Introduction

Blockchain technology has revolutionized the world of investing, opening up new opportunities and avenues for growth. As an investor interested in learning more about this exciting field, it’s essential to have access to reliable and trustworthy resources.

In this article, we will dive into a comprehensive review of 101 Blockchains, a leading platform that provides expert insights and guidance for investing in blockchain technology. Whether you’re a beginner or an experienced investor, 101 Blockchains offers valuable resources to help you navigate the complex world of blockchain investments.

Understanding the Basics of Blockchain Technology

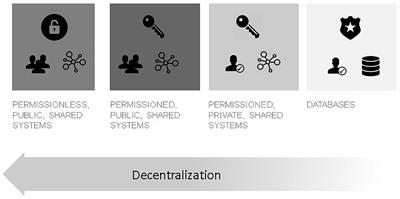

Blockchain technology is a decentralized system that eliminates intermediaries by allowing multiple parties to maintain a shared digital ledger. Transactions are recorded in blocks and linked together, creating an unalterable chain of information. It relies on cryptographic principles for security and uses consensus mechanisms for verification.

Blockchain has diverse applications in finance, supply chain management, identity verification, and healthcare records management. Its transparency reduces fraud and increases efficiency in various processes across industries.

As we explore this groundbreaking technology further, its impact will reshape how we interact with data and conduct transactions.

Introducing 101 Blockchains: A Review

101 Blockchains is a leading platform dedicated to providing comprehensive education and insights into blockchain technology and its investment potential. With a focus on empowering investors, they offer a wide range of valuable resources tailored specifically for those interested in exploring the world of blockchain.

At its core, 101 Blockchains aims to bridge the knowledge gap by offering educational courses, webinars, and tutorials. These resources cover various aspects of investing in blockchain, ensuring that investors have access to the latest information and trends.

By providing in-depth market research reports and expert analysis, 101 Blockchains equips investors with the tools they need to make informed decisions.

The platform’s team consists of industry professionals who have extensive experience in the field. Their expertise allows them to offer invaluable insights into market dynamics and potential risks associated with investing in blockchain technology.

By leveraging this knowledge, investors can minimize their risks and maximize their chances of success.

What sets 101 Blockchains apart is their commitment to delivering high-quality content that is easy to understand and digest. They understand that navigating the complex landscape of blockchain technology can be daunting for beginners, so they strive to present information in a clear and concise manner.

In summary, whether you are an experienced investor or just starting out, 101 Blockchains offers a wealth of resources to help you navigate the world of blockchain technology.

From educational courses to market research reports, their platform provides the necessary tools for investors to stay ahead of the curve and make informed investment decisions.

Examining the Benefits of Investing in Blockchain Technology

Investing in blockchain technology offers significant benefits for investors. The market is projected to grow exponentially, driven by increasing adoption across industries such as finance, supply chain management, and healthcare. This presents a high growth potential and lucrative opportunities for early adopters.

Blockchain technology is no longer limited to cryptocurrencies alone. Businesses recognize its potential in enhancing transparency, security, and streamlining processes. As more companies integrate blockchain into their operations, the value of blockchain investments continues to rise.

Investing in blockchain early can lead to substantial returns, similar to early investors in Bitcoin or Ethereum. By diversifying portfolios with blockchain-based assets, investors reduce reliance on traditional asset classes and mitigate risks associated with individual cryptocurrencies or startups.

In summary, investing in blockchain technology allows investors to tap into a rapidly growing market with diverse applications. The potential for high returns and portfolio diversification make it an attractive option for those looking to capitalize on this transformative technology.

Exploring Investment Options in Blockchain Technology

Investing in blockchain technology offers a range of opportunities for investors. One option is to invest in established cryptocurrencies like Bitcoin and Ethereum. Bitcoin dominates the market and is widely accepted, while Ethereum’s smart contract capabilities enable participation in decentralized applications (DApps).

Another avenue is investing in blockchain-based companies and startups. Thorough research is crucial, focusing on strong teams, innovative solutions, and scalability potential. Evaluating market demand and adoption potential is key for success.

Stay informed about market trends and regulatory developments to make informed investment decisions in this transformative industry.

Understanding the Risks Associated with Blockchain Investments

Investing in blockchain technology comes with inherent risks that investors should be aware of. Two significant risks include volatility in cryptocurrency prices and regulatory uncertainties/legal challenges.

Cryptocurrency prices are highly volatile, capable of fluctuating drastically within short periods. This volatility can lead to potential losses if not managed carefully. It is crucial for investors to have a robust risk management strategy and stay updated on market trends to mitigate these risks effectively.

Blockchain technology operates within a complex regulatory landscape that is still evolving. Changes in regulations and legal challenges can impact the value of blockchain investments. Staying informed about regulatory developments and seeking expert advice when needed are essential for navigating these risks successfully.

In summary, while investing in blockchain offers exciting opportunities, it’s crucial to understand and manage the risks associated with this emerging technology. Volatility in cryptocurrency prices and regulatory uncertainties/legal challenges require careful consideration and proactive risk management strategies from investors.

Navigating Through the World of Blockchain Investments with 101 Blockchains

When it comes to investing in blockchain, navigating the ever-changing landscape can be challenging. That’s why 101 Blockchains is here to help. They provide access to expert insights from industry professionals who understand the intricacies of blockchain investing.

These insights can guide you in making informed decisions and avoiding common pitfalls. Additionally, 101 Blockchains offers a wide range of educational resources, including courses, webinars, and tutorials, designed to equip investors with the knowledge needed to navigate the complexities of blockchain technology.

With their guidance and educational materials, you’ll be better prepared to thrive in the world of blockchain investments.

Success Stories – Investors Who Have Benefited from Blockchain Investments

Blockchain investments have proven to be a pathway to financial success, as demonstrated by two captivating stories of investors who reaped significant rewards.

Case Study #1: Early adopter turned millionaire

An early Bitcoin adopter made a modest investment in the cryptocurrency during its infancy. As Bitcoin gained mainstream acceptance and its value skyrocketed, this investor’s fortune grew exponentially, turning them into a millionaire.

This success story underscores the potential returns that can be achieved through early investments in blockchain technology.

Case Study #2: Strategic investment in a successful startup

Another inspiring tale involves an investor who recognized the potential of a promising blockchain startup and strategically invested in it. As the startup gained traction and flourished within the industry, the investor’s initial investment multiplied several times over.

This case study highlights the rewards of identifying high-potential projects within the blockchain ecosystem.

These success stories serve as reminders of how strategic decisions within the world of blockchain investments can lead to remarkable financial gains. By learning from these examples, we can navigate this exciting field with confidence, seeking out new opportunities for prosperity in decentralized finance.

Tips for Beginner Investors Venturing into the Blockchain Space

Entering the world of blockchain investments as a beginner can be overwhelming. Here are some tips to help you navigate your initial steps:

-

Start with a modest investment: Begin with a small amount to familiarize yourself with market dynamics and gain experience without risking too much capital.

-

Educate yourself about blockchain technology: Deepen your knowledge to make informed decisions by utilizing educational resources that explain blockchain principles and associated risks.

-

Stay updated on market trends and news: Follow reputable sources to understand new projects, regulatory changes, and technological advancements within the blockchain space.

-

Diversify your portfolio: Spread your investments across different cryptocurrencies or projects to mitigate risk and increase chances of long-term success.

-

Seek guidance from experienced professionals: Connect with knowledgeable individuals in blockchain investing communities or consider consulting financial advisors for expert advice.

-

Exercise caution and conduct due diligence: Scrutinize project details such as whitepapers, team backgrounds, partnerships, compliance, and real-world use cases before investing.

-

Embrace long-term thinking: Focus on projects with solid fundamentals aligned with your long-term goals rather than being swayed by short-term market volatility or hype.

By following these tips, you can approach blockchain investments more confidently while maximizing your chances of success.

[lyte id=’V8YRBlVn-xA’]