As an investor looking to make the most out of your trades, you understand the importance of having the right tools and resources at your disposal. One tool that has gained immense popularity among traders is TradingView.

With its robust features and user-friendly interface, TradingView has become the go-to platform for day traders seeking to analyze market data, implement strategies, and make informed trading decisions.

Introduction to TradingView

TradingView is a popular web-based platform that provides real-time market data, advanced charting tools, and social networking capabilities. With over 15 million active users worldwide, it has become a trusted platform for investors seeking insights into financial markets.

Offering customizable charting options and a collaborative community, TradingView caters to both novice and experienced traders. Its cloud-based architecture allows for easy access from any device with an internet connection. Overall, TradingView is a powerful tool for analyzing market trends and making informed trading decisions.

Understanding Day Trading with TradingView

Day trading involves buying and selling financial instruments within the same trading day to profit from short-term price movements. While it can be lucrative, it comes with inherent risks due to market volatility.

TradingView is a valuable tool for day traders, providing real-time charts, technical indicators, drawing tools, and other resources for analyzing market trends. Traders can use these features to identify entry and exit points, set stop-loss orders, and develop effective strategies.

With its comprehensive library of indicators and alert system, TradingView helps traders make informed decisions and manage risk in their day trading activities.

Key Features of TradingView for Day Traders

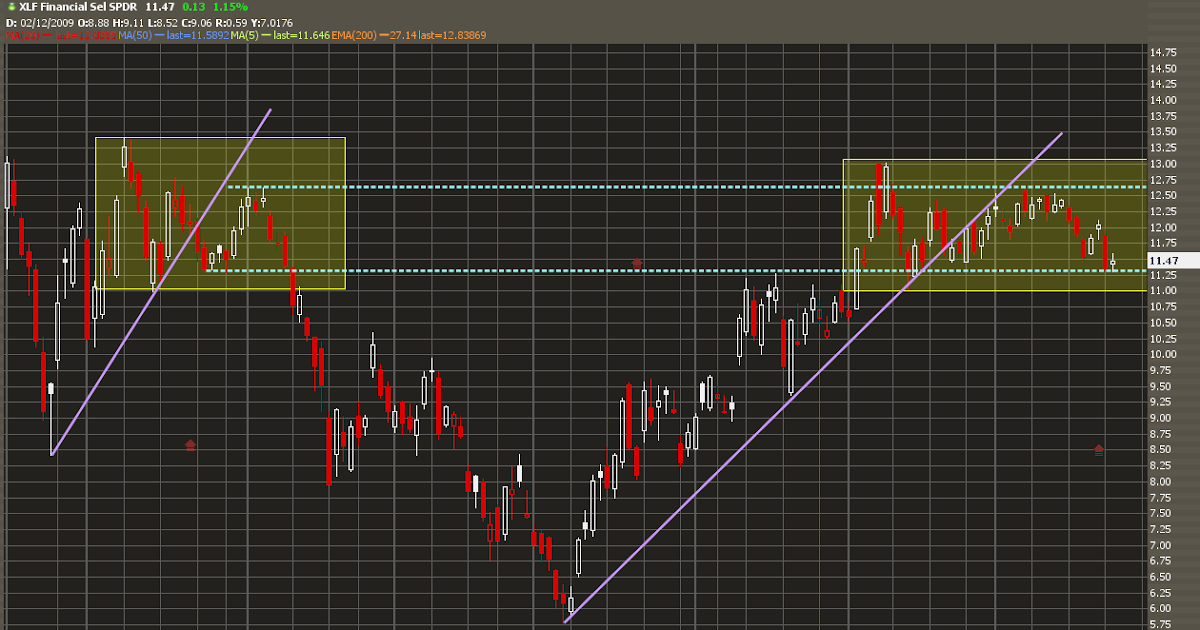

TradingView offers a user-friendly interface with a wide range of chart types, including line charts, bar charts, and candlestick charts. These options allow day traders to analyze price movements across different time frames.

The platform also provides essential technical analysis tools such as candlestick patterns, trend lines, moving averages, and oscillators. Traders can utilize these tools to identify trend reversals, determine support and resistance levels, and gauge market momentum.

With its intuitive interface and comprehensive features, TradingView is an invaluable resource for day traders looking to make informed trading decisions in real-time.

Analyzing Market Data on TradingView

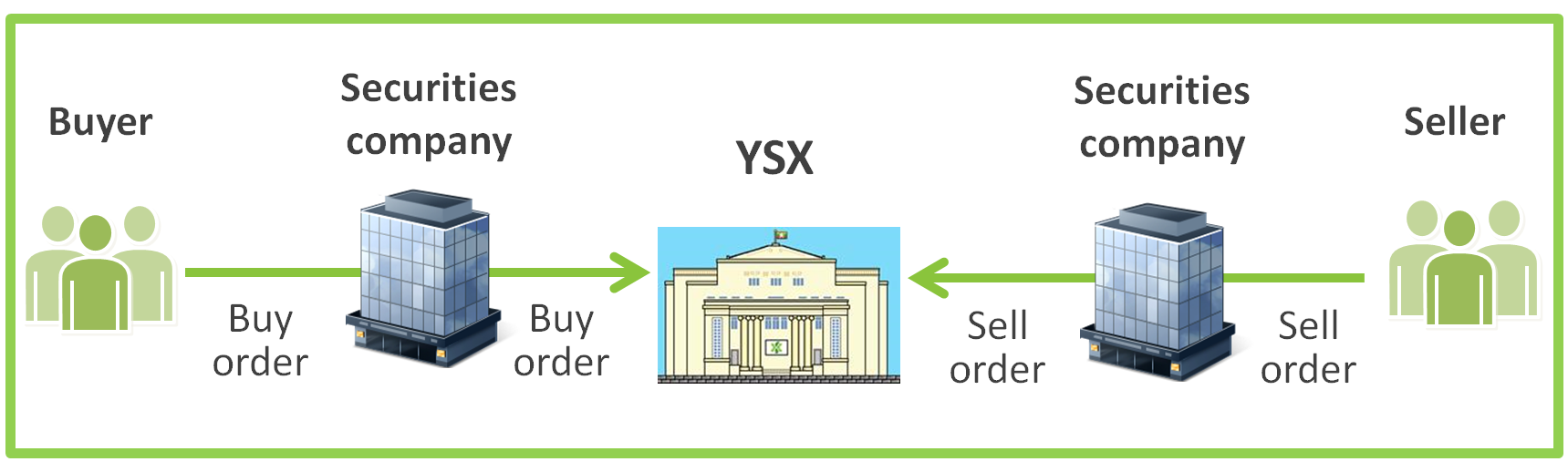

TradingView is a powerful platform that provides day traders with the ability to access and analyze real-time market data from various exchanges worldwide. This feature offers numerous benefits, allowing traders to stay informed about the latest price movements and make well-informed trading decisions based on accurate information.

One of the key advantages of using TradingView is its capability to provide real-time market data. This means that day traders can continuously monitor price fluctuations as they happen, ensuring that they are always up-to-date with the most current information.

By having access to real-time data, traders can seize opportunities and execute trades at optimal moments, maximizing their potential profits.

Moreover, TradingView’s advanced charting capabilities enable traders to conduct in-depth technical analysis. Through customizable charts and a wide range of technical indicators, traders can identify patterns, trends, and support/resistance levels more effectively.

This empowers them to develop comprehensive trading strategies based on solid market insights.

Furthermore, by utilizing TradingView’s real-time data for analysis purposes, day traders can gain a deeper understanding of market dynamics. They can observe how different assets react to news events or economic indicators in real-time, helping them anticipate future price movements and adjust their strategies accordingly.

This level of insight allows traders to navigate volatile markets with confidence and precision.

In summary, accessing and analyzing market data on TradingView provides day traders with invaluable advantages. The platform’s real-time data ensures that they are always equipped with the latest information necessary for making well-timed trading decisions.

Additionally, its advanced charting capabilities allow for in-depth technical analysis and the development of effective trading strategies. Ultimately, utilizing TradingView’s robust tools enhances a trader’s ability to succeed in dynamic financial markets.

Implementing Day Trading Strategies on TradingView

Day trading strategies require powerful tools to make informed decisions in fast-paced markets. TradingView offers a variety of tools specifically designed for day traders.

Drawing tools help mark support and resistance levels on charts, Fibonacci retracement identifies potential price targets, and the volume profile indicator gauges market sentiment by displaying traded volume at different price levels. These tools enhance technical analysis capabilities and increase chances of success in day trading.

With its user-friendly interface and extensive features, TradingView is a go-to resource for implementing effective day trading strategies.

Tips and Best Practices for Day Trading on TradingView

When day trading on TradingView, it’s important to be aware of common pitfalls and follow reliable strategies. Overtrading, not setting stop-loss orders, and relying solely on indicators are common mistakes to avoid. Additionally, exercise caution when following popular but potentially unreliable trading ideas shared by the community.

Conduct thorough research before implementing any strategy to ensure its suitability for your goals and risk tolerance. By avoiding pitfalls and conducting proper analysis, you can increase your chances of success in day trading on TradingView.

Conclusion: Leveraging TradingView for Successful Day Trading

[lyte id=’CiBMDVj7txM’]