Investing in graphene stocks has become increasingly popular as this revolutionary material continues to gain traction across various industries. Graphene, a one-atom-thick sheet of carbon, possesses remarkable properties that have the potential to transform numerous sectors.

In this article, we will explore the best graphene stocks to consider for investment and delve into the opportunities and challenges associated with them.

Introduction

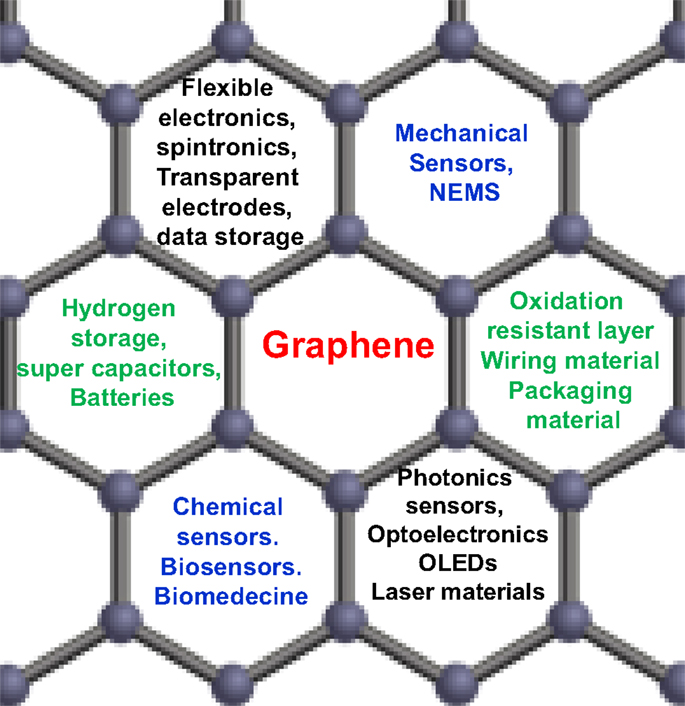

Graphene, a two-dimensional material made up of a single layer of carbon atoms arranged in a hexagonal lattice, possesses extraordinary properties that have the potential to revolutionize industries such as electronics, energy storage, healthcare, and aerospace.

With its exceptional strength, electrical conductivity, and thermal conductivity, graphene offers immense possibilities for enhancing device performance and efficiency.

From improving battery technology to reducing fuel consumption in automobiles and airplanes, graphene’s versatility makes it an incredibly promising material for future advancements.

Top Graphene Stocks to Invest In

This section explores three top graphene companies that offer promising investment opportunities. By analyzing their financial performance, growth prospects, partnerships, research initiatives, and competitive advantages, we can identify the most attractive options for investors.

Company A stands out for its financial stability and strong growth potential in the graphene industry. Strategic partnerships with key players in various industries give them a significant competitive advantage, providing access to expertise, resources, and distribution channels.

Company B specializes in developing graphene-based materials for energy storage applications. This targeted approach positions them as leaders in this niche market, making them an appealing choice for investors interested in the growing energy storage sector.

Company C has established a competitive edge through unique technologies or patents related to graphene production or application. Their consistent introduction of new products and advancements showcases their commitment to innovation and future success.

In summary, these top graphene stocks offer attractive investment opportunities based on their financial stability, market positioning, specialization in specific sectors, strategic partnerships, and innovative approaches. Investors looking for growth-oriented investments should consider these companies for potential returns on investment.

Real-Life Examples of Successful Investments in Graphene Stocks

This section explores real-life examples of investors who have achieved significant success by investing in graphene stocks. By examining their experiences, we can gain valuable insights into the factors that contributed to their achievements and learn important lessons for our own investment journeys.

Successful investors in graphene stocks attribute their accomplishments to thorough research, diversification, and long-term investment strategies. They emphasize the importance of staying updated with industry news and developments to make informed investment decisions.

Learning from these investors’ experiences can guide us on our own investment journeys. By staying informed about technological advancements, market trends, and identifying promising companies within the graphene sector, we increase our chances of success when investing in graphene stocks.

In summary, exploring real-life examples of successful investments in graphene stocks provides valuable insights into strategies and considerations for maximizing returns and minimizing risks in this emerging industry.

Tips for Investing Wisely in Graphene Stocks

To invest wisely in graphene stocks, consider the following tips:

-

Reliable Sources: Gather information from credible financial publications, industry reports, and expert analysis to understand a company’s financial health, growth potential, and competitive positioning.

-

Diversification: Spread investments across multiple companies in the graphene industry or related sectors like energy storage or electronics to minimize risks associated with individual stock performance.

-

Stay Updated: Regularly monitor industry news, technological advancements, market trends, and scientific research to identify emerging opportunities or potential threats.

-

Understand Applications: Research how different sectors are adopting graphene technology (electronics, aerospace, energy storage, healthcare, automotive) to identify companies with growth potential.

-

Evaluate Management Teams: Assess the experience and success of management teams in nanotechnology or commercializing innovative technologies to ensure effective execution of business strategies.

-

Long-Term Perspective: Focus on the long-term potential of graphene despite short-term market fluctuations or challenges faced by individual companies.

By following these tips, investors can make informed decisions and potentially benefit from the transformative nature of graphene technology.

Conclusion

[lyte id=’uqcyNSy3poc’]