics and unwavering commitment to research, Schaeffer has become a trusted name in the industry. As the founder of Schaeffer’s Investment Research, he shares his expertise through publications and resources, empowering individuals to make informed investment decisions.

Bernie Schaeffer’s background in options trading is marked by exceptional skills and groundbreaking strategies that continue to inspire others in navigating this dynamic market successfully.

Schaeffer’s Unique Approach and Success in the Field

Bernie Schaeffer’s success as an options trader can be attributed to his unconventional wisdom and innovative thinking. Unlike others who rely solely on technical analysis or blindly follow trends, Schaeffer emphasizes market sentiment analysis and effective use of technical indicators.

His ability to adapt to changing market conditions and think outside the box has consistently delivered impressive results. As a sought-after mentor, he offers valuable expertise to aspiring investors looking to learn from his unique approach.

Define Options and Their Significance in Investing

Options are financial derivatives that give investors the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. They provide flexibility in investment strategies and effective risk management.

One important aspect of options is their ability to act as insurance against potential losses. By purchasing options contracts, investors can protect their positions from adverse market movements. This involves buying put options to hedge against expected downturns in stock prices, limiting potential losses.

Options also serve as speculative instruments, allowing traders to profit from both rising and falling markets. Unlike stocks alone, options offer opportunities for gains regardless of market direction. Utilizing call and put options strategically enables traders to capitalize on market movements.

Understanding how options work is crucial for anyone entering the field of investing. It involves grasping concepts such as strike prices, expiration dates, implied volatility, and various trading strategies.

In summary, options play a vital role in investment portfolios by providing flexibility and risk management capabilities beyond stocks alone. They offer insurance against potential losses and enable speculation on market movements while requiring a solid understanding of their mechanics.

Explain the Basic Concepts of Calls and Puts

Calls and puts are two types of options that investors can use to their advantage. A call option gives the holder the right to buy an underlying asset at a specified price before or on a specific expiration date. On the other hand, a put option provides the holder with the right to sell an underlying asset at a predetermined price.

By purchasing call options, investors can benefit from upward price movements, while buying put options allows them to profit from downward price movements. These concepts form the foundation of options trading and open up possibilities for investors to diversify their strategies and potentially increase their returns.

Advantages and Risks of Options Trading

Options trading provides leverage, allowing investors to control larger positions with smaller investments. This amplifies potential returns but also increases risk. Options offer flexibility in timeframes and strategies, making them suitable for short-term speculation or long-term hedging.

Traders can generate income through writing covered calls or selling puts.

However, options trading comes with risks. Options can expire worthless if not utilized effectively due to their time-sensitive nature. The complex nature of options requires careful consideration and understanding before engaging in trades.

Explore Schaeffer’s Philosophy on Options Trading

Bernie Schaeffer’s approach to options trading revolves around the significance of market sentiment in predicting future trends. By understanding investor psychology and analyzing factors like fear and greed, he develops unique strategies that give him an edge over traditional traders.

Schaeffer believes that this understanding allows him to identify opportunities before they become apparent to others, enabling him to maximize profits. He leverages options as versatile tools for capitalizing on these insights, employing various strategies to generate income and manage risk effectively.

With his deep understanding of market sentiment dynamics, Schaeffer continues to inspire traders with his innovative methods and commitment to mastering the intricacies of options trading.

Unconventional Strategies and Techniques in Bernie Schaeffer’s Success

Bernie Schaeffer, a renowned trader and market analyst, employs unconventional strategies that set him apart from traditional traders. One of his key approaches is market sentiment analysis, which involves gauging investor mood to anticipate market moves.

By understanding the emotional aspect of trading, Schaeffer makes informed decisions aligned with prevailing sentiments.

He also combines sentiment analysis with technical indicators to identify trading opportunities. This holistic approach considers both quantitative data and subjective factors. By integrating these strategies, Schaeffer gains a unique perspective on the markets and stays ahead of trends.

Schaeffer’s success lies in his ability to think outside the box and challenge conventional wisdom. He recognizes that markets are influenced by human behavior and emotions. Incorporating these elements into his analysis gives him valuable insights others may overlook.

Traders can learn from Schaeffer’s success by embracing market sentiment analysis and leveraging technical indicators. These unconventional strategies have proven effective in navigating complex market conditions. Adopting a similar mindset can enhance understanding and improve chances of success in trading.

| Unconventional Strategies | Description |

|---|---|

| Market Sentiment Analysis | Gauging overall investor mood to anticipate market moves |

| Leveraging Technical Indicators | Combining sentiment analysis with objective data for identifying entry and exit points |

Bernie Schaeffer’s unconventional strategies have carved out a unique path in the trading world, making him an inspiration for aspiring traders everywhere.

Emphasize the Importance of Discipline and Risk Management in Options Trading

Options trading requires discipline and effective risk management. Bernie Schaeffer, an experienced trader, emphasizes the significance of setting clear rules and sticking to them, even in volatile situations.

By implementing stop-loss orders, managing position sizes, and having a well-defined exit strategy, traders can protect their capital and increase their chances of long-term success. Prioritizing discipline and risk management is essential for navigating the complexities of options trading.

[lyte id=’f6KApFnWo0I’]