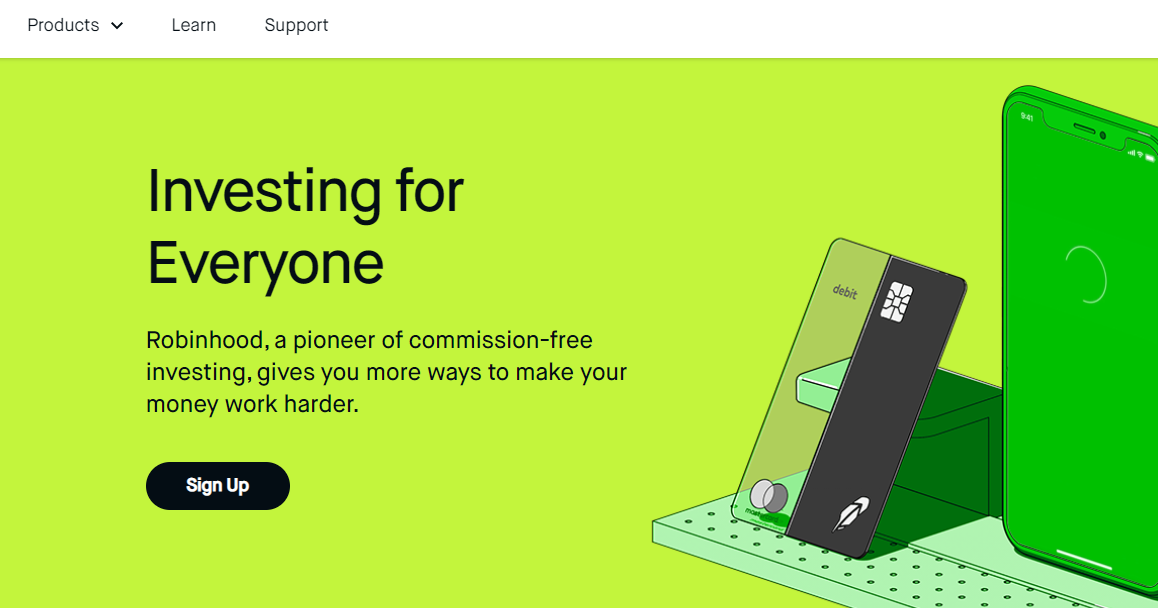

Robinhood has revolutionized investing by democratizing finance for all. Founded in 2013, this platform has made the stock market accessible to millions of people who were previously excluded from traditional brokerage firms.

With a user-friendly interface and zero-commission trading, Robinhood removes barriers and empowers individuals to take control of their finances. By simplifying complex concepts and eliminating fees, Robinhood is leveling the playing field and transforming the investment landscape.

How Robinhood has Transformed the Investing Landscape

Robinhood has revolutionized investing by eliminating barriers and empowering a new generation of investors. With commission-free trades and an intuitive mobile app, Robinhood has made investing more accessible and user-friendly.

This disruptive model has challenged traditional brokerages to reevaluate their fee structures and business models in order to remain competitive. By democratizing investing, Robinhood has opened doors for individuals with limited resources to participate in the financial markets alongside larger institutional investors.

Overall, Robinhood’s transformative impact on the investing landscape cannot be overstated.

Explanation of Options and Their Purpose

Options are financial instruments that grant investors the right to buy or sell an underlying asset at a predetermined price within a specific timeframe. They offer flexibility and leverage for enhancing investment strategies or hedging against potential losses.

Unlike stocks, options allow investors to speculate on price movements or generate income through various strategies. Whether you’re bullish, bearish, or looking to diversify your portfolio, options are valuable tools for achieving investment goals.

Options can be used to manage risk by hedging positions or generate income through selling options. Additionally, they enable the use of complex strategies based on volatility or directionality.

Understanding and incorporating options into your investment approach can provide a distinct advantage in navigating different market conditions and potentially enhancing overall performance.

Benefits and Risks Associated with Options Trading

Options trading offers numerous benefits that make it an attractive investment strategy for many individuals. One of the key advantages is the ability to control a larger position of an underlying asset with a smaller amount of capital.

This leverage can amplify potential gains and provide investors with opportunities to participate in markets that may have otherwise been inaccessible.

Another benefit of options trading is the potential to generate income through various strategies. For example, selling covered calls or cash-secured puts allows investors to leverage time decay and volatility to their advantage. By doing so, option sellers can profit from the passage of time or market stability.

However, it is important to acknowledge that options trading also carries inherent risks. Options are considered derivatives as their value is derived from an underlying asset. Consequently, if the price of the underlying asset does not move as anticipated, options can expire worthless.

This means that careful analysis and accurate predictions are crucial for success in options trading.

Furthermore, options trading involves complex strategies that require a thorough understanding of market dynamics. It demands knowledge and expertise in assessing factors such as implied volatility, delta, gamma, and theta.

Without a comprehensive comprehension of these concepts along with market trends and conditions, traders may face significant losses.

In summary, while options trading presents enticing benefits such as leverage and income generation opportunities, it also comes with its fair share of risks. Traders must carefully assess these risks and develop strategies based on sound analysis to maximize their chances of success in this dynamic and intricate market.

| Benefits | Risks |

|---|---|

| Leverage | Potential for loss |

| Income generation | Possibility of options expiring worthless |

| Accessible markets | Complexity requiring expertise |

Overview of Robinhood’s Platform and User-Friendly Interface

Robinhood’s platform is designed for simplicity, catering to both beginners and experienced investors. The clean and intuitive interface provides real-time market data, customizable watchlists, and detailed charts. With just a few taps on your smartphone, you can place trades, monitor your portfolio, and explore investment opportunities.

Robinhood also offers educational resources to expand your knowledge about investing and trading options. The platform is accessible across devices with no commission fees, making it easy for everyone to participate in online trading.

Step-by-step guide on how to access options trading on Robinhood

To start trading options on Robinhood, follow these simple steps:

- Download the Robinhood app from the App Store or Google Play.

- Sign up for a new account or log in if you already have one.

- Tap on the menu icon at the top left corner of the screen.

- Select “Investing” and then choose “Options.”

- Review and accept the Options Agreement.

6.

Start trading options on Robinhood!

By following these steps, you can easily access options trading on Robinhood’s user-friendly platform and begin exploring investment opportunities in the options market.

Explanation of Call and Put Options, Strike Prices, and Expiration Dates

Options trading involves call options and put options. A call option grants the right to buy an underlying asset at a predetermined price (strike price) within a specific timeframe. It is used when investors anticipate the asset’s price will rise.

Conversely, a put option gives the right to sell an asset at a predetermined price within a specific timeframe, commonly used when expecting the asset’s price to decline.

Understanding strike prices (exercise price) and expiration dates is crucial. The strike price is the reference point for exercising an option, while the expiration date is the last day to do so. These factors heavily influence an option’s value.

In summary, call and put options, along with strike prices and expiration dates, form the foundation of options trading. Mastering these components helps investors make informed decisions and maximize potential profits in the market.

Illustration of a Real-Life Example Using Robinhood’s Interface

To buy a call option for XYZ stock on Robinhood, follow these steps:

- Search for XYZ stock using its ticker symbol.

- Select “Trade Options” for XYZ stock.

- Choose “Buy Call” as your action.

- Enter the number of contracts you want to purchase.

- Select your desired expiration date and strike price.

- Review and confirm your order.

By buying this call option, you secure the right to buy XYZ stock at $50 per share within the next month. If the stock price rises above $50, your call option increases in value, potentially leading to profits.

Trading options on Robinhood is user-friendly and allows you to explore financial opportunities easily. Their intuitive interface guides both beginners and experienced traders through each step with clarity and precision.

Unleash your potential as a trader by utilizing Robinhood’s platform for options trading.

[lyte id=’dY9XZ4t5mgc’]