In today’s rapidly evolving world, battery-powered technology is on the rise. From electric vehicles to renewable energy storage solutions, the demand for efficient and sustainable battery systems has never been greater. This increasing demand is not only driving innovation in the industry but also presenting lucrative investment opportunities.

In this article, we will explore the top battery company stocks that investors should consider for their portfolios.

By delving into the success stories of companies like Tesla and BYD, as well as analyzing market trends and financial performance, we aim to provide readers with valuable insights into the potential growth and profitability of investing in battery company stocks.

Tesla (TSLA)

Tesla, a renowned name in the automotive industry, has successfully emerged as a dominant player in the electric vehicle market. With its cutting-edge technology and visionary approach led by Elon Musk, the company has revolutionized transportation as we know it.

This can be seen through Tesla’s remarkable stock performance, which has reached unprecedented heights.

One of Tesla’s key contributions to the battery industry lies in its energy storage solutions. The company’s Powerwall and Powerpack systems have completely transformed how renewable energy is stored and utilized.

By making energy storage more accessible and reliable, Tesla has played a crucial role in advancing the adoption of renewable energy sources.

Analyzing Tesla’s recent financial performance provides valuable insights for investors interested in the company’s long-term success. Factors such as revenue growth, profitability ratios, and stock market trends can all be examined to assess Tesla’s potential.

With its consistent focus on innovation and continuous improvement, Tesla has proven itself capable of delivering impressive financial results.

Furthermore, beyond just financial success, Tesla’s impact extends beyond the traditional automotive sector. It has become an inspiration for other companies within the industry to invest heavily in electric vehicles and sustainable technologies.

This ripple effect is evident as more major automakers are now dedicating resources towards developing their own electric vehicle lineups.

BYD Company Limited (BYDDF)

BYD Company Limited (BYDDF) has emerged as a prominent player in the electric vehicle industry, gaining recognition for its innovative technologies and high-quality products. With a strong focus on research and development, BYD has quickly risen to prominence in this rapidly growing sector.

One of BYD’s key strengths lies in its innovative battery technologies. The company has made significant advancements in this area, particularly with its Blade Battery. This groundbreaking technology not only offers improved safety but also boasts higher energy density compared to traditional batteries.

These innovations position BYD at the forefront of the industry, poised for substantial growth in the future.

To gain a deeper understanding of BYD’s potential, investors can evaluate the company’s recent financial results and stock valuation. By analyzing factors such as revenue growth, profitability, and market sentiment, investors can make more informed decisions about their investments.

Examining these indicators provides valuable insights into BYD’s financial stability and prospects for future success.

In summary, BYD Company Limited (BYDDF) has established itself as a major force in the electric vehicle industry through its commitment to innovation and exceptional battery technologies. With an impressive track record and promising financial outlook, BYD is well-positioned for continued growth and success in this ever-evolving market.

| Heading 1 | Heading 2 |

|---|---|

| Overview of Emergence | Rapid rise to prominence |

| Innovative Battery Techs | Advancements & Blade Battery |

| Financial Results | Revenue growth & valuation |

Albemarle Corporation (ALB)

Albemarle Corporation (ALB) is a leading lithium supplier, playing a vital role in the battery industry. With strategic partnerships and high-quality products, Albemarle has a competitive advantage in meeting the growing demand for batteries.

Analyzing its financial performance provides insights into stock valuation, while its commitment to sustainability appeals to socially responsible investors. ALB’s strong market position makes it an attractive investment option in the booming lithium market.

Panasonic Corporation (PCRFY)

Panasonic Corporation (PCRFY) is a leading battery supplier, serving various industries including automotive and consumer electronics. Its partnership with Tesla has significantly influenced its stock performance, showcasing potential for growth.

Factors such as technological advancements, market dynamics, and industry trends also impact Panasonic’s stock price, making it essential for investors to consider these when evaluating investment options.

Panasonic’s commitment to research and development keeps it at the forefront of battery technology innovation. Additionally, monitoring global demand, economic conditions, and competition within the industry helps investors understand the external forces shaping Panasonic’s financial outlook.

As sustainability gains importance worldwide, Panasonic’s expertise in providing renewable energy storage solutions positions it well to meet the growing demand.

In summary, while Panasonic’s collaboration with Tesla is a driving force behind its stock performance, factors like technological advancements and industry trends also play significant roles. Evaluating these aspects allows investors to gain insights into Panasonic’s potential for growth in the battery market and beyond.

QuantumScape Corporation (QS)

QuantumScape Corporation is a groundbreaking company that is laser-focused on developing solid-state battery technology. This innovative approach has the potential to completely revolutionize the battery industry, offering substantial advantages in terms of energy density and safety.

With its promising solid-state battery technology, QuantumScape has positioned itself as a key player in the pursuit of more efficient and reliable energy storage solutions.

The company’s commitment to pushing the boundaries of what is possible in battery technology has garnered significant attention and interest from investors and industry experts alike.

Analyzing QuantumScape’s potential for disruption is crucial for understanding its investment prospects. By delving into the company’s technological advancements, partnerships, and market positioning, we can gain valuable insights into its ability to shake up the status quo.

QuantumScape’s dedication to innovation and its relentless pursuit of excellence make it an exciting contender in the ever-evolving energy sector.

Evaluating recent developments and partnerships impacting QuantumScape’s stock valuation is essential for informed decision-making. Factors such as research breakthroughs, collaborations with other industry leaders, and market sentiment all play vital roles in shaping the trajectory of this emerging player.

Keeping a close eye on these developments allows investors to stay ahead of the curve and capitalize on potential opportunities presented by QuantumScape’s growth.

In summary, QuantumScape Corporation represents an exciting prospect within the solid-state battery technology realm. Its relentless pursuit of innovation, coupled with promising advancements and strategic partnerships, positions it as a disruptive force within the battery industry.

By staying abreast of QuantumScape’s latest developments and carefully analyzing its investment potential, one can potentially capitalize on this emerging player’s growth trajectory.

Investing Strategies for Battery Company Stocks

Investing in battery company stocks offers long-term benefits due to the growing demand for battery-powered technology. Evaluating company fundamentals, such as revenue growth, profitability ratios, competitive advantage, and management expertise, helps identify potential winners in this sector.

To manage risk, diversification is crucial. Allocating investments across different battery companies minimizes exposure to any single stock. Additionally, staying informed about industry trends allows investors to make timely decisions based on evolving market dynamics.

Tracking technological advancements, regulatory changes, and consumer preferences provides valuable insights.

By adopting a long-term investment approach and implementing effective risk management techniques like diversification and trend monitoring, investors can navigate the battery company stocks market with confidence and potentially reap significant returns.

| Company | Stock Symbol |

|---|---|

| Tesla | TSLA |

| BYD Company Limited | BYDDF |

| Albemarle Corporation (ALB) | ALB |

| Panasonic Corporation | PCRFY |

| QuantumScape Corporation | QS |

Note: Thorough research and analysis should be conducted before making any investment decisions in battery company stocks.

The Future Outlook for Battery Company Stocks

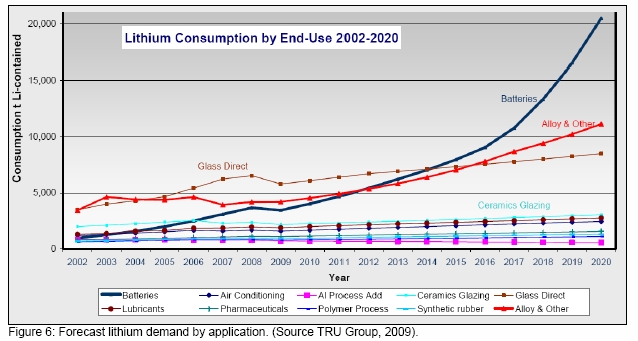

The future of battery company stocks is influenced by government policies and renewable energy initiatives. Analyzing these policies can help investors anticipate market trends and identify growth potential. International policies supporting clean energy adoption also provide insights into the future of battery stocks.

Technological advancements, such as solid-state batteries and improved energy storage systems, shape the demand for batteries. Understanding how these breakthroughs impact stock performance is crucial for informed investment decisions. Identifying companies at the forefront of innovation presents attractive opportunities.

In summary, government policies, renewable energy initiatives, and technological advancements play significant roles in shaping the future outlook for battery company stocks. Staying informed about market trends allows investors to position themselves strategically within this dynamic sector.

Conclusion

Investing in battery company stocks offers an exciting opportunity to capitalize on the rising demand for battery-powered technology. Leading players in this industry, such as Tesla, BYD, Albemarle Corporation, Panasonic Corporation, and QuantumScape, present compelling investment options.

By evaluating their financial performance, market positioning, partnerships, and industry trends, investors can make informed decisions to maximize potential returns.

Government support for renewable energy initiatives and technological advancements are reshaping the battery landscape. Investing in battery company stocks holds promise for long-term growth and profitability.

The forecast for electric vehicle battery stock market performance in 2023 suggests continued growth driven by the adoption of electric vehicles worldwide.

Factors like government regulations promoting clean transportation and advancements in battery technology are expected to positively influence stock market performance. However, thorough research and consultation with a financial advisor are essential before making investment decisions based on individual circumstances and risk tolerance.

[lyte id=’JH-8Tm2QCTo’]