In the world of investing, there are always new opportunities emerging. One sector that has been gaining increasing interest is nuclear power and uranium investments. This article will delve into the potential of this industry and explore the reasons behind its growing popularity.

Investing in Nuclear Power & Uranium

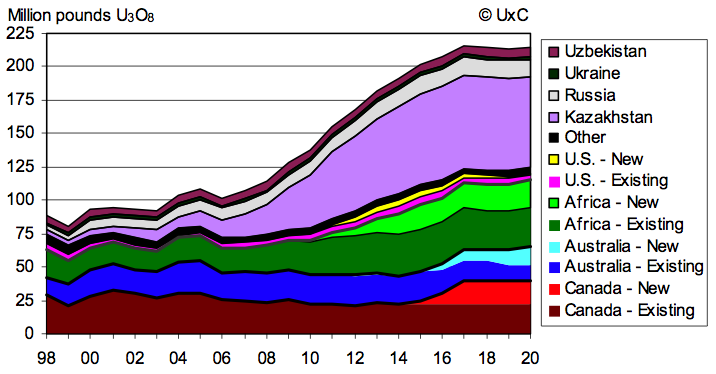

Nuclear power and uranium investments have gained attention as a clean energy solution. With growing concerns about climate change, nuclear power offers a promising alternative to fossil fuels. Uranium, the primary fuel for nuclear reactors, is in high demand as the need for nuclear energy increases.

Governments worldwide recognize the importance of reducing carbon emissions and transitioning to cleaner sources, making nuclear power an attractive investment option. Advancements in technology have made reactors safer and more efficient, alleviating concerns and increasing acceptance among policymakers and the public.

Geopolitical factors also drive interest in uranium investments as countries seek energy independence. However, potential investors should carefully evaluate risks such as regulations, public perception, and waste disposal challenges before entering this industry.

Overall, investing in nuclear power and uranium presents an intriguing opportunity for those interested in sustainable energy solutions.

Evaluating Uranium & Nuclear Energy ETFs

Exchange-Traded Funds (ETFs) are essential investment options in the uranium industry. These funds provide exposure to a diversified basket of assets, focusing on companies involved in uranium mining, nuclear power plant operations, and equipment manufacturing.

Investing in these ETFs allows investors to gain sector-wide exposure without the need to select individual stocks.

There are different types of uranium and nuclear energy ETFs available, some focusing solely on uranium mining companies, while others have a broader scope including various industry players. Investors should consider their risk tolerance and investment goals when choosing an ETF.

Market conditions and specific company performance can impact the volatility of these funds.

Fees associated with these ETFs should also be taken into account. Each fund has its own expense ratio that covers management fees and operating costs. Investors should evaluate these fees and compare them across different funds before making a decision.

In summary, evaluating uranium and nuclear energy ETFs involves considering risk tolerance, investment goals, market conditions, and associated fees. By understanding these factors, investors can make informed decisions about which ETF aligns best with their needs in the uranium industry.

Top-performing Uranium ETFs

Exchange-Traded Funds (ETFs) have become popular investment options in the uranium sector. Here, we highlight three top-performing uranium ETFs that offer unique characteristics and strong returns.

-

Example Uranium ETF 1: This fund focuses on uranium mining companies and related industries, consistently outperforming its peers.

-

Example Uranium ETF 2: With a diversified portfolio of miners and nuclear power plant operators, this fund provides steady growth with reduced volatility.

-

Example Uranium ETF 3: Investing in established companies within the uranium industry, this more conservative fund offers stability and consistent performance.

Analyzing their performance, returns, and market trends is crucial for informed investment decisions. Factors like uranium prices, geopolitical developments, and regulatory changes impact these funds’ performance and the industry as a whole.

Investing in these top-performing uranium ETFs presents opportunities to capitalize on the sector’s potential while aligning with individual investment goals and risk tolerance.

Global X Uranium ETF Performance Analysis

The performance of the Global X Uranium ETF has attracted significant attention in recent years. This fund has consistently shown strong growth, making it a popular choice among investors looking to gain exposure to the uranium sector.

Factors such as global demand for nuclear energy, supply dynamics within the uranium market, regulatory developments, and technological advancements have influenced its performance. By carefully examining these factors, investors can position themselves to take advantage of potential opportunities within this sector.

Summary of Key Findings

Investing in nuclear power and uranium offers an exciting opportunity to diversify portfolios and capitalize on a growing industry. Factors such as increasing global demand for clean energy, advancements in nuclear technology, and geopolitical considerations contribute to the rising interest in this sector.

By exploring different types of uranium and nuclear energy ETFs and analyzing their historical performance, investors can make informed decisions based on risk tolerance and investment goals. Thorough research and consultation with a financial advisor are essential before making any investment decisions in this market.

Positioning oneself for potential long-term success in the world of uranium investing requires staying informed about market trends and understanding the nuances of this dynamic industry.

[lyte id=’ZPtZjOd5gi4′]