When it comes to investing in the stock market, making informed decisions is crucial for success.

With so many stocks to choose from, how can investors identify the ones with the most potential? This is where the concept of a Stock Smart Score comes in. In this article, we will explore what a Stock Smart Score is and how it can help investors make smarter investment choices.

Whether you’re a seasoned investor or just starting out, understanding the Stock Smart Score can provide valuable insights into the companies you are considering investing in.

What is a Stock Smart Score?

A Stock Smart Score is a numerical rating assigned to individual stocks, reflecting their overall investment potential. It considers factors like financial health, growth potential, and management effectiveness to provide an objective measure of a stock’s attractiveness as an investment opportunity.

The Stock Smart Score helps investors navigate the volatile stock market by identifying stocks with strong fundamentals and long-term growth potential. By condensing multiple factors into a single score, it simplifies the evaluation process and allows for informed decision-making.

Investors can use the Stock Smart Score to quickly assess stocks and compare them based on their scores. This comprehensive analysis saves time and helps prioritize investment choices.

By considering critical aspects such as financial health, growth potential, and management effectiveness, the Stock Smart Score provides valuable insights for investors. It enables them to align their investments with their goals and make more informed decisions.

In summary, the Stock Smart Score is an invaluable tool that simplifies the evaluation of stocks and empowers investors to build successful portfolios based on objective metrics.

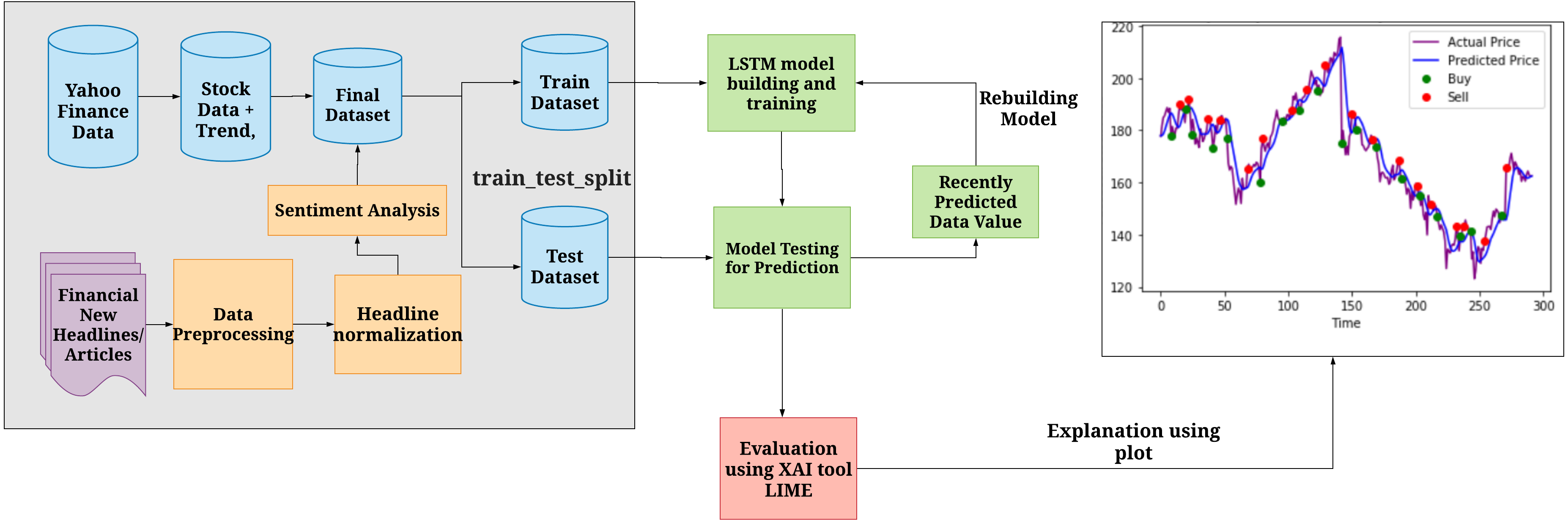

How is the Stock Smart Score Calculated?

The Stock Smart Score is determined by evaluating several key factors. One crucial aspect is the company’s financial health, including its balance sheet strength, income statement performance, liquidity ratios, solvency ratios, and profitability ratios.

Additionally, growth potential and market trends are considered by analyzing historical and projected growth rates, industry trends, market conditions, and relevant indicators. The effectiveness of the management team and corporate governance practices are also evaluated.

It’s important to understand that not all factors carry equal weight in calculating the Stock Smart Score. The weightage assigned to each factor may vary between platforms or research providers.

By considering these factors in conjunction with one another and understanding their relative importance, investors can make more informed decisions about investing in a particular stock.

Understanding the Components of a Stock Smart Score

The Stock Smart Score is a comprehensive assessment tool that evaluates the investment potential of a company’s stock. It consists of three main components:

This score assesses the company’s balance sheet strength, liquidity, solvency, and profitability ratios. A strong financial health score indicates stability and consistent returns for investors.

This score considers historical and projected growth rates, industry trends, market conditions, and technological advancements. A high growth potential score suggests opportunities for expansion and above-average returns.

This score analyzes the management team’s track record, experience, strategic execution, financial decisions, and corporate governance practices. A strong management effectiveness score indicates competent leadership that can drive growth and create value for shareholders.

By understanding these components, investors gain valuable insights into a company’s financial stability, growth prospects, and management capabilities when assessing its investment potential.

The Benefits of Using a Stock Smart Score for Investing Decisions

Incorporating a Stock Smart Score into investment decisions offers several advantages. Firstly, it provides an objective measure for evaluating stocks, eliminating subjective opinions and emotions. This score helps identify high-potential opportunities by considering multiple factors comprehensively.

It also reduces reliance on emotions, ensuring more rational decision-making.

Additionally, the Stock Smart Score mitigates risk by avoiding poor-performing stocks and selecting those with long-term growth potential. It improves portfolio diversification by incorporating stocks with varying smart scores, reducing the impact of individual stock performance.

Moreover, the Stock Smart Score saves time by condensing multiple factors into a single score, streamlining research processes. Investors can efficiently compare stocks using their smart scores, focusing on higher potential options.

Overall, the Stock Smart Score provides an objective measure of investment potential and enhances decision-making. However, additional research is still necessary to gain a comprehensive understanding of investments beyond smart scores’ limitations.

[lyte id=’q0BU94SmPbw’]