The rise of electric vehicles (EVs) has been remarkable as the world becomes more environmentally conscious. Governments are pushing for sustainable transportation, leading to increased popularity of EVs. However, we often overlook the companies behind the scenes that make EV charging possible.

Investing in EV charging stocks can be a wise move due to the growing demand for convenient charging solutions and government support. Technological advancements and positive market trends further contribute to the industry’s growth potential. Let’s explore these factors to help you make informed investment decisions.

Market Trends in the EV Charging Industry

| Market Trends | Description |

|---|---|

| Growing Demand | Increasing adoption of electric vehicles drives demand for accessible and efficient charging infrastructure. |

| Government Support | Governments worldwide provide incentives and policies to promote sustainable transportation options. |

| Technological Advancements | Continuous improvements in charging station efficiency, compatibility, and battery technology enhance user experience. |

| Promising Growth Prospects | The global EV charging infrastructure market is projected to grow at a CAGR of 34.7% between 2021 and 2028. |

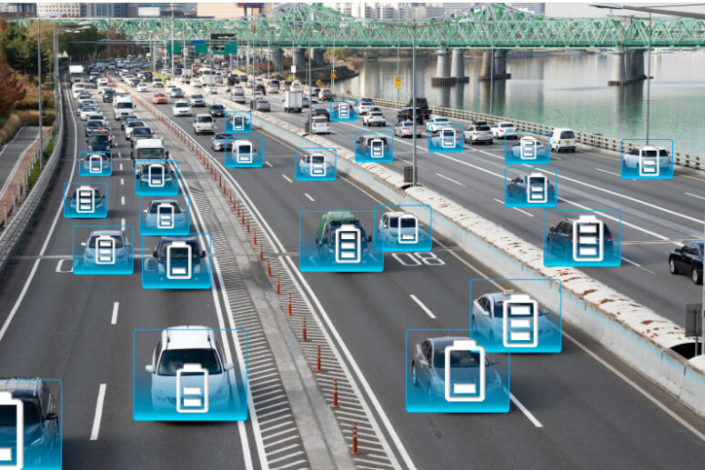

The Rise of Electric Vehicles

Electric vehicles (EVs) have experienced a remarkable surge in popularity over the past few years. With their eco-friendly nature and cutting-edge technology, EVs are garnering increasing favor among consumers worldwide.

This shift can be attributed to several key factors, including growing environmental concerns, soaring fuel prices, and government incentives.

In response to the urgent need for sustainable transportation options, countries across the globe are embracing EVs as a means to combat climate change and reduce carbon emissions. Governments are implementing policies aimed at encouraging the adoption of electric vehicles while phasing out traditional fossil-fueled cars.

This global movement towards sustainable transportation creates a favorable environment for investing in EV charging stocks.

The market for electric vehicles is expanding at an unprecedented rate. According to BloombergNEF, global sales of electric cars reached over 2 million units in 2019, marking a substantial 40% increase from the previous year.

These statistics highlight the growing demand for EVs and reflect a shift in consumer preferences towards cleaner and more efficient modes of transportation.

Furthermore, industry experts predict that by 2040, more than half of all new car sales will comprise electric vehicles. This projection underscores the long-term viability and potential dominance of EVs in the automotive industry.

As technology continues to advance and infrastructure for charging stations expands, electric vehicles are poised to become an integral part of our daily lives.

The Importance of EV Charging Infrastructure

Access to convenient charging stations is a major challenge for potential EV owners. To promote widespread adoption, it is crucial to develop an extensive and reliable charging infrastructure. Without it, EVs face limitations in range and accessibility.

Building a widespread charging network offers numerous benefits. It increases consumer confidence, reduces range anxiety, and improves convenience for EV owners. However, there are challenges like high initial costs and regulatory hurdles that require collaboration among stakeholders.

Successful examples of charging infrastructure projects exist globally. Norway has over 11,000 public charging points, while China has invested heavily in a nationwide network to support its booming electric vehicle market.

Government Initiatives and Support for EV Charging Stocks

Governments globally are actively supporting the development of electric vehicle (EV) charging infrastructure through funding programs, tax incentives, grants, and mandates for EV-ready parking spaces in new buildings. These initiatives create a favorable investment climate for companies operating in the EV charging sector.

Financial incentives, such as tax credits and subsidies, further encourage investment in clean energy initiatives by reducing capital expenditures for companies building EV charging infrastructure. This makes investing in EV charging stocks an attractive proposition for investors.

Countries like Germany and France have implemented comprehensive plans to support the growth of EV charging networks. Germany’s National Charging Infrastructure Masterplan aims to install one million public chargers by 2030, while France’s “Plan Véhicule Electrique” focuses on increasing both public and private charging stations.

Government initiatives play a crucial role in driving the deployment of EV charging infrastructure worldwide. As governments continue prioritizing sustainability goals, we can expect further support and incentives that will contribute to the growth of EV charging stocks.

Key Players in the EV Charging Industry

The EV charging industry is dominated by key players like Tesla, ChargePoint, EVBox, and Blink Charging. Tesla’s Supercharger network and ChargePoint’s extensive charging network have gained significant market share. EVBox focuses on solutions for businesses and municipalities, while Blink Charging offers diverse charging options.

These companies have experienced revenue growth due to increasing demand. Challenges include scalability and interoperability between networks, as well as evolving customer expectations.

Market Trends and Forecast for EV Charging Stocks

With the rapid growth of electric vehicles (EVs) in recent years, the demand for EV charging infrastructure has surged, leading to a significant rise in the market for EV charging stocks. Investors have started recognizing the potential of this emerging industry, resulting in substantial increases in stock prices for companies like Blink Charging.

Various factors influence the performance of EV charging stocks. Positive developments such as new partnerships or contracts can instill confidence among investors and drive stock prices up. On the other hand, negative news regarding regulatory changes or increased competition may cause a decline in stock prices.

Industry experts predict a promising future for EV charging stocks, with continued growth expected as electric vehicle adoption expands worldwide. Governments are heavily investing in infrastructure development to support the rising demand for EVs.

As access to convenient and reliable charging stations becomes crucial, the need for robust EV charging networks is becoming increasingly apparent.

The forecasted market projections suggest that there will be sustained growth in the EV charging sector. Global consumer demand is on the rise, and governments are prioritizing initiatives that promote clean transportation solutions. As a result, more investment opportunities are arising within the industry.

The Role of Technology in Driving Stock Performance

Technological advancements significantly impact the growth and performance of stocks in the EV charging industry. Innovations like wireless charging, ultra-fast chargers, and smart grid integration enhance user experience, improve efficiency, and attract investor interest.

Wireless charging eliminates the need for physical cables, offering convenient and seamless experiences. Ultra-fast chargers reduce charge times, driving market demand for EVs. Smart grid integration optimizes charging based on renewable energy availability.

Investors should monitor technological advancements to identify investment opportunities and capitalize on the growing market demand for innovative EV charging solutions.

Risks and Considerations for Investing in EV Charging Stocks

Investing in EV charging stocks comes with risks that should be carefully considered. Regulatory changes, such as alterations to government incentives or subsidies for electric vehicles, can impact market dynamics. Competition from new players entering the market and technological disruptions are also potential risks.

Delays in infrastructure development and slower adoption rates of electric vehicles can negatively affect stock prices.

To make informed investment decisions, thorough due diligence is necessary, including researching company financials, analyzing market trends, evaluating competitive landscapes, and understanding government policies related to electric vehicle adoption.

Being aware of these risks and conducting proper research can help mitigate potential losses and increase the chances of profitable investments in the EV charging sector.

[lyte id=’rqtfcfV4ItI’]