Investing in the stock market has always been an exciting and potentially lucrative endeavor. However, with the growing popularity of electric vehicles (EVs), a new sector has emerged that is capturing the attention of investors worldwide – battery EV stocks.

These stocks represent companies involved in the production, development, and distribution of batteries for electric vehicles.

A Brief Overview of the Growing Popularity of Electric Vehicles

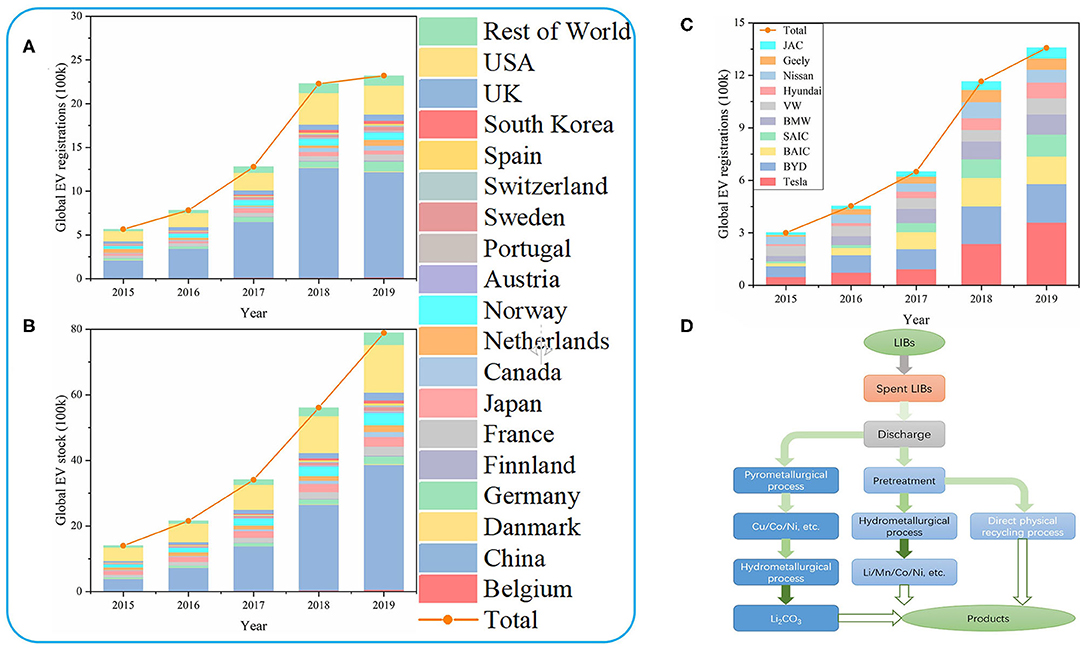

Electric vehicles (EVs) have gained significant traction as a sustainable alternative to traditional gasoline cars. Advancements in technology, increased environmental awareness, and potential cost savings have driven the surge in demand for EVs.

Technology has improved EV performance and range, alleviating concerns about range anxiety. Fast-charging stations have made recharging more convenient. Additionally, EVs emit lower carbon emissions, making them a greener transportation option. Governments incentivize their use through tax credits and subsidies.

EVs offer long-term cost savings with cheaper electricity compared to fuel costs. Maintenance expenses are also lower due to fewer moving parts. Investors recognize the market potential and are investing in EV manufacturing and infrastructure development.

With governments prioritizing sustainability and consumers becoming more conscious about their carbon footprint, the popularity of electric vehicles is expected to continue growing rapidly in the coming years.

Exploring the Impact of Battery Technology on the Stock Market

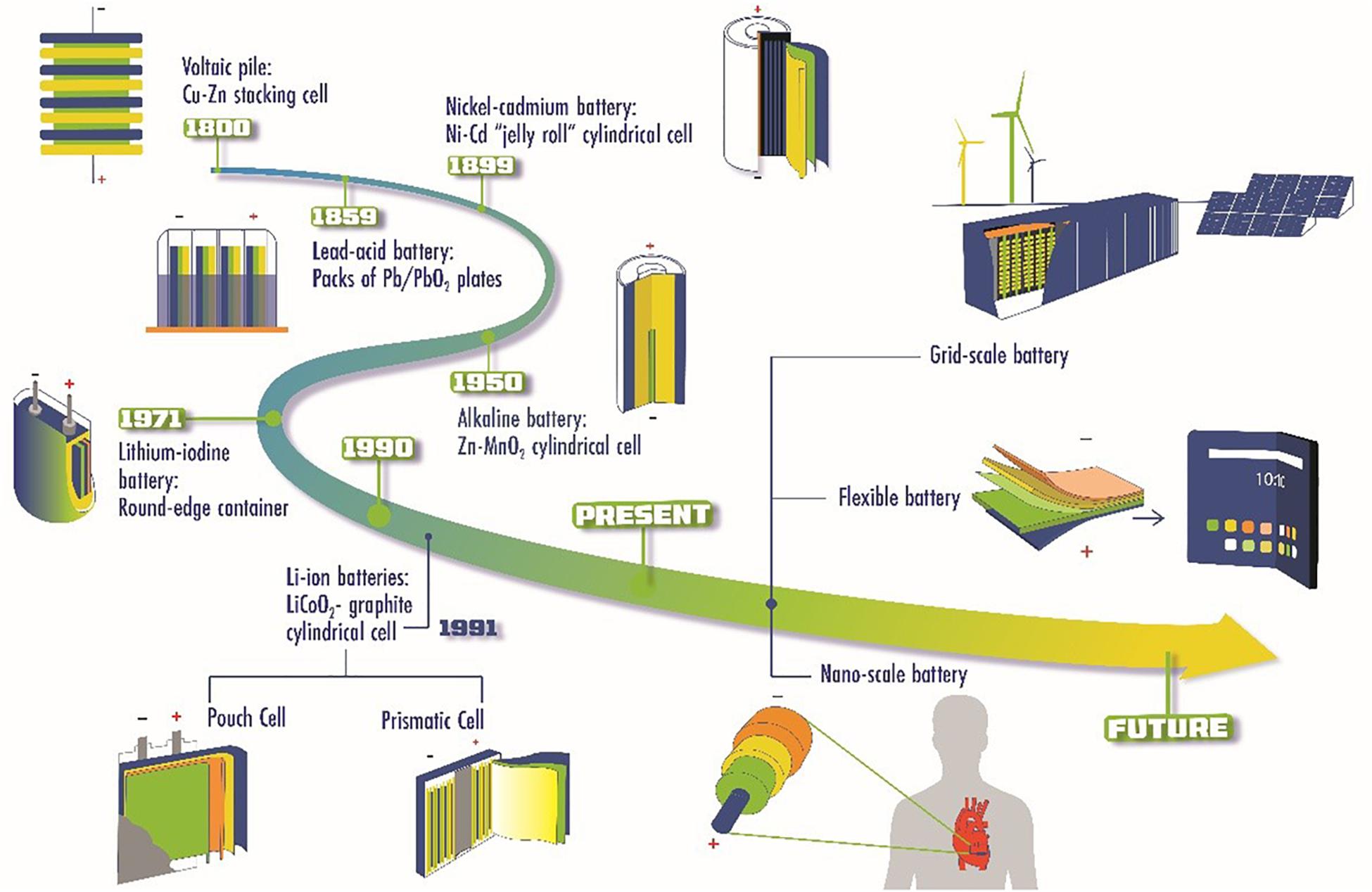

Advancements in battery technology are having a significant impact on the stock market. The success of electric vehicles (EVs) depends heavily on innovative battery solutions, which affect performance, range, and charging capabilities. As a result, investors are showing increased interest in battery EV stocks.

Understanding how battery technology differs from traditional automotive companies and identifying key growth factors is essential for investors looking to capitalize on this trend. Factors such as environmental consciousness, technological advancements, and government incentives all play a role in driving the growth of battery EV stocks.

By staying informed about these developments, investors can position themselves to potentially benefit from this evolving industry.

How Battery EV Stocks Differ from Traditional Automotive Companies

Battery electric vehicle (EV) stocks stand out from traditional automotive companies due to their specialization in designing and producing electric vehicle batteries. Unlike traditional automakers focused on internal combustion engines, battery EV companies are at the forefront of the global shift towards cleaner transportation solutions.

Investing in battery EV stocks offers opportunities for innovation, technological advancements, and exposure to a high-growth market segment driven by increasing demand for electric vehicles.

With their singular focus on electric mobility, battery EV companies have a competitive edge over traditional automakers transitioning from legacy infrastructure. Embracing this sector aligns with the global push for sustainable transportation and a greener future.

Factors driving the growth of battery EV stocks

The exponential growth potential of battery EV stocks can be attributed to several key factors that are shaping the industry and creating favorable conditions for investment. One significant driver is the implementation of government initiatives and policies supporting clean energy.

Governments worldwide are taking aggressive measures to combat climate change, investing heavily in incentives such as tax credits, grants, and infrastructure development to promote the adoption of electric vehicles. These actions not only contribute to a cleaner environment but also instill investor confidence in battery EV companies.

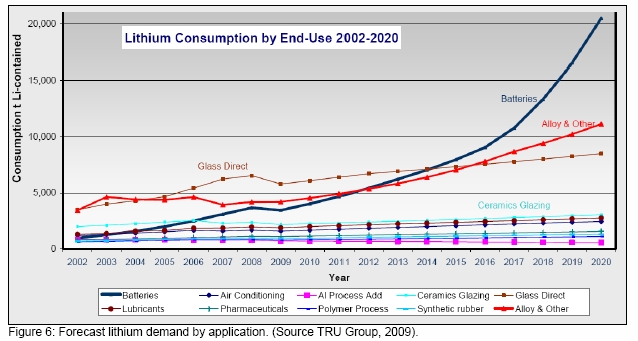

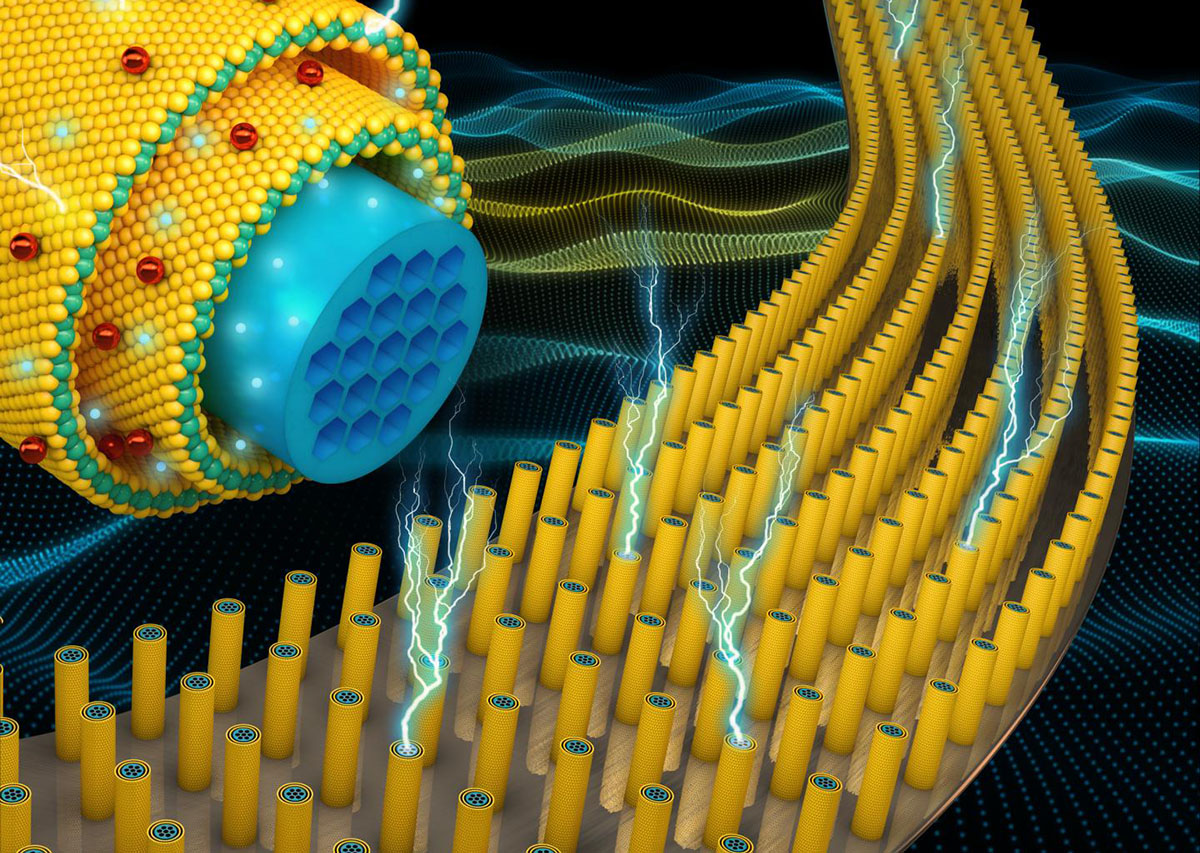

Technological advancements in battery technology also play a crucial role in driving the growth of battery EV stocks. Continuous research and development efforts are focused on developing batteries with longer ranges, faster charging times, and increased durability.

Breakthroughs in materials science and engineering are pushing the boundaries of what is possible, presenting new opportunities for investors as these technologies mature. The constant pursuit of innovation in this field ensures that battery EV companies remain at the forefront of cutting-edge solutions.

Furthermore, increasing consumer demand for electric vehicles is another significant factor propelling the growth of battery EV stocks. As individuals become more environmentally conscious and concerned about rising fuel costs, they are increasingly opting for electric vehicles as a sustainable alternative.

Battery EV companies that can meet this growing demand by providing high-quality products stand to benefit immensely from market expansion.

In summary, government support through clean energy policies, technological advancements in battery technology, and rising consumer demand for electric vehicles collectively drive the growth of battery EV stocks.

These factors create an environment conducive to investment and present opportunities for both established players and emerging companies within the industry.

Tesla: The Pioneer and Leader in Electric Vehicle Production

Tesla, the renowned name in the automotive industry, has firmly established itself as the pioneer and leader in electric vehicle production. With its unwavering commitment to innovation and forward-thinking design, Tesla has revolutionized the way people perceive electric vehicles.

What sets Tesla apart from traditional automakers is its unique approach to producing all-electric vehicles from scratch. Unlike its competitors, Tesla integrates battery technology into its design process right from the ground up.

This holistic approach allows them to achieve remarkable performance benchmarks while maintaining a sleek aesthetic appeal that is synonymous with their brand.

Through tireless research and development, Tesla has consistently pushed the boundaries of what electric vehicles can achieve. Their relentless focus on improving range capabilities and charging infrastructure has made them a favorite among consumers who value both sustainability and convenience.

By offering high-performance cars that can travel impressive distances on a single charge, Tesla has shattered preconceived notions about the limitations of electric vehicles.

Furthermore, Tesla’s financial performance and stock market success speak volumes about their impact on the industry. Over recent years, their stock has experienced unprecedented growth, making it one of the most sought-after investments in the market.

Investors are drawn to Tesla’s ability to consistently deliver on its promises and disrupt traditional automotive norms. The company’s long-term growth potential is undeniable, attracting those who recognize the value of being part of an industry-leading brand at the forefront of change.

General Motors: Transitioning towards EVs

General Motors (GM), a leading player in the automotive industry, is making significant strides in the electric vehicle (EV) market. With models like the Chevrolet Bolt EV already on the market and plans for more electric vehicles in their lineup, GM is positioning itself to compete with companies like Tesla.

GM recognizes the importance of sustainable transportation options and is investing in research, battery technology, and charging infrastructure to address consumer concerns. Investors looking for exposure to the growing EV market may find value in GM’s stock due to its stability and ability to adapt quickly to changing market dynamics.

Overall, GM’s transition towards EVs presents both challenges and opportunities as it leverages its existing infrastructure and expertise to capture a significant share of this expanding market.

Panasonic: The Key Supplier for Tesla’s Batteries

Panasonic has solidified its position as Tesla’s primary supplier of lithium-ion batteries for their electric vehicles (EVs). This strategic partnership benefits both companies, with Panasonic capitalizing on Tesla’s success while providing reliable battery technology.

As Tesla continues to grow and expand into new markets, the demand for batteries increases, offering investors an opportunity to capitalize on the successes of both industry leaders.

Contemporary Amperex Technology (CATL): Leading Chinese lithium-ion battery manufacturer

Contemporary Amperex Technology (CATL) has established itself as the forefront of China’s thriving electric vehicle industry. As one of the largest manufacturers of lithium-ion batteries worldwide, CATL not only supplies domestic automakers but also caters to renowned international players.

In China, where electric vehicle adoption surpasses that of any other country, CATL has seized remarkable opportunities for growth. Their reputation for delivering top-notch batteries at a competitive price point has positioned them as the preferred choice for both local and global automakers seeking reliable energy solutions.

Investors with an eye on capitalizing in the electric vehicle market can find immense value in investing in CATL. With China’s electric vehicle industry poised for continued expansion, being a leading battery manufacturer places CATL in an advantageous position for future success.

However, it is important to acknowledge and evaluate the risks and challenges associated with investing in battery EV stocks before making any investment decisions.

As with any investment venture, thorough consideration should be given to factors such as market volatility, technological advancements, regulatory changes, and competition within the industry.

To summarize, CATL’s dominance as a leading Chinese lithium-ion battery manufacturer stems from their ability to produce high-quality batteries that meet the demands of both domestic and international markets.

With China leading the charge in electric vehicle adoption, CATL’s strategic position ensures they are well-positioned to thrive amidst this rapidly growing industry.

[lyte id=’7bNCTIiuq1Y’]