Investing in uranium stocks on the NASDAQ has been a roller coaster ride for many investors. These stocks have seen periods of immense popularity, followed by challenging times.

In this article, we will delve into the history of uranium stocks on the NASDAQ, explore the factors that contribute to their rise in popularity, and discuss the challenges they have faced in recent years.

Exploring the History of Uranium Stocks on the NASDAQ

In the early 2000s, uranium stocks gained significant attention on the NASDAQ due to increasing global energy demand and growing interest in nuclear power as a cleaner alternative. Companies involved in uranium mining, exploration, and nuclear power generation saw substantial gains as demand exceeded supply.

Key players like Company A and Company B emerged during this period. Factors such as rising energy consumption, concerns about greenhouse gas emissions, and technological advancements contributed to the growth of uranium stocks.

However, volatility in commodity markets, geopolitical factors, and public sentiment regarding nuclear power posed risks for investors. Despite these challenges, uranium stocks continue to be an important investment opportunity in the evolving energy landscape.

| Heading | Content |

|---|---|

| Key Factors | – Increasing global energy demand – Growing interest in nuclear power |

| Key Players | – Company A – Company B |

| Reasons for Growth | – Rise in global energy consumption – Concerns about greenhouse gas emissions – Technological advancements |

| Risks and Challenges | – Volatility of commodity markets – Geopolitical factors – Public sentiment regarding nuclear power |

Factors Contributing to the Rise in Popularity of Uranium Stocks

Uranium stocks on the NASDAQ have become increasingly popular due to several key factors. Firstly, the potential for high returns has attracted investors as the demand for clean energy sources, and subsequently uranium prices, continues to rise.

Additionally, investing in uranium stocks offers diversification opportunities that can reduce overall risk while potentially increasing returns. The global demand for energy and the growth prospects of nuclear power have also boosted the popularity of these stocks, as nuclear power emerges as a viable alternative to fossil fuels.

Technological advancements and improved safety measures in the industry have further instilled confidence among investors. Lastly, supportive government policies promoting clean energy solutions have contributed to the increased interest in uranium stocks.

Overall, these factors combined position uranium stocks as an attractive investment option in line with growing environmental concerns and the need for sustainable energy solutions.

Challenges Faced by Uranium Stocks in Recent Years

Uranium stocks have encountered significant challenges in recent years, despite their initial popularity. One of the main obstacles is the inherent price volatility and market uncertainties associated with this sector. The price of uranium is highly sensitive to global supply-demand dynamics, geopolitical factors, and market sentiment.

Consequently, investors often find it difficult to predict and navigate through the frequent market fluctuations.

Moreover, regulatory and political risks related to nuclear energy pose additional challenges for uranium stocks. Changes in government policies or regulations can have a profound impact on the industry, directly affecting the profitability and growth prospects of companies involved in uranium mining and nuclear power generation.

Furthermore, environmental concerns and public perception of nuclear power have significantly influenced the performance of uranium stocks. High-profile accidents like the Fukushima disaster in 2011 have raised questions about the safety and sustainability of nuclear energy.

As a result, there has been increased scrutiny and skepticism surrounding this sector.

However, despite these formidable challenges, some investors still see potential in uranium stocks. It is crucial for prospective investors to understand the risks and considerations associated with investing in this sector before making any investment decisions.

In summary, uranium stocks face numerous hurdles that impede their growth and stability. Price volatility, regulatory risks, political uncertainties, environmental concerns, and public perception all contribute to the challenges faced by this industry.

By being aware of these obstacles, investors can make informed decisions when considering investing in uranium stocks on platforms such as NASDAQ.

Reasons Investors Are Drawn to Uranium Stocks

Investors are increasingly attracted to uranium stocks for several reasons. Firstly, these stocks offer the potential for high returns as global energy demand continues to rise and nuclear power plays a crucial role in meeting this demand.

Secondly, investing in uranium stocks allows for portfolio diversification, reducing risk by adding exposure to a unique asset class. Lastly, with the growing focus on sustainable energy solutions, nuclear power is gaining attention as a reliable source of clean energy, making investments in uranium stocks appealing.

Overall, these factors make uranium stocks an attractive investment option for those looking to capitalize on the future growth of the energy sector.

Risks and Considerations When Investing in Uranium Stocks

Investing in uranium stocks involves certain risks and considerations that investors should be aware of. One key risk is the price volatility and market uncertainties associated with uranium. Fluctuations in supply-demand dynamics, geopolitical tensions, and market sentiment can lead to significant volatility and uncertainty.

Regulatory and political risks are also important to consider. Government policies and regulations related to nuclear energy can have a major impact on the performance of uranium stocks. Changes in regulations or shifts in government priorities can affect profitability and growth prospects.

Environmental concerns and public perception play a role as well. The environmental impact of nuclear power generation and negative sentiment towards nuclear energy can influence the performance of uranium stocks.

To mitigate these risks, thorough research, staying updated on industry news, and consulting with financial advisors are essential. Analyzing key financial indicators like revenue growth, earnings per share (EPS), debt levels, and cash flow is crucial when evaluating uranium companies.

Additionally, macroeconomic factors such as global demand for nuclear energy, geopolitical stability, government policies, and technological advancements should be considered.

By understanding these risks and considerations, investors can make informed decisions when investing in uranium stocks. Monitoring market conditions and conducting thorough analysis are vital for successful investments in this sector.

Key Financial Indicators for Evaluating Uranium Companies

When evaluating uranium companies, it’s important to consider key financial indicators that provide insights into their financial health and growth potential. These indicators include:

-

Revenue growth and profitability ratios: Analyzing a company’s revenue growth over time helps assess its income generation ability. Profitability ratios like gross profit margin, net profit margin, and return on equity indicate overall financial health.

-

Debt levels and liquidity positions: Examining a company’s debt levels and liquidity helps understand its financial stability. High debt or inadequate liquidity can pose risks to meeting financial obligations.

-

Exploration activities, resource estimates, and production capabilities: Understanding a company’s exploration programs, resource estimates, and production capabilities provides insights into its growth potential. Strong exploration and significant uranium reserves enhance the chances of benefiting from rising demand.

By considering these indicators, investors can make informed decisions about investing in uranium companies based on their financial performance and future prospects.

Macroeconomic Factors Impacting Uranium Stocks’ Performance

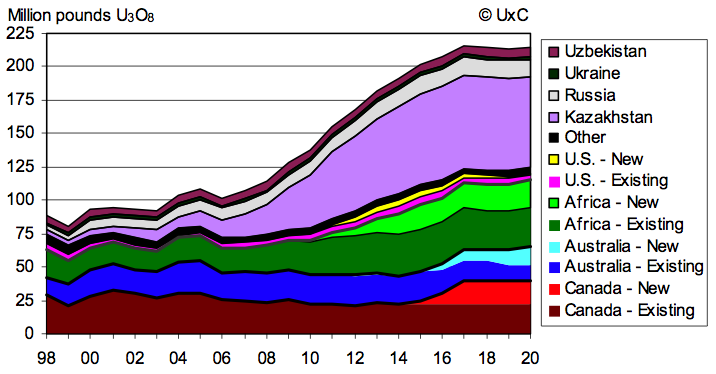

The performance of uranium stocks on the NASDAQ is influenced by macroeconomic factors beyond individual company financials. Monitoring the global supply-demand dynamics of the uranium market is crucial to understanding its overall health.

Changes in mine closures, new projects, and demand from nuclear power plants can significantly impact uranium prices and stock performance.

Government policies and regulations shape the nuclear power industry, affecting investor sentiment towards uranium stocks. Shifts in regulations or government priorities can influence the industry’s growth prospects and investor confidence.

Technological advancements in the nuclear power industry also play a role. Improvements in reactor designs or fuel efficiency enhance cost-efficiency, making nuclear power more competitive compared to other energy sources. This benefits both utility companies operating nuclear plants and investors holding uranium stocks.

When evaluating uranium stocks, it is essential to consider these macroeconomic factors alongside financial indicators specific to each company. Stay tuned for Part II where we will explore specific companies worth considering and strategies for investing in this sector.

| Macro Factors | Impact on Uranium Stocks’ Performance |

|---|---|

| Supply-Demand Dynamics | Influence prices based on balance |

| Government Policies and Regulations | Affect investor sentiment |

| Technological Advancements | Enhance cost-efficiency of nuclear power generation |

[lyte id=’OddUlCgqXJ0′]