Investing in cutting-edge industries can be both exciting and lucrative. One such industry that has been gaining significant attention in recent years is stem cell research.

Stem cells have the potential to revolutionize medical treatments and therapies, making them an attractive investment opportunity for those looking to make a difference while also seeking financial gain.

In this article, we will dive into the world of stem cell investment, exploring its potential, success stories, risks, and tips for investing wisely.

Introduction to Stem Cells

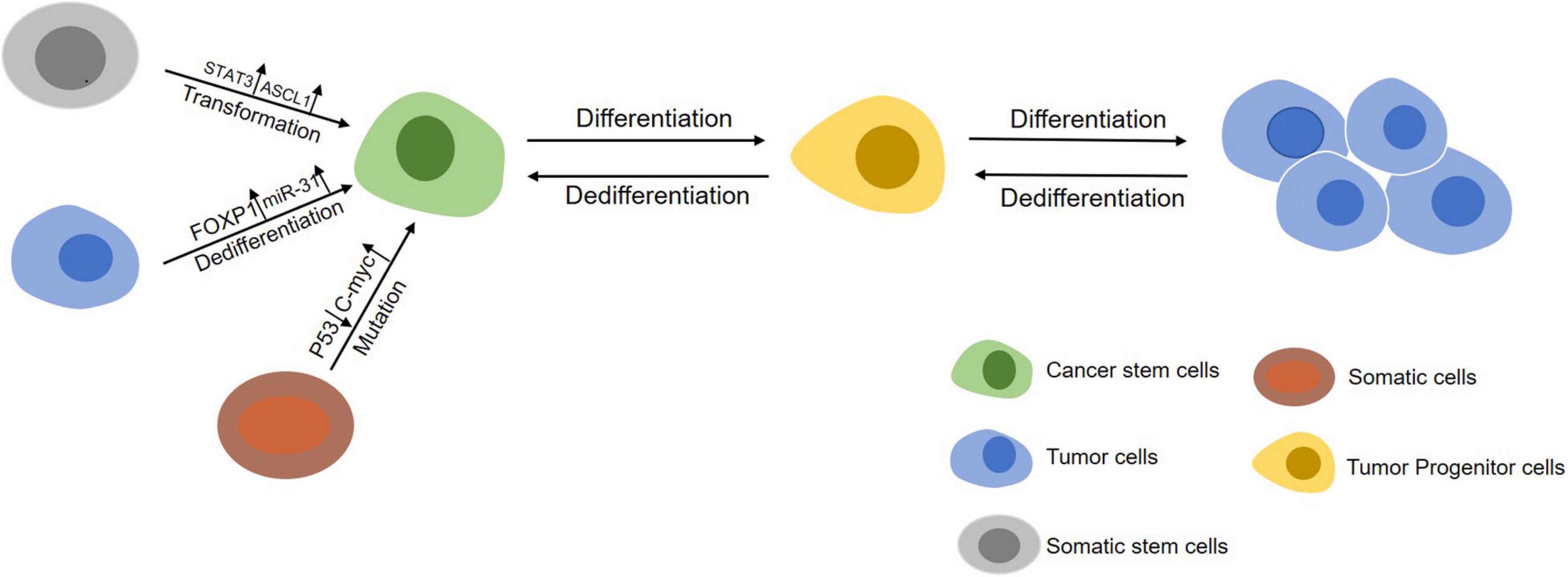

Stem cells are remarkable cells with the ability to develop into different specialized cells in the body. They can renew themselves indefinitely and have the potential to repair damaged tissues or organs.

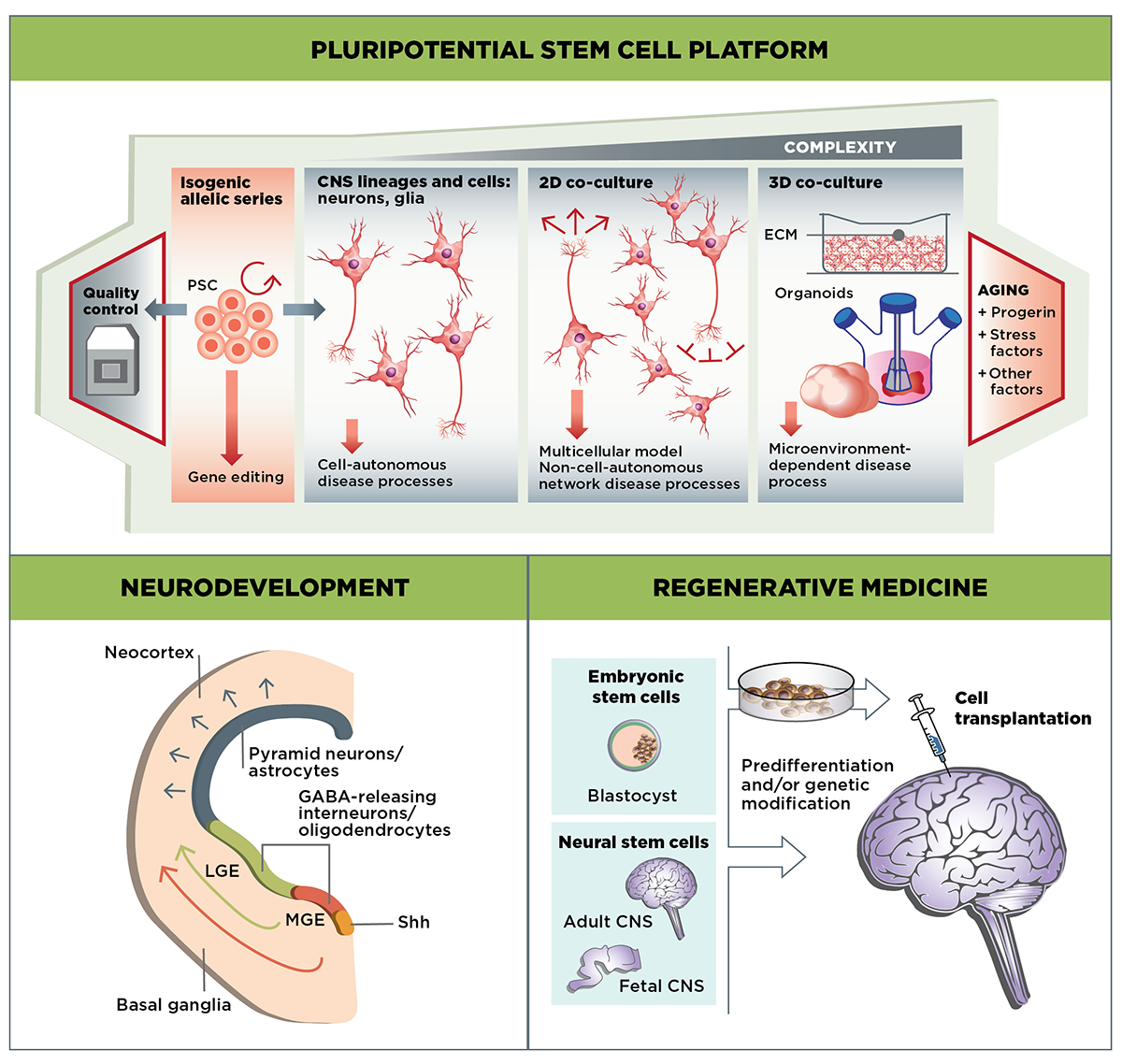

Stem cell research holds immense promise for treating a wide range of diseases, including cancer, Parkinson’s disease, spinal cord injuries, diabetes, and heart disease. By harnessing the regenerative properties of stem cells, scientists aim to develop new therapies that can potentially cure previously untreatable conditions.

Stem Cell Therapy

Stem cell therapy is an innovative approach that utilizes stem cells to treat diseases and injuries by repairing damaged tissues or organs. This technique has shown remarkable results in clinical trials, offering immense potential to transform healthcare.

Successful cases include restoring vision in macular degeneration patients and improving motor function in those with spinal cord injuries. Ongoing research explores the application of stem cell therapy for various conditions such as heart disease, diabetes, Parkinson’s disease, and cancer.

These breakthroughs highlight the promising future of stem cell therapies in modern medicine.

Stem Cell Banking

Stem cell banking involves collecting and preserving valuable stem cells from cord blood for future medical treatments. These cells, obtained from a newborn’s umbilical cord, have the potential to develop into various types of specialized cells found in organs, tissues, and blood.

By choosing to bank their newborn’s cord blood, parents secure a personal resource that could be life-saving for themselves or family members. Preserving these stem cells at birth ensures access to personalized therapies if serious illnesses or conditions arise later in life.

Stem cell banking unlocks a world of possibilities in regenerative medicine. Ongoing research continues to uncover new applications for these stored stem cells in treating diseases like Parkinson’s and genetic conditions such as sickle cell anemia.

In summary, stem cell banking is an investment in the future of healthcare. By taking proactive steps to preserve these cells, individuals can have peace of mind knowing they are prepared for potential medical challenges and hold hope for improved treatments down the line.

Top 10 NASDAQ Stem Cell Stocks in 2023

The NASDAQ stock exchange offers exciting investment opportunities in the field of stem cell research. Here are five notable companies leading the way:

- Company A: A pioneer in regenerative medicine, focusing on therapies for chronic diseases.

- Company B: Specializes in cellular therapeutics and has shown progress in clinical trials.

- Company C: Known for innovative approaches to tissue engineering.

- Company D: Developing stem cell-based treatments for neurological disorders.

- Company E: Advancing gene editing technology combined with stem cells.

Additional promising companies listed on the NASDAQ include those focused on cancer therapies, stem cell banking, tissue regeneration, drug discovery, and manufacturing.

Investing in these top NASDAQ-listed companies not only offers financial growth but also supports groundbreaking medical advancements. Stay informed about developments at the forefront of stem cell research by keeping an eye on these stocks.

Evaluating Stem Cell Investment Opportunities

Before investing in stem cell companies, it’s crucial to consider key factors that can impact your investment’s success. These include:

- Regulatory landscape and legal considerations: Stay informed about stem cell research regulations as they can significantly affect the industry.

- Market potential and demand for specific therapies: Assess the market need and potential for the stem cell therapies being developed by the company you’re considering.

- Research and development progress of the company: Look into their pipeline, ongoing clinical trials, and ability to bring therapies to market successfully.

- Competitive analysis within the industry: Evaluate how a company differentiates itself from peers.

By evaluating these factors, you can make more informed investment decisions aligned with your goals and risk tolerance. Remember to conduct due diligence in emerging industries like stem cell research, gathering relevant information and seeking expert advice when needed.

Risks and Challenges in Stem Cell Investments

Investing in early-stage biotech companies, particularly those focused on stem cell research, comes with inherent risks. One major risk is the uncertain regulatory environment surrounding stem cell therapies, which can impact approvals and funding.

Additionally, the high failure rate of experimental therapies during clinical trials or regulatory approval processes poses financial risks for investors. Furthermore, the lengthy development timelines from initial research to commercialization require patience from investors.

Stem cell investments also face unique challenges such as regulatory hurdles and changing policies due to ethical concerns surrounding embryonic stem cells. The controversial nature of embryonic stem cells can limit funding opportunities and lead to public backlash.

It is important for potential investors to be aware of these risks and challenges before considering stem cell investments.

Successful Case Studies – Profiting from Stem Cell Investments

Investing in stem cell companies has proven to be highly profitable for many investors. For instance, Investor X saw significant returns after Company A’s therapy received FDA approval. Investor Y benefited greatly by investing early in Company B, which showed promising results in clinical trials.

Thorough due diligence, staying informed about advancements, and diversifying portfolios were common factors contributing to their success. These case studies demonstrate the potential for profit in stem cell investments and emphasize the importance of research and diversification for aspiring investors.

Tips for Investing in Stem Cell Companies

When investing in stem cell companies, it’s important to approach the field with caution and a well-informed strategy. Here are some valuable tips to consider:

-

Diversify Your Portfolio: Spread your risk by investing in a mix of stem cell companies at different stages of development.

-

Stay Updated with Scientific Advancements: Keep abreast of the latest breakthroughs and developments within the stem cell industry to make informed investment decisions.

-

Seek Expert Opinions and Advice: Consult professionals specializing in biotech investments or stem cell research for guidance on potential opportunities and risks.

-

Perform Thorough Due Diligence: Scrutinize the financial health, research pipeline, management team, and competitive advantages of the companies you’re considering.

-

Understand Regulatory Frameworks: Familiarize yourself with the regulations governing stem cell therapies in different jurisdictions to assess potential roadblocks.

By following these tips, you can navigate the complex landscape of investing in stem cell companies more effectively and increase your chances of success.

[lyte id=’FVmqNiFJ23I’]