Investing in real estate can be an excellent way to grow your wealth and generate passive income. However, buying physical properties may not always be feasible or practical for everyone. This is where Real Estate Investment Trusts (REITs) come into play.

REITs offer individuals the opportunity to invest in real estate without needing to directly own and manage properties.

But are REITs a safe investment?

In this article, we will explore the advantages of investing in REITs, the risks involved, factors to consider before investing, evaluate a REIT investment opportunity, share real-life success stories, provide tips for building a balanced portfolio with REIT investments, and ultimately determine if they are a safe investment option.

Introduction to REITs

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate. By pooling funds from multiple investors, REITs can acquire properties like office buildings, hotels, and shopping centers. Their primary goal is to generate rental income and distribute it as dividends to shareholders.

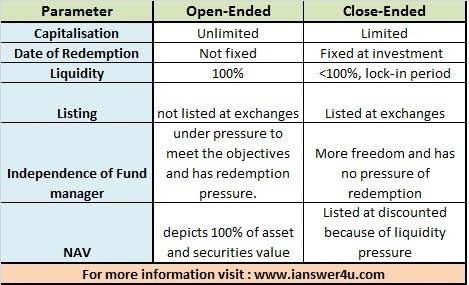

There are different types of REITs. Equity REITs own physical properties and earn income from rentals. Mortgage REITs invest in mortgage-backed securities for interest income. Hybrid REITs combine elements of both equity and mortgage REITs by investing in properties and providing financing for real estate projects.

Investing in a REIT offers advantages such as access to professionally managed portfolios and liquidity through publicly traded shares. Understanding the basics of REITs is crucial for those interested in real estate investment.

Advantages of Investing in REITs

Investing in real estate investment trusts (REITs) offers several significant advantages.

One advantage is the potential for regular income through dividends. By law, REITs are required to distribute at least 90% of their taxable income to shareholders as dividends, providing investors with a consistent stream of passive income.

Another advantage is diversification. REITs allow investors to diversify their portfolios beyond traditional stocks and bonds by owning a wide range of properties across different sectors and locations. This helps spread risk and protect against market fluctuations.

Investing in REITs also provides the benefit of professional management and expertise. With REITs, you benefit from experienced teams that handle property acquisition, leasing, maintenance, and other operational aspects on your behalf.

Lastly, investing in REITs offers the potential for long-term capital appreciation. As property values increase or new developments positively impact specific sectors, the value of your investment may grow significantly over time.

In summary, investing in REITs provides regular income through dividends, diversification benefits, professional management, and the potential for long-term capital appreciation. These advantages make REITs an attractive option for investors seeking passive income and long-term wealth building opportunities.

Risks Associated with Investing in REITs

Investing in REITs comes with certain risks that investors should be aware of. One risk is the sensitivity to interest rate changes and market volatility. As REITs rely on borrowing for property acquisitions, rising interest rates can impact their profitability. Market volatility can also cause temporary declines in value.

Another risk is tenant and occupancy issues. A significant tenant vacating or defaulting on lease payments can affect a REIT’s rental income. Assessing tenant quality and occupancy rates is crucial when considering investing in a specific REIT.

Regulatory changes and tax implications are additional risks to consider. Changes in zoning laws or tax codes can impact property values and rental income potential. Staying informed about potential regulatory changes is essential for investors.

In summary, investing in REITs offers opportunities but also carries risks related to interest rates, tenants, and regulations. Understanding these risks allows investors to make informed decisions.

Factors to Consider Before Investing in REITs

Before investing in REITs, it’s essential to conduct thorough research and consider key factors:

Evaluate the REIT’s historical financial performance, looking at metrics like revenue growth, profitability, and dividend history. Seek consistent and stable earnings.

Assess the quality and location of the REIT’s assets. Consider factors such as property type, location demographics, lease terms, and tenant quality. High-quality assets in desirable locations offer stability.

Research the management team’s experience in managing real estate portfolios and their ability to make sound investment decisions. A proven team with industry knowledge is crucial.

Different sectors within real estate carry varying levels of risk and growth potential. Understand the dynamics and trends specific to the sector or property type in which the REIT operates.

By considering these factors, you can make informed investment decisions that align with your goals while minimizing risks associated with investing in REITs.

Evaluating a REIT Investment Opportunity

When evaluating a specific REIT investment opportunity, consider the following:

Review the REIT’s historical performance, including revenue, earnings growth, and dividend history. Analyze financial statements like funds from operations (FFO) and net asset value (NAV) to assess its financial health.

Evaluate occupancy rates of properties in the REIT’s portfolio. Look for stable or increasing rates over time with favorable lease terms and reputable tenants.

Consider sector-specific risks that may impact the REIT’s performance. For example, in retail-focused REITs, evaluate online shopping trends or changing consumer preferences.

By carefully considering these factors when evaluating a REIT investment opportunity, you can make informed decisions that align with your goals in real estate investing.

Real-Life Examples: Success Stories of Investing in REITs

Investing in real estate investment trusts (REITs) can be rewarding, offering consistent income and potential capital appreciation. Let’s explore two success stories that demonstrate the benefits of investing in REITs.

During an economic downturn, an investor earned steady income by investing in a well-managed retail-focused REIT. Despite challenging market conditions, this REIT had diverse tenants who continued to pay rent, ensuring reliable cash flow.

By investing in a residential-focused REIT, an investor enjoyed both income and capital appreciation. Increasing demand for rental properties boosted the value of the underlying residential properties, resulting in regular dividends and significant gains upon selling the investment.

These success stories highlight the advantages of investing in REITs. However, thorough research and analysis are essential before making any investment decisions. Factors such as historical performance, management expertise, tenant quality, and market conditions should be carefully evaluated.

Consulting with financial advisors or real estate professionals can provide valuable guidance.

Tips for Building a Balanced Portfolio with REIT Investments

When incorporating REIT investments into your portfolio, consider diversifying across different sectors or property types. This helps protect against sector-specific downturns and provides exposure to various real estate market segments.

Additionally, allocate an appropriate percentage of your overall investment portfolio to REITs based on your risk tolerance and financial goals. Maintaining a balanced portfolio aligned with your investment objectives is crucial. By following these tips, you can optimize your chances for success in the real estate market.

Summary: Are REITs a Safe Investment?

REITs, or Real Estate Investment Trusts, provide investors with the opportunity to gain exposure to the real estate market without owning properties directly. They offer advantages such as regular dividends, diversification benefits, professional management expertise, and potential long-term capital appreciation.

However, there are risks to consider, including interest rate risk, tenant and occupancy risks, regulatory changes, and tax implications. Thorough research on factors like financial performance and asset quality is essential before investing in a specific REIT.

Taking a diversified approach within a real estate portfolio can help minimize risks while maximizing opportunities presented by high-quality REITs. Overall, investing in REITs can be safe when approached with careful consideration and due diligence.

[lyte id=’HdWjOgI4Cd4′]