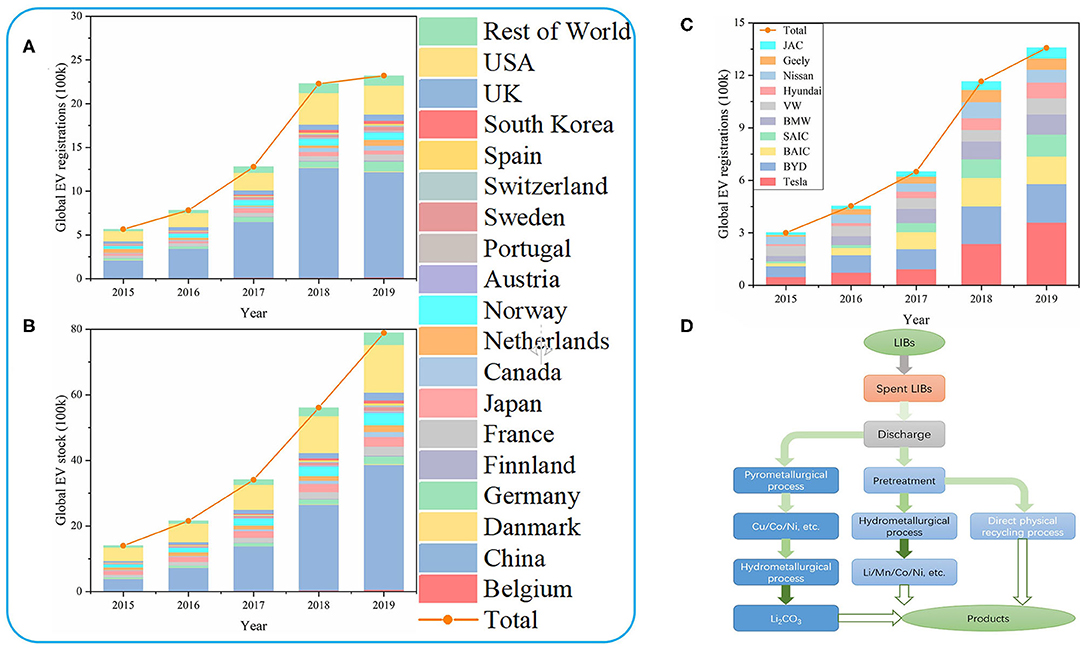

The global automotive industry is undergoing a monumental shift towards electric vehicles (EVs). As governments around the world implement stricter emissions regulations to combat climate change, EVs have emerged as a sustainable alternative to traditional gasoline-powered cars.

This transition has sparked a surge in demand for battery stocks, as batteries are an integral component of EVs. In this article, we will explore the market potential for battery stocks and delve into the various technologies driving their growth.

The Global Shift Towards Electric Vehicles

Electric vehicles (EVs) are experiencing a surge in popularity due to their environmental benefits and technological advancements. Concerns about air pollution and greenhouse gas emissions have led consumers to choose EVs as a cleaner transportation option.

According to BloombergNEF, EV sales are projected to reach 8 million units by 2025 and exceed 54 million units by 2040.

The positive impact of EVs on the environment is a key driver for their adoption. Unlike traditional vehicles, EVs produce zero tailpipe emissions, reducing harmful air pollutants. Technological advancements in batteries have improved driving ranges and charging times, addressing concerns about range anxiety.

Governments are supporting this shift by implementing incentives and policies to encourage the use of EVs.

The growing popularity of electric vehicles presents opportunities for businesses involved in manufacturing EV components and developing charging infrastructure. This shift towards electromobility is driving economic growth and fostering innovation in the automotive sector.

As the global shift towards electric vehicles gains momentum, it is clear that they will revolutionize the transportation industry and shape a more sustainable future.

The Pivotal Role of Batteries in EVs

Batteries are the backbone of electric vehicles, driving their performance and range capabilities. Advancements in battery technology have led to higher energy density, longer driving ranges, and faster charging times for EVs.

With improved batteries, range anxiety is a thing of the past as modern EVs can cover substantial distances on a single charge. Additionally, fast-charging capabilities minimize downtime and make long-distance travel more feasible.

Batteries have become a critical component within the electric vehicle ecosystem, with investments in research and development driving sustainability goals. As we move towards a greener future, batteries will continue to shape the way we travel and reduce our environmental impact.

Exploring the Market Potential for Battery Stocks

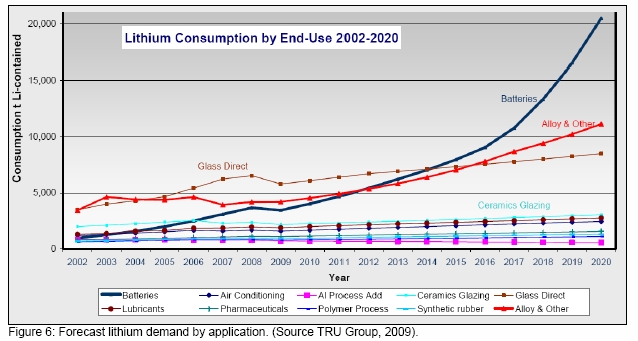

The demand for electric vehicles (EVs) has created a lucrative market opportunity for battery stocks. Automakers are relying on advancements in battery technology to meet consumer demands for longer-range EVs with shorter charging times.

This reliance opens up avenues for investment in companies involved in battery manufacturing, raw material production, and research and development.

Advancements in battery technologies, such as solid-state batteries, lithium-sulfur (Li-S) batteries, lithium-air (Li-Air) batteries, and sodium-ion (Na-ion) batteries, have the potential to revolutionize the EV industry and create new investment opportunities. Solid-state batteries offer increased energy density and improved safety.

Li-S batteries provide higher energy density without compromising weight or cost. Li-Air batteries can store even more energy but face technical challenges. Na-ion batteries offer affordability while maintaining satisfactory performance.

As EV adoption continues to rise globally, investors should closely monitor these technological developments and the companies involved in battery research and production to capitalize on this growing market.

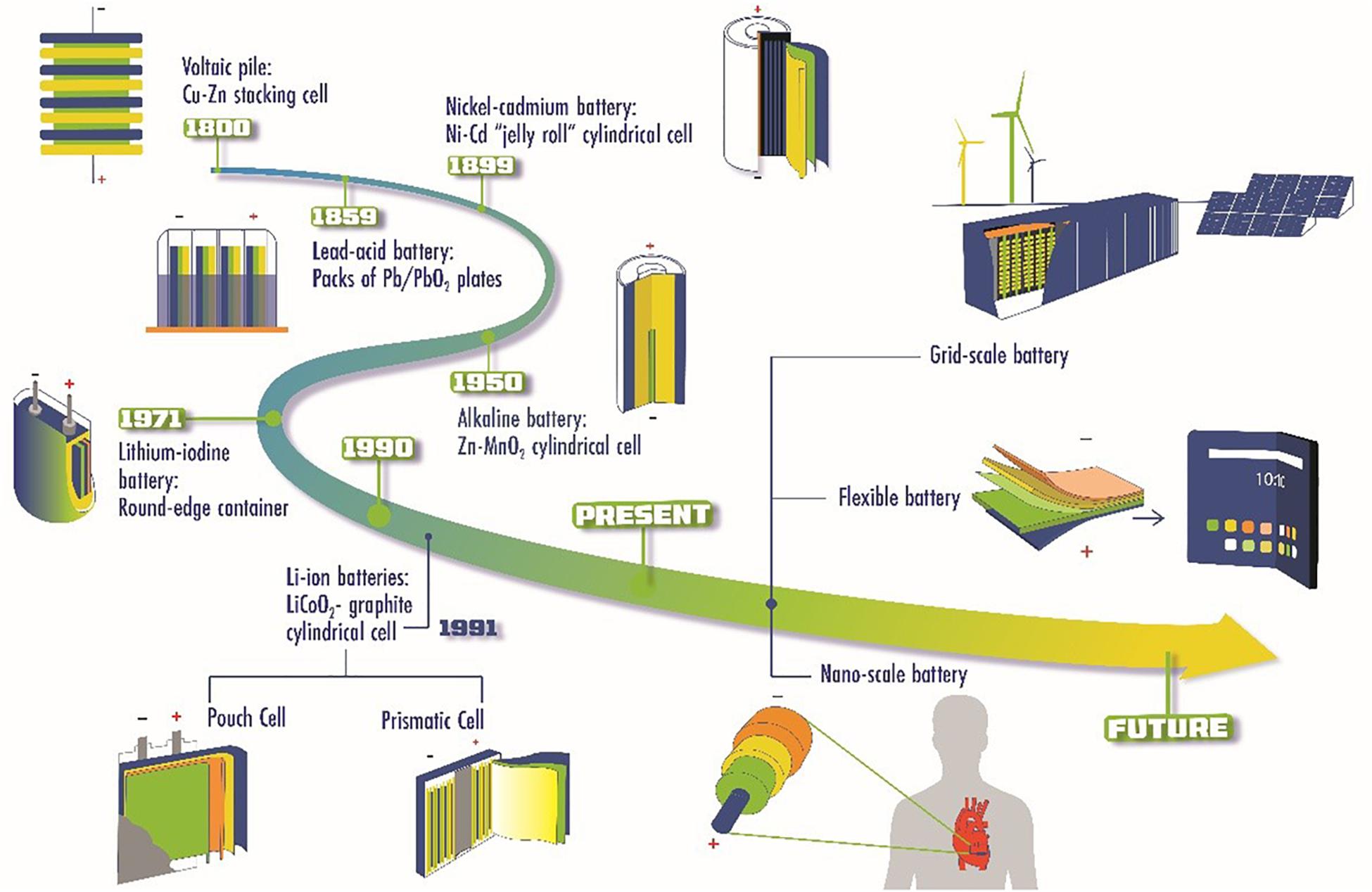

Lithium-ion Batteries: The Current Industry Standard

Lithium-ion batteries are the prevailing battery technology in the electric vehicle (EV) industry. They offer high energy density and long cycle life, making them ideal for EVs. These rechargeable batteries consist of a cathode, an anode, and an electrolyte solution that allows ions to flow during charging and discharging.

The cathode is typically made from lithium cobalt oxide (LiCoO2) or lithium iron phosphate (LiFePO4), while the anode is commonly graphite. When the battery is charged, lithium ions move from the cathode to the anode, releasing energy to power the vehicle.

Lithium-ion batteries have several advantages for EVs. They have a high energy density, providing longer driving ranges. They also have a low self-discharge rate and minimal memory effect, allowing for efficient use over multiple charge cycles.

However, there are limitations to consider. Lithium-ion batteries can be expensive due to the high cost of raw materials like lithium and cobalt. Additionally, they have limited thermal stability and may overheat if not properly managed.

Emerging Battery Technologies: Exploring the Alternatives

The field of battery technology is continuously evolving, with emerging alternatives to lithium-ion batteries showing promise for electric vehicles (EVs). Solid-state batteries, utilizing solid electrolytes instead of flammable liquids or gels, offer higher energy density, faster charging times, and improved safety.

Zinc-air batteries, which generate electricity using zinc metal and oxygen from the air, provide high energy density and sustainability due to the abundance and affordability of zinc. Other potential breakthroughs include lithium-sulfur batteries with higher energy densities and sodium-ion batteries that utilize sodium as a charge carrier.

Investing in battery stocks allows investors to capitalize on the growing demand for EVs and advancements in battery technology. By staying informed about emerging trends and key players in the industry, investors can make strategic investment decisions.

Established Battery Manufacturers Dominating the Market

Tesla’s Gigafactory in Nevada and LG Chem are leading the charge in revolutionizing battery production and supplying batteries to major electric vehicle (EV) manufacturers. The Gigafactory has significantly boosted Tesla’s production capacity while driving down costs through economies of scale.

Meanwhile, LG Chem supplies batteries to automakers like General Motors, Hyundai, and Audi, powering a wide range of successful EVs. These established manufacturers are at the forefront of meeting the growing demand for EVs and shaping the future of sustainable transportation.

Up-and-Coming Contenders Challenging the Status Quo

The battery industry is experiencing a shift as up-and-coming contenders challenge traditional players. Albemarle, a leading lithium producer, has become a key player in meeting the soaring demand for lithium-ion batteries.

Panasonic, a crucial supplier to Tesla, positions itself for success in the battery market through their partnership with the electric vehicle giant. These emerging companies bring fresh perspectives and innovative solutions to the table, pushing established players to adapt and improve.

Investors should consider factors such as market demand, technological advancements, and strategic partnerships when evaluating these contenders as investment opportunities. The successes of Albemarle and Panasonic demonstrate significant opportunities for growth and innovation within the battery industry’s evolving landscape.

Factors to Consider When Investing in Battery Stocks

Investing in battery stocks requires careful consideration of several factors. Firstly, assess the projected growth of the electric vehicle market and how it will drive demand for batteries. Stay updated on market research reports and forecasts to identify potential opportunities.

Secondly, look for battery companies with a strong focus on research and development. These companies are more likely to stay ahead of technological advancements and have a competitive edge through innovative technologies or strategic partnerships.

Thirdly, consider companies that demonstrate commitment to sustainability. Look for responsible sourcing of raw materials and recycling programs as indicators of sustainable practices.

Lastly, monitor regulatory factors that may impact the industry’s growth prospects. Government policies promoting renewable energy sources and clean transportation can significantly influence the battery market.

In summary, when investing in battery stocks, evaluate market growth projections, technological advancements, sustainability practices, and regulatory factors to make informed decisions.

| Factors to Consider When Investing in Battery Stocks |

|---|

| – Market Growth and Demand Projections for EVs |

| – Technological Advancements and Competitive Edge |

| – Sustainability and Environmental Impact |

| – Regulatory Factors |

[lyte id=’L080Il137Mw’]