Investing in the future is a key strategy for success, and one field that is taking the world by storm is synthetic biology. This revolutionary field has the potential to transform various industries and drive significant advancements in science and technology.

If you’re interested in learning more about investing in synthetic biology, this article will introduce you to the top companies leading the way in this exciting arena.

The Rise of Synthetic Biology: A Revolutionary Field

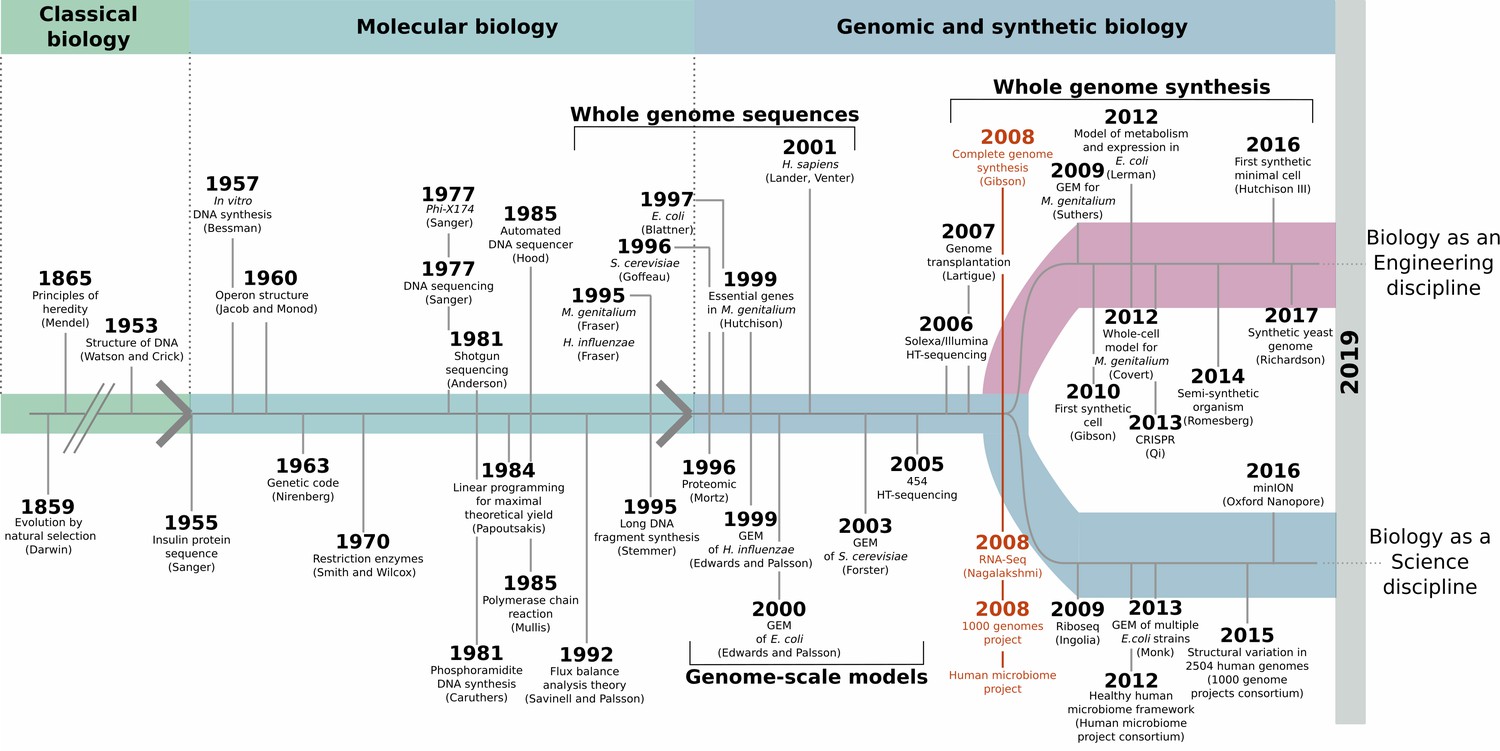

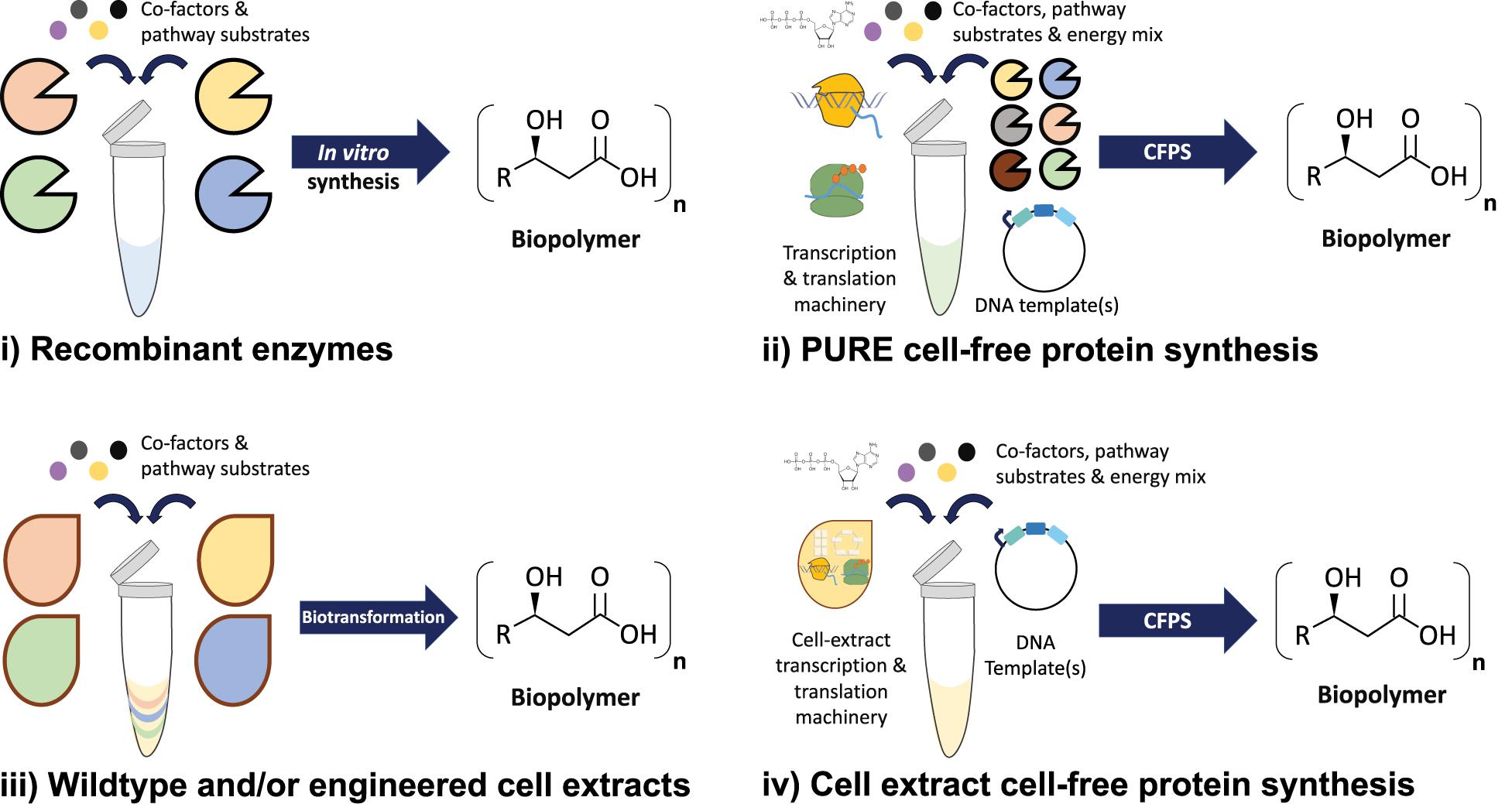

Synthetic biology is revolutionizing the way we manipulate biological systems by combining principles from biology, engineering, and computer science. Through DNA manipulation, scientists can create organisms with specific traits or even design entirely new ones.

Its potential impact spans industries like healthcare, agriculture, energy, and materials science. Synthetic biology has the power to develop new drugs, improve crop yields, create sustainable biofuels, and produce environmentally friendly materials.

This field has also given rise to innovative companies at the forefront of scientific advancements in genetic engineering. They leverage cutting-edge technologies to drive groundbreaking discoveries and commercialize their products.

Synthetic biology represents a promising frontier that holds tremendous potential for solving humanity’s challenges across various industries.

Top Synthetic Biology Companies to Keep an Eye On

GenScript, founded in 2002 by Dr. Frank Zhang, is a global leader in gene synthesis, peptide synthesis, and antibody development. Their innovative technologies and strategic partnerships have contributed to breakthroughs in cancer therapy and steady revenue growth.

Twist Bioscience revolutionizes DNA synthesis with its rapid and cost-effective platform. Their technology enables the creation of custom DNA sequences for drug discovery and genetically modified crops. Collaborations with industry giants like Microsoft showcase their potential in data storage.

Zymergen combines biology, automation, and machine learning to create novel materials and chemicals. Their focus on advanced materials has the potential to transform various industries such as electronics and agriculture. Strong investor confidence drives their valuation growth.

Intrexon pioneers synthetic biology since 1998 with precise genetic engineering tools like the UltraVector® platform. Collaborations with pharmaceutical companies aim to develop innovative therapies, including CAR-T cell treatments for cancer. Strategic acquisitions fuel long-term growth.

These top synthetic biology companies are driving innovation, forging partnerships, and disrupting traditional industries through their groundbreaking technologies and impressive achievements.

III Case Study: How Synthetic Biology Companies are Attracting Investors

Synthetic biology companies have become attractive investment opportunities due to their potential for significant growth and groundbreaking innovations. Investors are drawn to the market potential and competitive advantage that these companies offer in various industries.

The expertise and track record of a company’s management team also play a crucial role in attracting investors. Technological advancements, such as gene editing and DNA synthesis, set these companies apart from competitors and demonstrate their ability to create disruptive solutions.

Evaluating market dynamics and assessing a company’s competitive advantage helps investors determine its long-term viability. As the field of synthetic biology continues to evolve, investor interest is expected to grow.

Tips for Investing in Synthetic Biology Companies

Investing in synthetic biology companies requires careful consideration to maximize potential returns while managing risks. Here are some key tips to keep in mind:

-

Diversify your portfolio: Spread your investments across multiple companies to reduce the impact of individual setbacks and mitigate risks associated with specific stocks or sectors.

-

Evaluate regulatory hurdles: Synthetic biology companies face unique challenges, including navigating complex regulatory frameworks. Assess a company’s ability to comply with regulations and its ethical stance before investing.

-

Stay informed about market trends: Keep track of market trends and industry forecasts to understand growth opportunities and potential challenges within the field of synthetic biology.

By following these tips, investors can make more informed decisions and increase their chances of success when investing in synthetic biology companies.

V Conclusion: The Future of Synthetic Biology Companies

[lyte id=’j8MjCTXo0z0′]