Investing in the energy sector has always been a lucrative opportunity for investors. With the growing demand for cleaner and more sustainable sources of energy, liquefied natural gas (LNG) has emerged as a key player in the global energy landscape.

In this article, we will explore the world of US LNG stocks and why investing in them can be a smart move for those interested in the field of investing and learning about investment strategies.

Overview of the LNG Market

The global liquefied natural gas (LNG) market is experiencing remarkable growth as countries transition towards cleaner fuels. LNG’s lower carbon emissions make it an attractive choice for industries and power generation.

Factors such as increased urbanization, industrialization, and government initiatives promoting cleaner energy alternatives are driving the surge in demand for LNG. Its flexibility in storage and transportation makes it ideal for urban areas with infrastructure constraints.

Government policies and incentives further support the adoption of LNG, creating favorable conditions for market growth. The future of the LNG market looks promising as sustainability becomes a priority worldwide.

Top LNG Companies

The global liquefied natural gas (LNG) industry is driven by a select group of companies that have established themselves as leaders in this dynamic and growing market. These companies have not only embraced the potential of LNG but have also invested heavily in infrastructure, technology, and strategic partnerships to solidify their positions.

Cheniere Energy stands out as one of the key players in the US LNG industry. With an extensive network of pipelines supplying natural gas to its liquefaction facilities along the Gulf Coast, the company has positioned itself as a major exporter of LNG globally.

Cheniere Energy’s strategic partnerships with international buyers further strengthen its foothold in the market.

Another multinational energy corporation making significant strides in the LNG market is Chevron. Leveraging its vast resources and expertise in exploration and production, Chevron has successfully developed several major LNG projects worldwide.

The company’s commitment to sustainability and environmental responsibility not only enhances its reputation but also attracts investors seeking socially responsible investments.

ExxonMobil, one of the largest publicly traded oil and gas companies, has made substantial contributions to the US LNG industry. Through heavy investments in LNG infrastructure and technology, ExxonMobil has demonstrated its dedication to staying at the forefront of this evolving market.

The company’s focus on innovation and efficiency positions it favorably for future growth in the LNG sector.

These top LNG companies exemplify excellence within their respective fields. Their innovative approaches, robust infrastructure, and strategic alliances have enabled them to carve out prominent roles in an increasingly competitive global marketplace.

As demand for cleaner energy sources continues to rise, these companies remain at the forefront of satisfying global energy needs while driving forward sustainable practices within the LNG industry.

Cheniere Energy: Overview, Projects, and Growth Prospects

Cheniere Energy is a leading player in the US liquefied natural gas (LNG) industry. With advanced facilities along the Gulf Coast, the company has a competitive advantage in exporting LNG globally. Ongoing projects, like the Corpus Christi Liquefaction Project, will further boost production capacity to meet rising demand.

Cheniere Energy’s commitment to growth and profitability positions it as a key player in the evolving LNG landscape, securing a cleaner and more sustainable energy future.

Chevron: Highlights, Achievements, and Future Plans

Chevron’s entry into the LNG market has been a wise move, with successful development of major projects worldwide. The company’s ability to navigate complex regulations and deliver results highlights its expertise. Chevron has ambitious plans for further expansion in the LNG sector, promising stable growth opportunities for long-term investors.

With a focus on innovation, environmental responsibility, and community engagement, Chevron is well-positioned to capitalize on emerging opportunities and contribute to a sustainable energy future.

ExxonMobil: Notable Contributions and Investment Opportunities

ExxonMobil’s expertise in exploration, production, and technology makes it an appealing investment choice for US LNG stocks. With a focus on innovation, the company actively develops cutting-edge solutions for the LNG market.

Additionally, ExxonMobil’s commitment to sustainability positions it well for future growth as global energy consumption patterns evolve. Investors should closely monitor ExxonMobil as it continues to explore new opportunities and adapt to changing market dynamics.

| Key Points | |

|---|---|

| Expertise | Extensive experience in exploration, production, and technology |

| Innovation | Developing innovative solutions for the LNG market |

| Sustainability | Commitment to reducing environmental impact and meeting cleaner energy demands |

| Adaptability | Navigating changing energy consumption patterns and pursuing new opportunities |

Current Market Trends and Projections

The global demand for liquefied natural gas (LNG) is set to experience significant growth in the coming decade. As nations increasingly prioritize cleaner energy sources, natural gas emerges as a favored alternative to coal and oil due to its lower carbon emissions.

This shift towards cleaner fuels presents lucrative opportunities for US LNG stocks, as they cater to international markets seeking sustainable energy solutions.

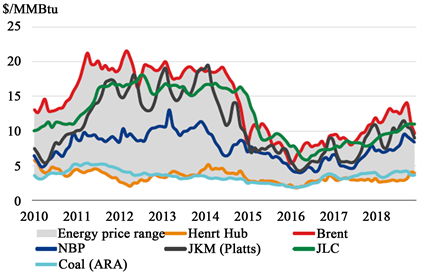

Geopolitical factors play a crucial role in shaping the pricing and trade dynamics of LNG. Tensions between major energy-producing nations, shifts in government policies, and infrastructure developments all exert influence on the market.

Staying well-informed about these geopolitical factors is essential for investors looking to make informed decisions regarding their investments in US LNG stocks.

Investing in the energy sector, including the LNG industry, comes with its fair share of regulatory challenges. Environmental regulations, export/import restrictions, and geopolitical uncertainties can directly impact the profitability of US LNG stocks.

Therefore, investors must conduct careful analysis of these regulatory challenges and consider them when formulating their investment strategies.

To summarize, the global demand for LNG is poised for substantial growth over the next decade as countries embrace cleaner fuels. Geopolitical factors significantly influence pricing and trade dynamics in the LNG market, necessitating investor vigilance.

Additionally, regulatory challenges present considerations that should be carefully evaluated when investing in US LNG stocks. By staying informed and proactive in analyzing these trends and challenges, investors can position themselves advantageously within this evolving market landscape.

Investment Strategies for Profiting from US LNG Stocks

Investing in US LNG stocks offers opportunities for financial gain amidst the growing demand for liquefied natural gas. Two primary investment strategies can be considered:

Conservative investors seeking stability can invest in established companies like Cheniere Energy, Chevron, and ExxonMobil. These firms have a proven track record of success in the LNG industry and are well-positioned to benefit from increasing global demand.

For more risk-tolerant investors, short-term trading opportunities exist by monitoring market volatility and news events impacting the LNG industry. Rapid price fluctuations provide potential profits for those who can anticipate market movements accurately.

Diversification is essential when investing in any sector, including US LNG stocks. Spreading investments across different companies or sectors helps mitigate risks associated with individual stocks or industries.

Thorough research and due diligence are crucial before committing funds to US LNG stocks or any investment opportunity. Analyzing financial statements, evaluating company strategies, assessing market trends, and staying updated with industry news enables informed investment decisions.

By considering these strategies and conducting proper research, investors can position themselves to profit from US LNG stocks.

Expert Insights and Forecasts for the Future

The future of US LNG stocks is a topic that industry experts have been closely analyzing and forecasting. By gathering insights from these experts, investors can gain valuable information to make informed decisions about their investments.

One key aspect that experts focus on is the potential opportunities and challenges that lie ahead for investors in the LNG sector. While there are promising investment opportunities, it is important to acknowledge the risks involved. Fluctuating prices, geopolitical tensions, and regulatory changes can all pose challenges for investors.

However, it is worth noting that these challenges also create opportunities for astute investors who can navigate through them effectively.

Another crucial factor that impacts the long-term growth prospects of US LNG stocks is changing energy consumption patterns globally. As more countries transition towards cleaner fuels, there is an increasing demand for LNG. This shift in energy consumption patterns presents significant growth potential for US LNG stocks.

Investors who recognize this trend early stand to benefit from substantial returns on their investments.

To fully understand the future outlook of US LNG stocks, it is essential to consider expert insights and forecasts. These insights provide valuable guidance on potential opportunities and challenges in the sector, as well as the impact of changing energy consumption patterns globally.

By staying informed about these aspects, investors can make strategic investment decisions and position themselves for success in the dynamic world of US LNG stocks.

| Key Points |

|---|

| – Industry experts offer valuable insights into future prospects of US LNG stocks |

| – Fluctuating prices, geopolitical tensions, and regulatory changes pose risks |

| – Challenges also create opportunities for astute investors |

| – Changing energy consumption patterns globally impact long-term growth prospects |

| – Demand for LNG expected to skyrocket as countries transition towards cleaner fuels |

[lyte id=’PaMsc8z1Ls4′]