Investing in the stock market can be an exciting and potentially lucrative venture. While there are countless investment opportunities out there, one area that has been gaining attention recently is stem cell penny stocks.

Stem cell research and regenerative medicine have shown great promise in revolutionizing healthcare, and investing in companies involved in this field can offer significant growth potential.

In this article, we will explore what stem cell penny stocks are and take a closer look at some key players in the market, including Cue Biopharma (CUE), Sana Biotechnology (SANA), Precigen (PGEN), and Atossa Therapeutics (ATOS).

So, if you’re interested in learning more about investing in this exciting sector, keep reading!

What are stem cell penny stocks?

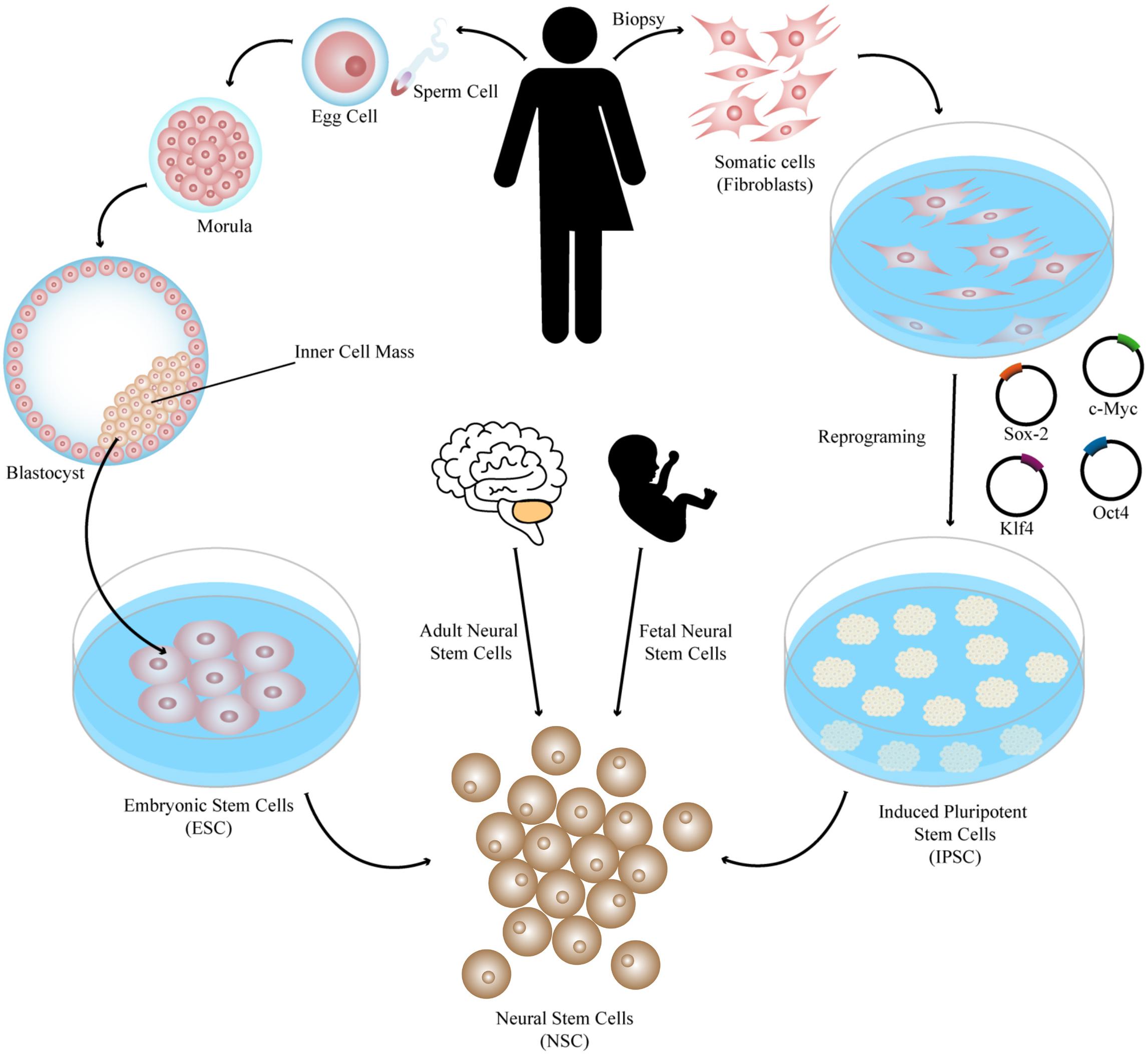

Stem cell penny stocks combine the potential of regenerative medicine with the volatility and potential for significant returns that penny stocks offer. Stem cells are undifferentiated cells with the capability to develop into specialized cells within the body, making them valuable for medical purposes.

Penny stocks refer to low-priced shares of small-cap companies, often trading at relatively low prices per share. Investing in stem cell penny stocks involves focusing on small-cap biotech companies involved in stem cell research and development, which have immense growth potential but come with risks.

Thorough research and consultation with a financial advisor are crucial before venturing into this niche market.

Overview of Cue Biopharma (CUE)

Cue Biopharma (CUE) is a prominent player in the stem cell penny stock market, specializing in the development of biologic drugs that harness the power of the immune system to target and treat various diseases, particularly cancer.

The company’s unique approach lies in its platform technology called Immuno-STAT (Selective Targeting and Alteration of T cells), which allows for precise engineering of T cells to enhance their therapeutic properties.

What sets Cue Biopharma apart from its competitors is its focus on modulating T cell activity by targeting specific antigens on cancer cells. By doing so, Cue aims to unleash the full potential of the immune system in fighting against tumors.

Through several ongoing clinical programs, the company has shown promising results in preclinical and early-stage trials.

The Immuno-STAT technology developed by Cue Biopharma enables researchers to selectively alter T cells, enhancing their ability to recognize and destroy cancer cells while minimizing harm to healthy tissues. This targeted approach holds immense potential for more effective and personalized cancer treatments.

Cue’s commitment to innovation is demonstrated through its continuous research and development efforts. The company collaborates with leading academic institutions and industry partners to advance its therapeutic pipeline. By leveraging cutting-edge science and technology, Cue strives to bring novel therapies to patients who need them most.

Insights into Sana Biotechnology (SANA)

Sana Biotechnology (SANA) is a leading player in the stem cell market, specializing in developing engineered cells as potential medicines for various diseases. Their innovative approach involves reprogramming cells to perform desired functions or deliver therapies directly to targeted tissues.

With their versatile platform technology, Sana can engineer different types of cells, including stem cells and immune cells. This versatility opens up possibilities for personalized treatments and therapies. Backed by experienced scientists and a robust pipeline, Sana has attracted significant investor attention in the regenerative medicine field.

Moreover, Sana’s patient-centric focus aligns with the demand for personalized medicine. They strive to develop tailored treatments that cater to individual patients’ needs, setting them apart from traditional pharmaceutical approaches.

Collaboration is also a core value at Sana Biotechnology. They actively seek partnerships with academic institutions and biopharmaceutical companies to accelerate research efforts and bring breakthrough therapies into clinical practice more efficiently.

Overall, Sana Biotechnology stands out as an exciting company with immense potential in regenerative medicine. Their dedication to engineering cells as medicines showcases forward-thinking innovation that could lead to transformative contributions in healthcare.

As they continue advancing their pipeline and attracting investment interest, all eyes are on Sana for groundbreaking treatments in the future.

Exploring Precigen (PGEN) as a Stem Cell Penny Stock

Precigen (PGEN), formerly known as Intrexon Corporation, is an intriguing player in the stem cell penny stock market. The company leverages synthetic biology and gene editing technologies to develop innovative solutions for medical challenges.

Their UltraCAR-T platform enhances CAR-T cell therapy, reducing side effects while improving effectiveness. With ongoing clinical trials and collaborations with leading healthcare organizations, Precigen stands out as a promising contender in the stem cell penny stock market.

Analyzing Atossa Therapeutics (ATOS) in the Stem Cell Market

Atossa Therapeutics (ATOS) is a company focused on developing novel therapeutics for breast cancer and other breast conditions. While not strictly a stem cell company, Atossa utilizes stem cell technology in their drug development process.

Their lead product candidate, Endoxifen, is an active metabolite of tamoxifen used for treating hormone receptor-positive breast cancer. By leveraging stem cells to produce high-quality Endoxifen, Atossa aims to improve treatment outcomes and reduce potential side effects.

They are also exploring the use of their proprietary technology in other indications such as male infertility and COVID-19. With ongoing clinical trials and a unique approach to drug development, Atossa Therapeutics presents an interesting investment opportunity within the stem cell market.

Thorough research and careful evaluation are vital when considering investments in this sector.

[lyte id=’xZZEi-kNwV0′]