Investing in the future requires identifying groundbreaking technologies and materials that have the potential to revolutionize industries. One such material is graphene, a single layer of carbon atoms arranged in a hexagonal lattice.

Graphene’s remarkable properties, coupled with its wide range of potential applications, make it an intriguing investment opportunity for those interested in the world of investing.

Introduction to Graphene and Its Unique Properties

Graphene, known as a “wonder material,” possesses exceptional properties that have captured the attention of scientists. This single layer of carbon atoms is incredibly strong, flexible, and lightweight. It also exhibits excellent conductivity for heat and electricity.

These remarkable characteristics make graphene ideal for applications in electronics, energy storage, healthcare, and more. From its strength to its conductivity, graphene’s unique properties hold immense potential for innovation across various industries.

Brief History of Graphene’s Discovery and Development

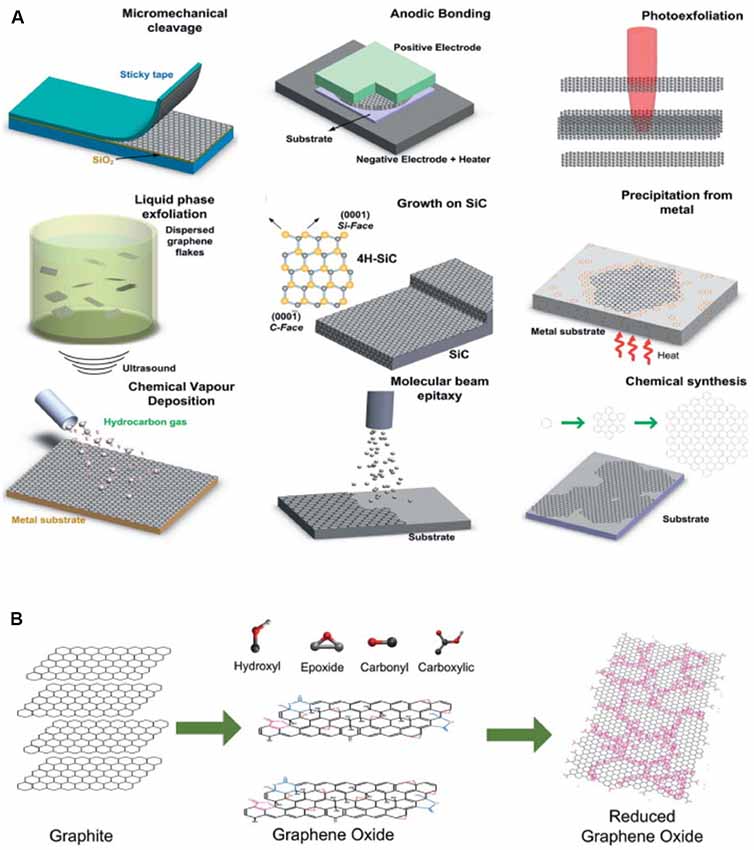

In 2004, Andre Geim and Konstantin Novoselov at the University of Manchester isolated graphene – a two-dimensional material made of a single layer of carbon atoms arranged in a hexagonal lattice. Their groundbreaking work earned them the Nobel Prize in Physics in 2010.

Since then, scientists worldwide have been exploring graphene’s properties and developing practical applications. Its exceptional strength, electrical conductivity, and thermal conductivity make it promising for electronics, energy storage, water purification, and more.

Continuous research aims to improve production methods and unlock its full potential.

Potential Applications and Impact on Various Industries

Graphene, discovered in 2004 by Andre Geim and Konstantin Novoselov, has the potential to revolutionize multiple industries. In electronics, it could create faster and more efficient devices like transistors and touchscreens.

In energy storage, graphene shows promise for enhancing battery performance and enabling high-energy-density supercapacitors. Its thinness also makes it valuable in aerospace and automotive industries for reducing weight and improving fuel efficiency.

Additionally, its biocompatibility opens doors for advancements in healthcare through drug delivery systems and tissue engineering. Investing in graphene stocks offers strategic opportunities for capitalizing on emerging technologies with significant growth potential.

Overview of the Current State of the Graphene Market

Graphene, a remarkable material discovered in 2004, holds immense potential and is expected to experience substantial growth in the coming years. Currently, the Asia-Pacific region dominates the market due to increased research and development activities in China and South Korea.

However, North America and Europe are also actively investing in graphene-related projects. With its exceptional properties, graphene is being integrated into various industries worldwide. As advancements continue to be made, we can expect exponential growth and innovation across sectors, shaping the future of the global graphene market.

| Region | Market Dominance Factors |

|---|---|

| Asia-Pacific | Increased research and development activities |

| North America | Active investments in graphene-related projects |

| Europe | Collaborative efforts in research and commercialization |

Market Trends and Growth Potential for Graphene Stocks

The market for graphene stocks is booming, driven by the potential for high returns on investment. The demand for lightweight, durable materials with exceptional conductivity is creating a favorable climate for companies involved in graphene production.

As industries increasingly seek sustainable solutions and consumer electronics evolve, the demand for graphene-based products is expected to skyrocket. This presents an opportunity for investors who can identify emerging trends and understand the implications of adopting this revolutionary material.

Ongoing research and development efforts further contribute to the growth potential of graphene stocks, making it an exciting sector to watch.

| Factors Driving Growth Potential |

|---|

| Increasing demand for lightweight and durable materials |

| Rising need for sustainable solutions across industries |

| Ongoing research and development efforts |

Benefits and Risks of Investing in Graphene Stocks

Investing in graphene stocks offers the potential for substantial financial gains as an early investor in this disruptive technology. Diversifying investment portfolios with exposure to emerging technologies like graphene can also mitigate risk.

However, there are uncertainties due to ongoing research and technical challenges that may delay widespread commercial adoption. Thorough analysis is necessary to identify promising companies within the graphene industry and monitor their roles, financial performance, and recent developments.

Overall, investing in graphene stocks presents both enticing benefits and inherent risks that require careful consideration.

Company 1: In-depth Analysis, Financial Performance, and Recent Developments

Company 1 has positioned itself as a dominant player in the graphene industry by producing high-quality graphene materials on a large scale. Their expertise lies in synthesizing consistent and reliable graphene sheets, making them an attractive partner for industries seeking to incorporate this material into their products.

With a strong foothold in the market, Company 1 has experienced steady revenue growth over the past few years. This can be attributed to the increasing demand for graphene-based solutions across multiple sectors. Furthermore, their impressive profit margins indicate efficient operations and a competitive edge within the industry.

One noteworthy recent development from Company 1 is their groundbreaking collaboration with a major electronics manufacturer. This strategic partnership aims to develop flexible displays using Company 1’s cutting-edge graphene technology.

Such an initiative not only showcases their potential to disrupt the electronics industry but also opens doors for future growth opportunities.

By leveraging their expertise in synthesizing high-quality graphene materials and capitalizing on collaborative partnerships, Company 1 is poised to continue making significant advancements in the field of graphene technology.

With their ability to meet market demands and drive innovation, they are well-positioned for continued success in the coming years.

It is important to note that while this section focuses specifically on Company 1’s analysis, financial performance, and recent developments, other companies within the graphene industry may have equally compelling stories of progress and growth.

Company 2: In-depth Analysis, Financial Performance, and Recent Developments

Investing in graphene stocks requires thorough research and understanding of key factors that influence their value. This includes analyzing a company’s in-depth analysis, financial performance, and recent developments.

In-depth analysis involves evaluating a company’s business strategy, competitive advantage, target markets, and product portfolio. Assessing these aspects helps determine if the company has a solid foundation for long-term growth.

Financial performance evaluation involves analyzing revenue trends, profitability ratios, cash flow patterns, and debt levels. A company with consistent revenue growth and healthy profit margins may be an attractive investment option.

Staying updated on recent developments in the graphene industry is crucial. This includes monitoring advancements in technology or processes related to graphene production or applications. Companies engaged in research collaborations or with breakthrough innovations may have a competitive edge.

By considering these factors and conducting thorough research on companies involved in the graphene industry, investors can make informed decisions about investing in graphene stocks.

However, it is important to remember that investing carries inherent risks and should be done after careful consideration of individual financial goals and risk tolerance.

[lyte id=’iXqXOddmRp8′]