The world of electric vehicles is buzzing with excitement as tech giant Apple makes its highly anticipated entry into the electric car market. With its reputation for innovation and groundbreaking products, Apple’s foray into this industry has investors and enthusiasts alike eagerly awaiting what could be a game-changing development.

In this article, we will explore the details of Apple’s car project, discuss its potential impact on electric vehicle stocks, and evaluate investment opportunities in Apple’s electric car stock.

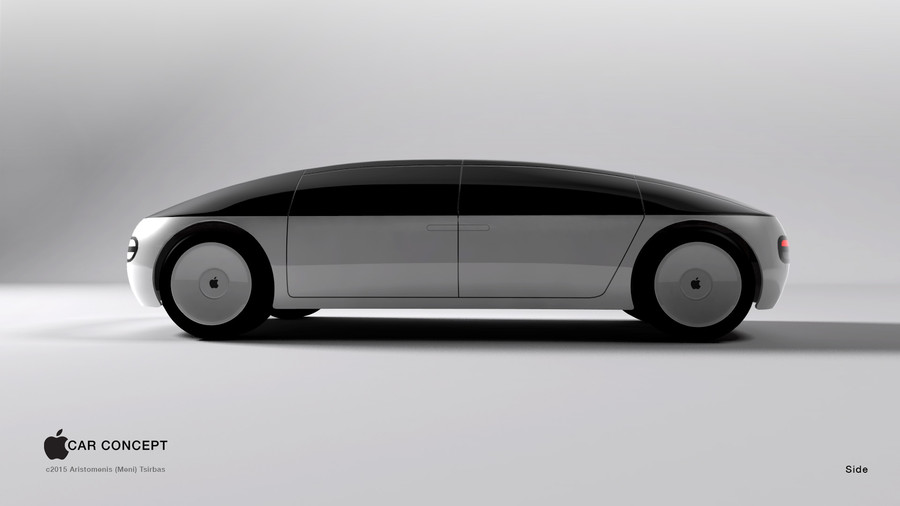

Apple has long been known for its disruptive technologies, from the iPhone to the Macbook. Now, it aims to revolutionize another industry with its top-secret Project Titan, also known as the Apple Car.

While details about the project are closely guarded, reports suggest that Apple is working on developing an autonomous electric vehicle that combines cutting-edge technology with sleek design.

Rumors about Apple’s interest in the automotive industry have been circulating for years. However, it was only recently that concrete evidence emerged when various sources confirmed that Apple had obtained permits to test self-driving cars on public roads.

This marked a significant step forward in their project and heightened anticipation among investors.

With its expertise in software development and consumer electronics, Apple has the potential to disrupt the traditional automotive market. By integrating advanced technologies such as artificial intelligence, machine learning, and augmented reality into their cars, they could create a unique driving experience that sets them apart from competitors.

As news of Apple’s entry into the electric car market spread, it naturally sparked interest among investors looking for opportunities in this rapidly growing sector. While it is still early days for the project, there are several electric vehicle stocks that could potentially benefit from Apple’s involvement.

Let’s take a closer look at some of these stocks:

Canoo (GOEV)

Canoo, a dynamic electric vehicle startup, is making waves in the automotive industry with its innovative approach to designing and manufacturing affordable, subscription-based electric vehicles.

The company’s commitment to sustainability and accessibility has positioned it as a frontrunner in the rapidly growing market for eco-friendly transportation solutions.

One of Canoo’s standout features is its revolutionary modular platform, which sets it apart from traditional vehicle manufacturers. This cutting-edge technology allows for flexible customization, giving consumers the freedom to personalize their electric vehicles according to their needs and preferences.

By offering such versatility, Canoo not only caters to individual tastes but also anticipates changing trends and evolving consumer demands.

With Apple recently announcing its entry into the electric vehicle market, interest in this futuristic industry has reached new heights. This development could potentially benefit Canoo by attracting increased investor attention and solidifying its position as an influential player in the electric vehicle space.

As more consumers embrace environmentally friendly alternatives, Canoo’s commitment to sustainable mobility aligns perfectly with the global shift towards greener transportation options.

Furthermore, Canoo’s subscription-based model provides customers with a hassle-free ownership experience. By eliminating large upfront costs and offering all-inclusive packages that cover maintenance and insurance, Canoo aims to make electric vehicles more accessible to a wider audience.

This unique approach removes barriers associated with traditional car ownership while providing convenience and peace of mind.

Luminar Technologies (LAZR)

Luminar Technologies, a leading provider of lidar technology, is revolutionizing the autonomous driving industry. Lidar, short for Light Detection and Ranging, utilizes lasers to create highly detailed 3D maps of the surrounding environment. By doing so, it enables self-driving cars to navigate safely and accurately.

With the rise of autonomous vehicles and the increasing demand for advanced sensor technologies, lidar has emerged as a critical component in the development of these cutting-edge systems. As companies like Apple venture into the realm of electric and autonomous vehicles, their need for sophisticated lidar solutions becomes evident.

This presents an exciting opportunity for Luminar Technologies to collaborate with Apple or even be acquired by them. Given Luminar’s expertise in developing state-of-the-art lidar systems, their technology could greatly complement Apple’s ambitious plans in the autonomous driving space.

By joining forces with Luminar, Apple would gain access to advanced lidar technology that could significantly enhance their self-driving capabilities. This collaboration could pave the way for more efficient and safer autonomous vehicles on our roads.

Moreover, merging with a renowned tech giant like Apple would provide Luminar Technologies with greater resources and reach. It would enable them to further innovate and expand their lidar offerings while benefiting from Apple’s extensive network and market influence.

Ayro (AYRO)

Ayro is a leading manufacturer of compact electric vehicles for urban environments, specializing in last-mile delivery and transportation. With their stylish and efficient designs, there is potential for collaboration between Ayro and Apple to create innovative electric vehicles tailored for city dwellers.

This partnership could revolutionize urban mobility and offer sustainable solutions for last-mile delivery services, reducing congestion and emissions in crowded cities. Combining Ayro’s expertise with Apple’s design and technology prowess opens up exciting possibilities for the future of urban transportation.

Foresight Autonomous (FRSX)

Foresight Autonomous is a leading developer of advanced vision systems and sensor technologies for autonomous vehicles. Their cutting-edge solutions accurately detect obstacles, pedestrians, and other vehicles, enhancing safety and reliability.

With Apple’s focus on self-driving capabilities, a partnership with Foresight Autonomous could provide them with state-of-the-art vision systems to further enhance their car project. Foresight Autonomous is at the forefront of this industry, constantly pushing boundaries and delivering excellence in autonomous driving technology.

ChargePoint (SBE)

ChargePoint is a leading player in the global electric vehicle charging infrastructure industry. With one of the largest networks of charging stations worldwide, ChargePoint is well-positioned to benefit from the increasing adoption of electric vehicles by consumers.

As more people choose to go electric, the demand for convenient and accessible charging solutions continues to rise.

The potential entry of Apple into the electric car market further amplifies the growth opportunities for ChargePoint. If Apple successfully ventures into this space, it would contribute to a significant increase in the number of electric vehicle owners who require reliable and efficient charging facilities.

In response to this growing market, ChargePoint can expand its network even further, catering to the needs of these new electric car owners.

As investors evaluate potential investment opportunities in Apple’s electric car stock, it is crucial to consider companies like ChargePoint that can leverage Apple’s entry into the market.

By expanding their charging infrastructure network and offering convenient solutions for electric vehicle owners, ChargePoint stands to benefit from this exciting development.

It is important for investors to conduct thorough research and analyze various factors before making investment decisions. Factors such as financial performance, competitive landscape, and industry trends should be carefully considered.

Staying informed about developments in both the electric vehicle sector and Apple’s car project will enable investors to position themselves strategically and potentially capitalize on opportunities within this dynamic space.

| Key Points |

|---|

| – ChargePoint operates a large network of EV charging stations globally |

| – The demand for charging infrastructure is growing as more consumers adopt electric vehicles |

| – Apple’s entry into the EV market could result in increased demand for convenient charging solutions |

| – This presents significant growth opportunities for ChargePoint as they expand their network |

| – Investors should carefully evaluate various EV stocks that could benefit from Apple’s involvement |

[lyte id=’O3WhErYeckI’]