Investing in gold has always been a popular choice for individuals looking to diversify their portfolios and hedge against economic uncertainties. As the world grapples with the ongoing pandemic and volatile markets, many investors are wondering if now is the right time to buy gold stocks.

In this article, we will explore the potential benefits of investing in gold stocks, understand gold as an investment, analyze current market conditions and trends, discuss factors to consider before buying gold stocks, provide strategies for investing in gold stocks based on risk profiles, highlight common mistakes to avoid when investing in gold stocks, and ultimately help you make an informed decision.

Understanding Gold as an Investment

Gold has been a valuable asset for centuries, known for its scarcity and durability. It serves as a store of value and a hedge against economic uncertainty or inflation. When investing in gold, there are two main options: physical gold (bullion bars or coins) and gold stocks (shares of mining companies).

Physical gold offers security and ownership, while gold stocks provide potential growth beyond the price of gold itself. Consider your risk tolerance, investment goals, and market conditions before choosing the best approach for your needs.

Current Market Conditions and Trends

Analyzing current market conditions and trends is crucial for determining the right time to invest in gold stocks. The stock market has been volatile due to global trade tensions and geopolitical uncertainties, prompting investors to seek safe-haven assets like gold.

Recent trends show an upward trajectory in gold prices, driven by increased demand amid market turbulence, geopolitical tensions, and inflationary concerns.

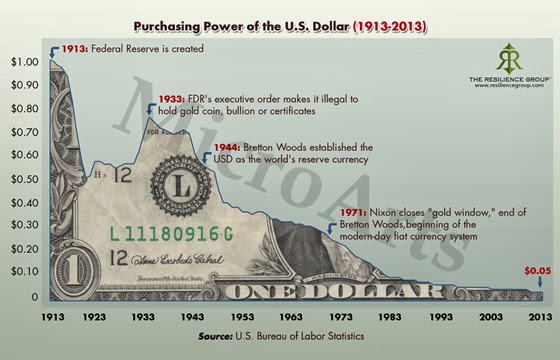

Factors such as central bank policies, political unrest, and global economic indicators significantly influence the price of gold. Changes in central bank policies can impact gold prices, while political instability drives investors towards safe-haven assets.

Monitoring global economic indicators provides insights into market shifts that may affect investment strategies.

Considering these factors helps investors make informed decisions when investing in gold stocks. Understanding stock market volatility, upward trends in gold prices, and geopolitical/economic influences aligns investments with objectives.

Factors to Consider Before Buying Gold Stocks

Investing in gold stocks offers potential for high returns during uncertain times and diversification benefits. Gold tends to perform well when other investments falter, making it a safe-haven asset. Adding gold stocks to your portfolio can offset losses in other sectors and provide stability during market downturns.

However, it’s important to note the inherent volatility of commodity investments like gold. Prices can fluctuate rapidly due to supply and demand dynamics or changes in investor sentiment. Regulatory risks also exist, impacting the profitability of mining companies involved in gold production.

Thorough research and monitoring of market trends are essential before buying gold stocks.

Strategies for Investing in Gold Stocks

Investing in gold stocks requires strategic thinking to maximize returns and minimize risks. For long-term investors, focusing on established mining companies with a stable track record can provide stability. Active traders can capitalize on short-term market volatility by closely monitoring trends and using technical analysis indicators.

Diversifying investments across multiple companies or considering alternative forms of gold investments is essential for risk management. Staying informed about economic and geopolitical factors that impact the price of gold will help adjust investment strategies accordingly.

By implementing these strategies, investors can increase their chances of success in the dynamic world of gold stock investments.

| Strategy | Description |

|---|---|

| Focus on Established Mining Companies | Invest in companies with a strong track record and financial position. |

| Utilize Technical Analysis Indicators | Monitor trends and use indicators for timing entry and exit points. |

| Diversify Your Investments | Spread investments across multiple gold stocks or consider alternative forms of gold investments. |

| Stay Informed about Economic and Geopolitical Factors | Keep an eye on factors that impact the price of gold. |

Common Mistakes to Avoid When Investing in Gold Stocks

When investing in gold stocks, beginners should avoid common pitfalls. One mistake is chasing short-term gains without considering long-term prospects. Thorough research and analysis are crucial to align investments with goals and ensure sustainable growth.

Another error is concentrating too much on a single stock or sector. Diversification reduces risk by spreading investments across different companies and sectors.

Additionally, don’t solely rely on past performance. Consider current industry conditions, management competence, competitive advantage, and financial stability when evaluating potential investments.

Set realistic expectations and avoid being swayed by short-term price fluctuations. Focus on long-term trends and make informed decisions based on thorough analysis.

Lastly, don’t overlook geopolitical factors that influence gold prices. Stay informed about global affairs for well-informed investment decisions.

To succeed in gold stock investments, avoid these mistakes: chasing short-term gains, lack of diversification, relying solely on past performance, unrealistic expectations, and overlooking geopolitical factors. Thorough research and a holistic understanding of market dynamics are vital for success.

Conclusion: Making an Informed Decision

[lyte id=’p8PMcwjx0og’]