Investing in cryptocurrencies can be a complex and daunting task, especially with the vast number of digital currencies available in the market. That’s where the Weiss Crypto Portfolio comes in.

This article will provide a comprehensive guide to understanding the Weiss Crypto Portfolio and how it can help you navigate the world of cryptocurrency investing with confidence.

What is a crypto portfolio?

A crypto portfolio is a collection of different cryptocurrencies held by an investor for investment purposes. It functions similarly to a traditional investment portfolio, aiming to diversify risk and potentially generate high returns through investments in various digital assets.

Cryptocurrencies have gained popularity as an alternative investment option in today’s digital world. They operate on blockchain technology and offer opportunities for investors seeking exposure to this emerging asset class. However, it’s important to note that investing in cryptocurrencies can be volatile and speculative.

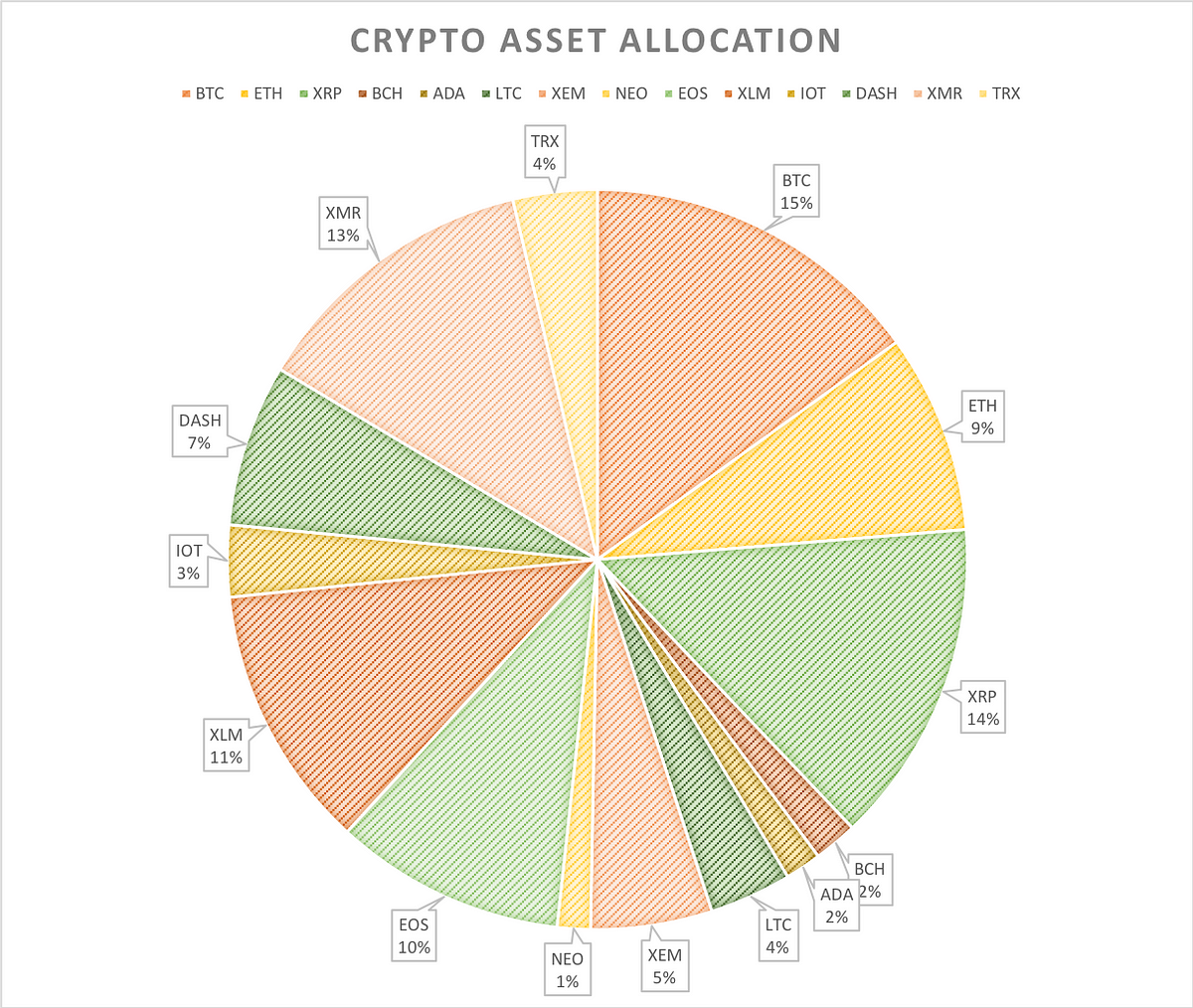

A well-structured crypto portfolio consists of a range of cryptocurrencies varying in market capitalization, industry focus, and underlying technology. Diversification helps mitigate risks by spreading investments across different digital assets, reducing vulnerability to fluctuations in any single cryptocurrency’s value.

Constructing a crypto portfolio involves thorough research and analysis to identify promising projects with strong fundamentals and growth potential. Regular monitoring and periodic rebalancing are necessary to maintain an optimal portfolio, adapting strategies based on market changes.

How does the Weiss Crypto Portfolio work?

The Weiss Crypto Portfolio simplifies cryptocurrency investing by providing expert analysis and ratings on different cryptocurrencies. It evaluates factors like technology, adoption, market performance, and risk to offer valuable insights for growth and long-term success.

The portfolio suggests allocations based on diversification strategies, reducing risk and maximizing returns across various sectors. Additionally, it incorporates risk management techniques like stop-loss orders to minimize losses during market downturns.

With the Weiss Crypto Portfolio, investors can make informed decisions, build balanced portfolios, and navigate the volatile cryptocurrency market more effectively.

The Rise of Digital Currencies

Digital currencies have gained immense popularity and acceptance worldwide in recent years. With increasing adoption by businesses and individuals, these virtual currencies are reshaping the financial landscape. Investing in cryptocurrencies allows you to be part of this revolutionary movement and potentially benefit from its growth.

One key factor driving the rise of digital currencies is their decentralized nature. Operating on a peer-to-peer network known as blockchain, they offer transparency, security, and fast transactions across borders.

Additionally, their potential for lucrative returns on investment and the opportunity for financial inclusion make them attractive to a wide range of individuals.

As governments grapple with regulation, major companies and institutional investors are recognizing the value of cryptocurrencies by allocating portions of their portfolios to these assets.

The rise of digital currencies signifies a paradigm shift in how we perceive and interact with money, positioning us at the forefront of a financial revolution that is reshaping the world.

Potential for High Returns

Cryptocurrencies offer the potential for significant returns to early investors. Bitcoin, the pioneer of digital currencies, has experienced exponential growth since its inception, turning many initial investors into millionaires and even billionaires.

Additionally, other cryptocurrencies like Ethereum and Ripple have also seen substantial gains, providing ample opportunities for generating profits.

The limited supply of certain cryptocurrencies contributes to their value appreciation. For instance, Bitcoin’s scarcity with only 21 million coins creates demand-driven value.

Furthermore, the decentralized nature of cryptocurrencies allows for transparent transactions without intermediaries, which can lead to disruption and economic transformation.

However, it’s important to consider the volatility of the market when investing in cryptocurrencies. Sudden price fluctuations present both risks and opportunities. While careful analysis and risk management are crucial, being well-informed about market trends and technological advancements is essential.

In conclusion, cryptocurrencies offer promising potential for high returns due to their historical performance and disruptive nature. However, investors should approach this market with caution and stay informed to navigate potential risks effectively.

| Pros | Cons |

|---|---|

| Potential for high returns | Market volatility |

| Decentralized nature | Regulatory uncertainty |

Diversification Benefits

Adding cryptocurrencies to your investment portfolio can provide valuable diversification benefits. Unlike traditional asset classes such as stocks and bonds, cryptocurrencies often have a low correlation. This means that their performance tends to differ under various market conditions.

Including cryptocurrencies in your portfolio can help reduce overall risk and increase the potential for higher returns. By diversifying into this emerging asset class, you are not solely dependent on the performance of traditional investments. Instead, you have exposure to a different set of market dynamics.

One of the key advantages of diversification is that it allows you to spread your investment across multiple assets that do not move in tandem with each other. Cryptocurrencies present an opportunity to achieve this diversification due to their unique characteristics and distinct market behavior.

In times of economic downturn or stock market volatility, cryptocurrencies may demonstrate resilience or even perform positively. This can act as a hedge against losses in other parts of your portfolio.

Additionally, when traditional markets are performing well, cryptocurrencies may offer additional growth opportunities that are not available through conventional investments.

It is important, however, to conduct thorough research and analysis before including cryptocurrencies in your investment strategy. While they offer diversification benefits, they also come with their own set of risks and complexities.

Understanding the fundamentals and factors influencing cryptocurrency prices is crucial for making informed investment decisions.

Evaluating cryptocurrencies using Weiss Ratings

Cryptocurrencies have gained significant popularity as a form of digital currency, but with the ever-growing number of options available, it can be challenging to determine which ones are worth investing in. This is where Weiss Ratings comes in.

With its comprehensive evaluation system, Weiss Ratings provides invaluable insights into the world of cryptocurrencies.

Weiss Ratings assesses cryptocurrencies based on multiple factors, including technology, adoption, market performance, and risk. By considering these key aspects, investors can make informed decisions that align with their investment goals.

The technology factor evaluates the underlying infrastructure and innovation behind a cryptocurrency. It examines the security protocols, scalability potential, and overall technological advancements. Adopting cutting-edge technology is crucial for long-term success in this rapidly evolving industry.

Another vital aspect considered by Weiss Ratings is adoption. This factor gauges how widely accepted a cryptocurrency is among businesses and individuals alike. The more widespread the adoption, the greater the potential for growth and stability.

Market performance plays a significant role in evaluating cryptocurrencies as well. Weiss Ratings analyzes various market indicators to assess how well a cryptocurrency has performed historically and its potential for future growth. This includes factors such as market capitalization, trading volume, and price volatility.

Lastly, risk factors are carefully examined to provide investors with an understanding of the potential downsides associated with each cryptocurrency. These risks may include regulatory challenges, competition from other cryptocurrencies or traditional financial systems, and vulnerabilities within the technology itself.

By leveraging Weiss Ratings’ comprehensive evaluation system, investors can navigate the complex world of cryptocurrencies with confidence. The insights provided by Weiss Ratings enable individuals to make informed decisions about which cryptocurrencies align best with their investment goals and risk appetite.

Factors to Consider When Selecting Cryptocurrencies for Investment

Investing in cryptocurrencies requires careful consideration. Here are key factors to evaluate:

-

Project Team: Assess the skills and experience of the team behind the cryptocurrency.

-

Technology: Look for innovative technologies that set the cryptocurrency apart.

-

Real-World Applications: Evaluate how the cryptocurrency solves real-world problems or improves existing industries.

-

Growth Potential: Consider market demand, liquidity, and upcoming developments.

-

Due Diligence: Conduct thorough research on the project, team, and community opinions.

By considering these factors, you can identify promising cryptocurrencies with strong fundamentals. Remember to diversify your investment portfolio to manage risks.

Understanding risks involved in investing in cryptocurrencies

Investing in cryptocurrencies carries inherent risks, including price volatility, regulatory uncertainty, technological challenges, and market manipulation. These factors can significantly impact the value of investments and require careful consideration.

Having a well-defined risk management strategy and diversifying your portfolio are crucial for long-term success in this volatile market.

[lyte id=’r1vcBuZr93c’]