Investing in the stock market can be a lucrative way to grow your wealth, but it can also be overwhelming with so many options available. If you’re interested in investing and want to learn more about a specific sector that holds great potential, smart grid stocks may be worth exploring.

In this article, we will delve into the world of smart grid stocks, their importance, benefits of investing in them, top companies in the industry, key factors to consider when investing, and the future outlook for this sector.

Definition of Smart Grid Stocks

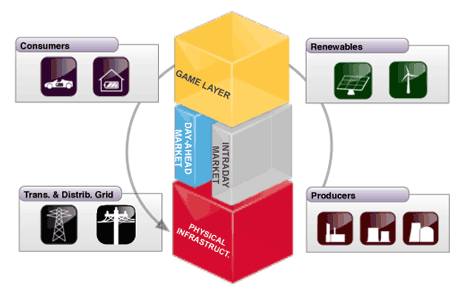

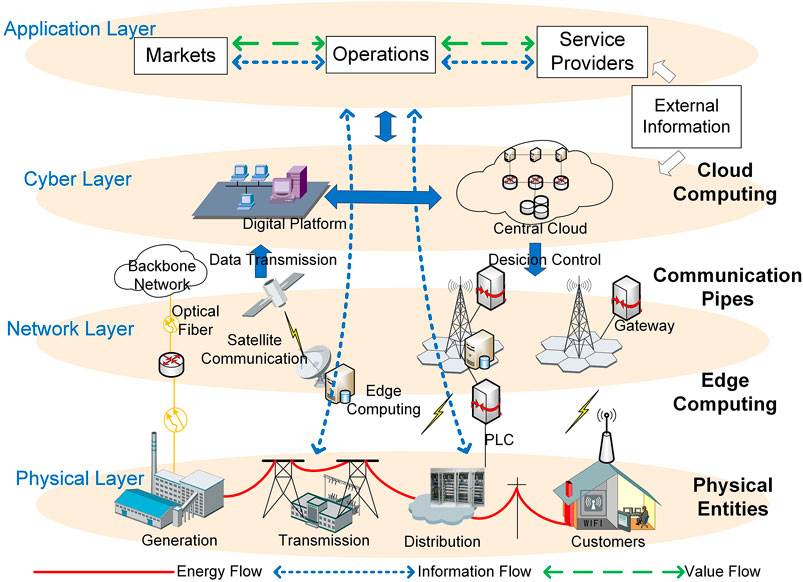

Smart grid stocks are shares of companies operating within the advanced electrical network industry known as the smart grid. This innovative technology incorporates digital communication and automation to enhance electricity distribution efficiency, reliability, and sustainability.

These stocks are typically offered by companies involved in developing, manufacturing, or providing services related to smart grid technologies.

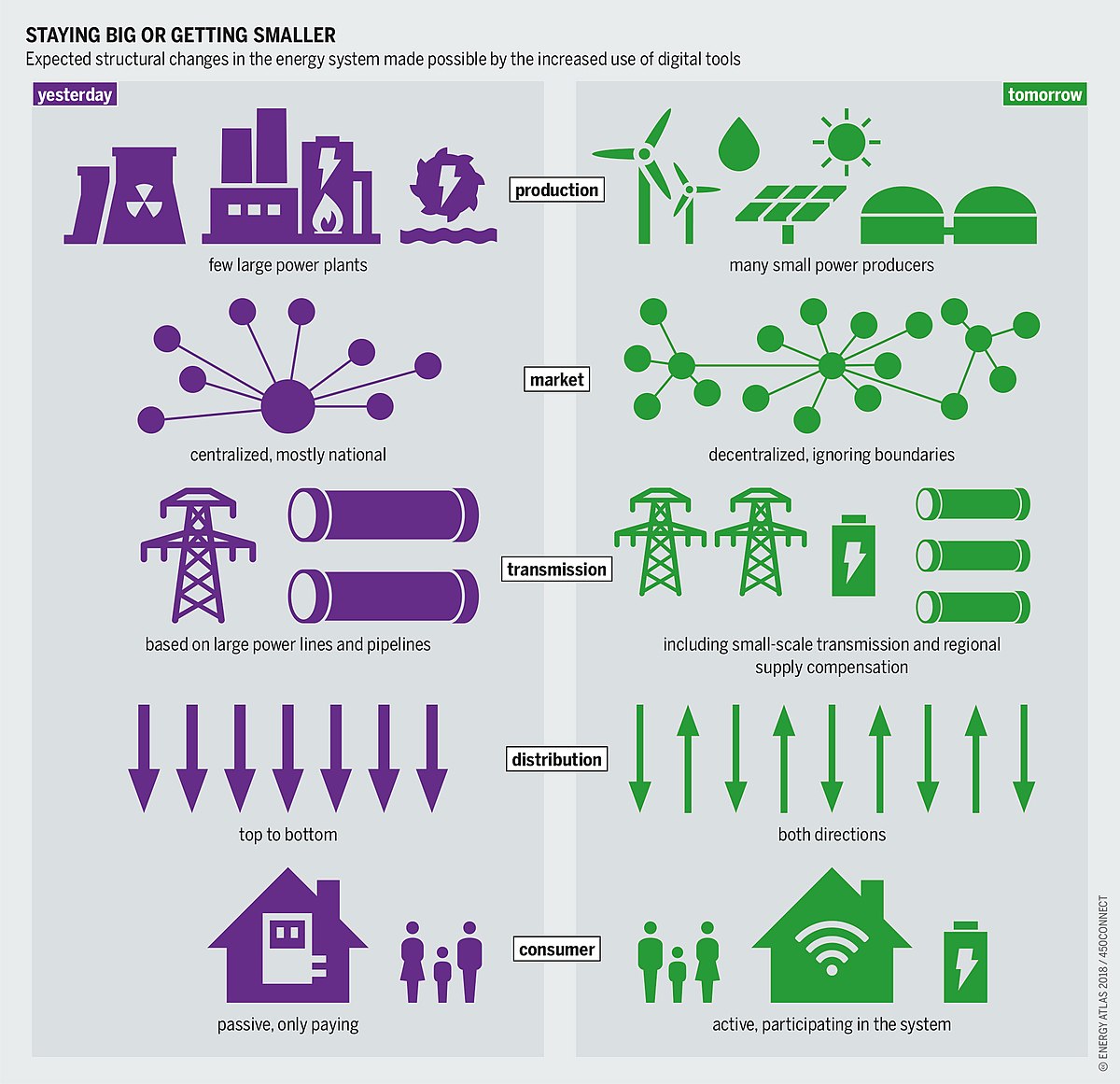

Smart grids revolutionize the traditional one-way power grid by enabling two-way communication between power plants and consumers. This bidirectional flow allows for real-time monitoring, optimized energy allocation, and reduced wastage.

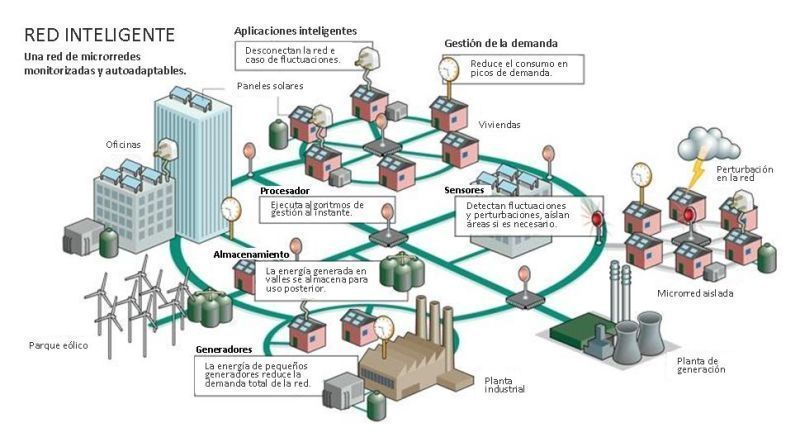

Through digital sensors and meters, these grids provide accurate data for consumption patterns, enabling utilities to allocate resources efficiently and detect faults more effectively.

Apart from improving operational efficiency, smart grids also facilitate the integration of renewable energy sources into existing infrastructure. By managing fluctuations in solar or wind power generation, they contribute to a greener energy mix while reducing reliance on fossil fuels.

Investing in smart grid stocks presents an opportunity to participate in this transformative industry’s growth potential.

Before investing in smart grid stocks, thorough research is crucial. Consider factors such as company financials, technological advancements, regulatory environments, and competitive landscapes. Diversifying investments across multiple companies within the smart grid industry can help mitigate risks associated with individual stock performance.

In summary, smart grid stocks represent shares of companies operating within the dynamic smart grid industry. These stocks offer investors an opportunity to be part of the transformation towards a more efficient and sustainable future in the electrical sector.

Importance of Investing in Smart Grid Stocks

Investing in smart grid stocks is important for several reasons. Firstly, as the world transitions towards cleaner energy sources and strives for energy efficiency, the demand for smart grid technologies is expected to soar. By investing early on, investors position themselves for long-term growth and profitability.

Secondly, investing in smart grid stocks contributes to sustainable energy solutions by reducing carbon emissions and optimizing energy consumption. Governments worldwide prioritize combating climate change, making investments in clean energy sectors like smart grids increasingly vital.

Lastly, including smart grid stocks in your portfolio provides diversification and risk management benefits. Spreading investments across different sectors alongside smart grids mitigates risks associated with market fluctuations or economic downturns.

Overall, investing in smart grid stocks aligns with sustainable practices while providing potential financial rewards and opportunities for growth in a rapidly evolving sector.

Potential for Long-Term Growth and Profitability

The smart grid industry is set to experience significant growth in the coming years. As more countries invest in renewable energy sources and upgrade their electrical infrastructure, the demand for smart grid technologies will continue to rise.

This presents a promising opportunity for investors to capitalize on the long-term growth and profitability of smart grid stocks.

Advancements in technology are enhancing the capabilities of smart grids, positioning companies in this sector to innovate and develop new products and services. These innovations can drive revenue growth and increase the value of smart grid stocks.

Investing in smart grid stocks offers not only financial gains but also contributes to a sustainable future. Smart grids optimize renewable energy utilization, reduce costs, and modernize aging electrical infrastructures.

By recognizing the potential for long-term growth and profitability in this industry, investors align their interests with achieving a greener and more sustainable planet.

Contribution to Sustainable Energy Solutions

Investing in smart grid stocks allows individuals to directly contribute to sustainable energy solutions. Smart grids enable the integration of renewable energy sources like solar and wind power into the electrical grid, reducing reliance on fossil fuels and decreasing carbon emissions.

By investing in companies leading the development and implementation of these technologies, investors can accelerate the transition towards cleaner energy systems and play a role in creating a greener future.

Smart grids efficiently manage renewable energy generation, support electric vehicle adoption, foster innovation, and drive research for a more sustainable energy future.

Diversification and Risk Management in Investment Portfolio

Including smart grid stocks in your investment portfolio provides diversification benefits, helping to mitigate risks associated with market volatility or industry-specific challenges. By spreading investments across various sectors, you reduce exposure to the performance of any single sector.

Investing in sustainable technologies like smart grids aligns with long-term trends driven by global clean energy initiatives. This stability stems from the increasing adoption of smart grids for optimizing energy distribution and reducing carbon emissions.

Thorough research is crucial when considering potential investment opportunities within the smart grid sector. Here are five reputable companies to consider:

| Company Name | Description |

|---|---|

| Company A | Description |

| Company B | Description |

| Company C | Description |

| Company D | Description |

| Company E | Description |

By diversifying your portfolio and conducting thorough research, you can effectively manage risk and position yourself for long-term growth in the emerging smart grid industry.

Company 1: Overview, Products/Services, and Financial Performance

Company 1 is a leading provider of smart grid solutions, offering advanced metering infrastructure, distribution automation systems, and demand response solutions. Their strong brand reputation and extensive experience in the industry set them apart.

Recent developments include securing a major contract for deploying their smart grid technology in a large metropolitan area, expected to boost revenue significantly. Despite competition from emerging startups and potential regulatory challenges, Company 1 remains well-positioned to maintain their market leadership.

| Strengths | Weaknesses |

|---|---|

| Strong brand reputation | Potential regulatory challenges |

| Extensive experience in the industry | Competition from emerging startups |

In summary, Company 1’s overview highlights their comprehensive product offerings and financial performance as a prominent player in the smart grid sector. With recent contract wins and their ability to adapt to market demands, they are positioned for continued success and growth.

Company 2: Overview, Products/Services, and Financial Performance

Company 2 specializes in developing software platforms for smart grid management. Their products help utilities optimize energy distribution, monitor power usage patterns, and enhance customer engagement. Recently, they launched an innovative AI-powered platform that analyzes data from smart grids to provide valuable insights for utilities.

This has gained attention from industry experts and investors.

With a strong focus on technological innovation, Company 2 is a leader in the smart grid software solutions segment. However, they face challenges related to cybersecurity threats that could impact customer trust. Despite this, their financial performance has been impressive, driven by continuous improvement and investment in R&D.

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Strong focus on technological innovation | Challenges related to cybersecurity threats impacting customer trust | Increasing demand for smart grid solutions globally | Intense competition from other software solution providers |

| Impressive financial performance and revenue growth | Varied range of products/services offered | Expansion into new geographic markets | Rapidly evolving technology landscape |

| Significant attention and recognition from industry experts and investors | Robust security measures to protect customer data | Collaborations with utilities for joint product development | Regulatory changes impacting the smart grid industry |

Company 2’s commitment to advancing smart grid management through technology makes them a prominent player in the industry.

Company 3: Overview, Products/Services, and Financial Performance

Company 3 is a leading player in the field of renewable energy integration within smart grids. With their expertise in developing advanced energy storage systems and microgrid solutions, they have revolutionized the seamless integration of intermittent renewable energy sources into existing electrical networks.

One of their recent achievements includes successful pilot projects where they integrated their energy storage systems with wind farms. This demonstration showcased the efficacy of their solutions and has generated significant interest from utilities looking to enhance their renewable energy capabilities.

By effectively managing the intermittency of renewable energy sources, Company 3’s innovative technology offers a reliable and sustainable solution for meeting the growing demand for clean power.

In terms of financial performance, Company 3 has experienced steady growth due to its focus on renewable energy integration. The increasing importance placed on sustainability in today’s market has positioned them well to meet the rising demand for environmentally-friendly solutions.

However, they do face challenges related to scalability and cost-effectiveness of their offerings. As renewable energy continues to gain traction, finding scalable solutions that are economically viable remains essential.

Company 3’s commitment to renewable energy integration sets them apart from competitors in an industry that is rapidly evolving towards sustainability. Their dedication to overcoming obstacles and delivering practical solutions positions them as a key player in driving the transition towards a greener future.

| Strengths | Weaknesses |

|---|---|

| Expertise in renewable energy integration | Scalability challenges |

| Advanced energy storage systems | Cost-effectiveness concerns |

| Microgrid solutions | |

| Successful pilot projects |

As they continue to innovate and refine their technologies, Company 3 is well-positioned to capitalize on the growing demand for efficient and sustainable smart grid solutions.

By addressing scalability issues and optimizing cost-effectiveness, they can solidify their position as a leader in the field while contributing significantly to global efforts towards achieving a cleaner and more sustainable energy future.

[lyte id=’GMWSKEKWibY’]