Investing in the stock market can be an excellent way to grow your wealth and secure your financial future. While many investors focus on capital appreciation, there is another strategy that offers a consistent and reliable income stream – dividend stocks.

Dividend stocks are shares of companies that distribute a portion of their profits to shareholders on a regular basis. In this article, we will explore an even more enticing option – stocks that pay dividends every week.

The Basics of Dividend Stocks

Dividend stocks are shares of publicly traded companies that distribute a portion of their profits as cash payments to shareholders. These payments, known as dividends, are typically paid out quarterly or annually.

Investing in dividend stocks provides a steady stream of income, making them attractive for retirees and those looking to supplement their earnings. Additionally, dividend-paying companies often demonstrate stable financial health and strong performance records, which can contribute to long-term capital appreciation.

Weekly Dividend Stocks: An Introduction

Weekly dividend stocks offer a unique opportunity for investors to receive more frequent payouts compared to traditional quarterly or annual dividend payments.

These stocks, unlike their counterparts, provide cash dividends on a weekly basis, allowing investors to enjoy a consistent income stream and potentially meet their financial goals more efficiently.

What sets weekly dividend stocks apart from other dividend-paying stocks is the frequency of their dividend payments. While most companies distribute dividends every quarter or year, investing in weekly dividend stocks provides individuals with the chance to receive cash payments on a weekly basis.

This regular flow of income can be particularly advantageous for those who rely on their investments for living expenses or desire a steady source of funds.

The benefits of investing in weekly dividend stocks are numerous. Firstly, they offer a reliable income stream that can assist individuals in meeting their financial obligations and maintaining a comfortable lifestyle. The more frequent payouts allow investors to reinvest their earnings promptly, potentially compounding their returns over time.

Alternatively, these regular cash payments can be used immediately to achieve personal financial goals such as paying off debts, saving for retirement, or funding educational expenses.

Furthermore, investing in weekly dividend stocks provides greater flexibility and liquidity compared to other investment options. With the ability to access funds on a weekly basis, investors have increased control over their finances and can react quickly to any unforeseen circumstances or opportunities that may arise.

In summary, weekly dividend stocks present an attractive investment option for those seeking regular income and potential capital growth. By providing more frequent payouts and offering greater flexibility and liquidity, these stocks can play an essential role in building wealth and achieving financial objectives.

Finding the Right Weekly Dividend Stocks

When seeking to invest in weekly dividend stocks, it is crucial to conduct thorough research on reputable companies with a history of consistent dividend payments. Look for established companies that have demonstrated their ability to sustain regular payouts.

Additionally, evaluate the company’s financial health and stability by reviewing its balance sheet, income statement, and cash flow statement. This will ensure that the company has sufficient funds to sustain regular dividend payments.

Furthermore, analyzing the historical performance of weekly dividend stocks can provide insights into their reliability and potential returns. Consider factors such as annual increases in dividends, consistency of payouts, and overall stock price performance over time.

By considering these key factors, investors can increase their chances of finding the right weekly dividend stocks for their investment portfolios.

Understanding Dividend Yield and Payout Ratio

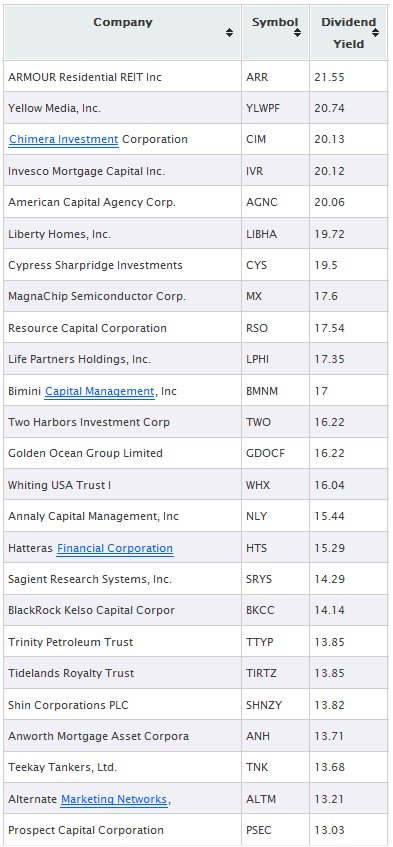

Dividend yield measures the percentage return an investor receives from owning a particular stock based on its annualized dividends relative to its current share price. It helps determine how much income an investment generates compared to its cost.

The payout ratio indicates what proportion of a company’s earnings is distributed as dividends to shareholders. A lower payout ratio suggests that the company retains more of its earnings for reinvestment or future growth, while a higher ratio indicates a larger portion goes to shareholders.

Understanding these metrics is crucial for investors in evaluating potential stocks for investment. Dividend yield provides insights into the income potential of an investment, while the payout ratio reveals how much of a company’s earnings are allocated towards rewarding shareholders.

By considering these metrics alongside other factors such as financial stability and growth prospects, investors can make informed decisions aligned with their goals and risk tolerance levels.

Best Practices for Investing in Weekly Dividend Stocks

Diversify your portfolio across various sectors and industries to mitigate risk and maximize returns. Setting realistic expectations for long-term stability and consistent payouts is crucial. Consider reinvesting dividends to compound returns over time or opt for regular cash payouts if immediate income is needed.

Thorough research, including analyzing financial health and dividend policies, helps identify solid investment opportunities. Keep an eye on dividend yield measures as an indicator of potential returns, but consider other factors like company growth prospects.

By following these best practices, investors can achieve financial stability and growth with weekly dividend stocks.

Risks Associated with Weekly Dividend Stocks

Investing in weekly dividend stocks carries certain risks that investors should be aware of. Market volatility can impact stock prices and dividends, potentially affecting the value of investments. Assessing a company’s financial health is crucial to ensure consistent dividend payments.

Additionally, investors should consider potential tax implications associated with dividend income. By understanding these risks, investors can make informed decisions when including weekly dividend stocks in their portfolios.

Case Studies: Successful Investors and Their Strategies

In this section, we will explore case studies of successful investors who have utilized different strategies to achieve their financial goals. By examining these examples, we can gain insights into the approaches they have taken and learn from their experiences.

John, a retired investor, strategically builds a portfolio of dividend stocks that provide him with weekly income. He selects companies with consistent payout histories and diversifies across sectors to ensure a stable income stream during retirement.

Sarah, a young investor, focuses on long-term wealth accumulation. She reinvests her weekly dividends by purchasing additional shares, taking advantage of the compounding effect. Sarah carefully selects dividend stocks with growth potential to maximize her returns over time.

These case studies highlight the diverse strategies employed by successful investors when investing in weekly dividends. Whether prioritizing income security or harnessing compounding growth, each investor tailors their approach to align with their financial goals and risk tolerance.

By learning from their experiences, we can enhance our own investment strategies.

Tips for Maximizing Returns with Weekly Dividends

To maximize returns with weekly dividend stocks, consider these strategies:

-

Dollar-Cost Averaging: Invest a fixed amount regularly, regardless of market conditions. This helps smooth out entry points and mitigate volatility.

-

Reinvest Dividends: Capitalize on compounding interest by using dividend earnings to purchase additional shares. Over time, this can amplify returns.

-

Monitor Market Trends: Stay informed about industry developments and adjust your portfolio accordingly. Regularly review and make necessary adjustments to align with your goals.

Implementing these tips can optimize your investment strategy and potentially increase your earnings over time. Remember to stay informed, be patient, and maintain a long-term perspective for investment success.

[lyte id=’ivWgwTzb_jo’]