Investing in precious metals has always been a popular choice for investors looking to diversify their portfolios and protect their wealth. While gold often takes the spotlight, silver is another shining star that shouldn’t be overlooked.

In this article, we will delve into the world of silver-related stocks and explore the potential benefits they offer to savvy investors.

Understanding the Allure of Silver as an Investment

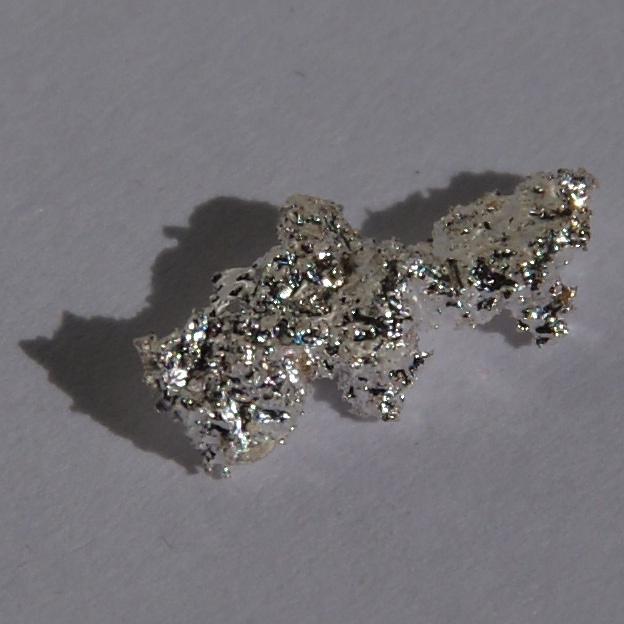

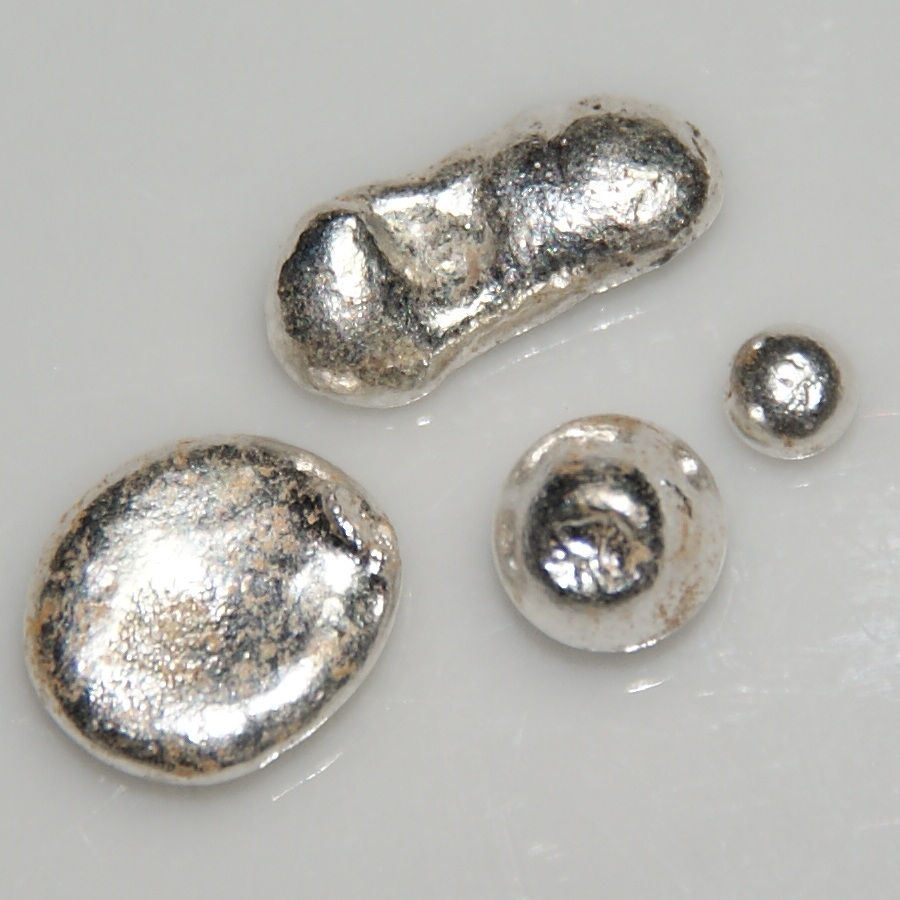

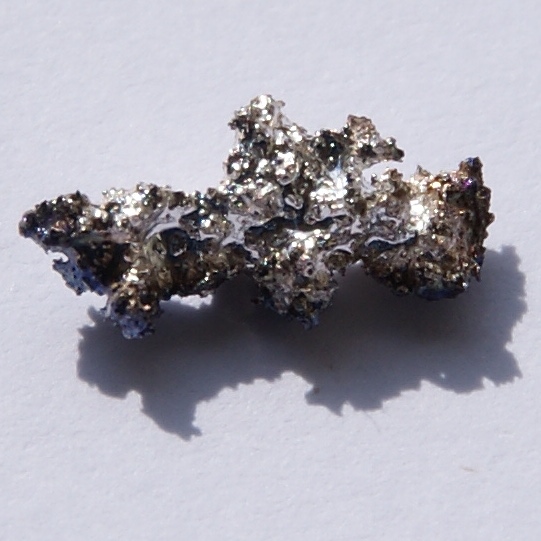

Silver’s allure as an investment stems from its beauty and practicality. It is highly sought-after in industries such as jewelry, electronics, solar panels, and medicine. The widespread demand for silver creates a strong foundation for investing in silver-related stocks.

As technology advances, the demand for electronic devices and renewable energy sources continues to drive up the need for silver. Additionally, silver’s historical significance as a store of value and medium of exchange adds to its appeal.

Investing in silver offers diversification, acts as a hedge against inflation and currency fluctuations, and provides more affordable entry points compared to gold. Overall, understanding the allure of silver makes it an enticing investment choice with long-term growth potential.

Introducing Silver-Related Stocks and Their Benefits

Investing in silver-related stocks provides flexibility and liquidity, allowing investors to gain exposure to silver price movements without owning physical metal. During bull markets, silver-related stocks can offer attractive returns as industrial demand increases. Dividend payments from these companies can also provide a steady income stream.

However, it’s important to conduct thorough research and analysis before investing due to market volatility and company-specific risks.

Top 5 Silver Stocks in 2023

Investing in silver stocks requires identifying top-performing companies with strong growth potential. Here are five notable options:

-

First Majestic Silver: One of the largest primary silver producers globally, with a focus on low-cost production and expanding their resource base.

-

Pan American Silver: Boasting a diverse portfolio of mining assets across the Americas, this company is known for sustainable mining practices and a strong financial position.

-

Wheaton Precious Metals: As a streaming and royalty company, Wheaton provides upfront financing to mining companies in exchange for future silver production at a predetermined price, offering exposure to multiple mining operations without operational risks.

-

iShares Silver Trust (ETF): For diversified exposure to the silver market, this ETF reflects the performance of the price of silver by holding physical silver bullion, providing liquidity and convenience through trading on major stock exchanges.

These top five silver stocks offer investors opportunities for capitalizing on the growing demand for silver. By understanding market trends and analyzing financial performance, individuals can make well-informed investment decisions in this dynamic sector.

Riding the Wave: How to Identify Promising Silver-Related Stocks

Investing in silver-related stocks requires careful analysis and research. To identify promising opportunities, consider these key factors:

Research silver market trends and demands: Stay informed about global economic indicators, industrial demand, and emerging technological applications that may drive future demand.

Analyze financial health and performance: Look for companies with a solid balance sheet, positive cash flow, and consistent performance.

Evaluate management teams: Assess the experience, expertise, and past achievements of the management team behind the silver-related stocks you are considering.

Consider geopolitical factors: Stay informed about political stability, trade policies, and currency fluctuations that may impact silver prices.

By researching market trends, analyzing financial health, evaluating management teams’ capabilities, and considering geopolitical factors, investors can increase their chances of identifying promising silver-related stocks.

Uncovering Hidden Gems: Lesser-Known Silver-Related Stocks with High Potential Returns

Investing in established companies can provide stability, but exploring lesser-known silver-related stocks offers exciting growth opportunities. Three areas worth considering are:

Junior mining companies actively search for new silver deposits or develop early-stage projects. While investing in juniors carries risk, successful exploration results can lead to substantial gains.

Undervalued streaming or royalty companies, like Wheaton Precious Metals, offer unique business models that benefit from rising silver prices without significant operational risks.

Silver plays a vital role in emerging industries such as electric vehicles and renewable energy. Investing in companies at the forefront of technological advancements can present exciting opportunities.

By focusing on these hidden gems, investors can uncover high potential returns within the world of silver-related stocks. It’s important to consider the associated risks with each investment. In the next section, we will explore these potential risks to provide a comprehensive understanding of this market.

Navigating Risks: Challenges and Pitfalls to Watch Out For When Investing in Silver-Related Stocks

Investing in silver-related stocks involves certain risks that investors should be aware of. First, the volatility and cyclical nature of precious metal markets can lead to significant price swings. It’s important to have a long-term perspective when dealing with these fluctuations.

Second, operational risks within mining companies, such as production disruptions or regulatory challenges, should be thoroughly analyzed. Lastly, understanding regulatory risks and environmental concerns associated with mining activities is crucial for assessing a company’s sustainability practices.

By being mindful of these risks, investors can navigate the silver market more effectively and incorporate silver-related stocks into their portfolios.

Diversification Strategies: Incorporating Silver-Related Stocks into a Well-Balanced Investment Portfolio

Diversification is key to building a resilient investment portfolio. By spreading your investments across different asset classes, geographies, and sectors, you can mitigate risk and potentially enhance returns. Adding silver-related stocks to your portfolio offers a unique asset with low correlation to traditional investments.

You can consider blue-chip silver miners for stability, small-cap explorers for high growth potential, or silver-focused ETFs for diversification within the sector. Incorporating silver-related stocks expands your diversification strategy and provides exposure to an asset class with historical significance and industrial demand.

It enhances your portfolio’s resilience and performance in various market conditions.

Beyond Borders: Exploring Global Opportunities in Silver Mining Investments

When it comes to silver mining investments, opportunities extend beyond borders. Established mining regions like Mexico, Peru, Canada, and Australia offer favorable regulations and rich mineral resources for potential higher returns.

Emerging markets such as Argentina, Bolivia, or Chile present untapped potential but require thorough assessment of geopolitical risks and regulatory frameworks before making investment decisions.

By exploring global opportunities in silver mining investments, investors can diversify their portfolios and capitalize on the dynamic nature of the industry. In the next section, we will discuss strategies for success when investing in silver-related stocks.

| Established Mining Regions | Emerging Markets | |

|---|---|---|

| 1 | Mexico | Argentina |

| 2 | Peru | Bolivia |

| 3 | Canada | Chile |

| 4 | Australia |

Please note that this table provides a concise overview of some established mining regions and emerging markets with untapped potential. Further research is recommended to explore additional opportunities.

[lyte id=’1k20if1Ejco’]