Investing in real estate has always been a popular choice for investors looking to diversify their portfolios and generate long-term returns. However, the emergence of real estate private equity investments has taken this asset class to new heights.

As more individuals and institutions seek opportunities in this space, the need for reliable information and insights becomes paramount. This is where real estate private equity rankings come into play.

Introduction to the Growing Popularity of Real Estate Private Equity Investments

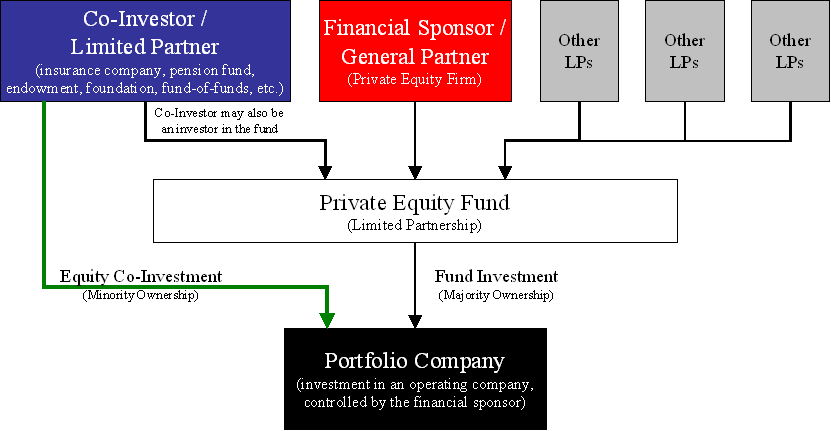

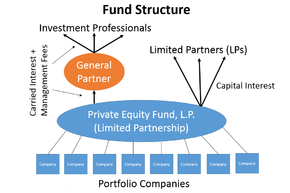

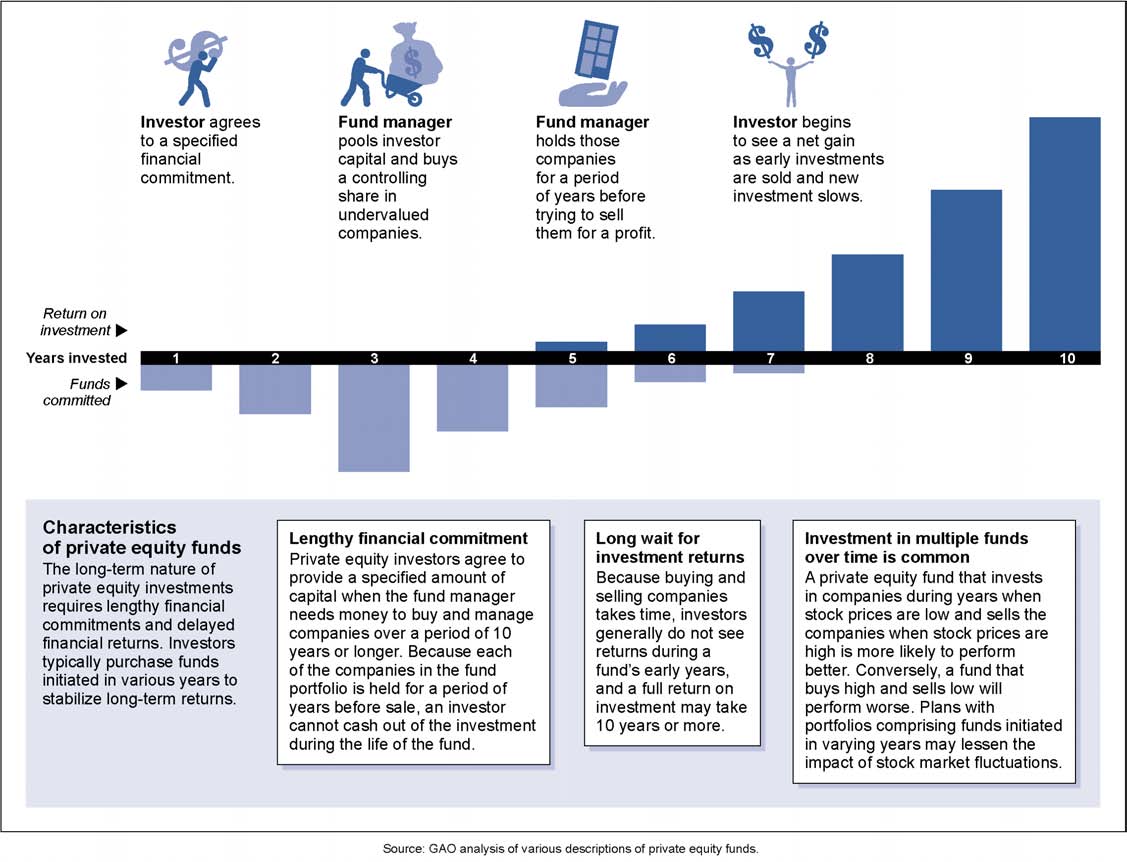

Real estate private equity investments have gained significant popularity in recent years. By pooling capital from multiple investors, these investments provide access to a wide range of opportunities that may otherwise be out of reach for individuals.

With potential for high returns and portfolio diversification, real estate private equity has become an attractive asset class. Its accessibility has also improved, allowing more investors to participate through crowdfunding and innovative platforms.

As technology evolves and investing opportunities expand, the popularity of real estate private equity is likely to continue growing.

Explanation of How Rankings Can Help Investors Make Informed Decisions

Real estate private equity rankings are a valuable tool for investors. These rankings allow investors to analyze and compare the performance and reputation of different firms or funds. By utilizing these rankings, investors can make informed decisions about where to invest their money.

Rankings provide insights into factors such as historical performance, risk management strategies, and investor satisfaction. They also offer an objective assessment conducted by independent experts, allowing investors to benchmark their investments against industry standards.

Overall, real estate private equity rankings empower investors to navigate the investment landscape with confidence and make choices that align with their financial goals and risk tolerance.

Definition and Explanation of Real Estate Private Equity Rankings

Real estate private equity rankings are assessments conducted by specialized agencies or platforms to evaluate and rank investment firms or funds based on various criteria. These rankings provide investors with an objective assessment of the quality and potential profitability of different investment opportunities.

By considering factors such as performance, risk management, track record, and transparency, these rankings help investors make informed decisions in a competitive market. Additionally, they promote transparency within the sector and encourage accountability among industry players.

While rankings are helpful, thorough due diligence is still necessary before making any investment decisions.

Importance of Rankings in Evaluating Investment Opportunities

Rankings are crucial in evaluating real estate private equity investments. They provide a benchmark for comparing different firms or funds, offering insights into historical performance, fund size, investment strategy, management experience, and market sentiment.

By considering rankings, investors can make informed decisions that align with their goals and risk tolerance.

Overview of key factors considered by ranking agencies

Ranking agencies assess various factors to determine the rankings of firms and funds in the real estate industry. These include historical performance, fund size and assets under management (AUM), investment strategy and specialization, and the track record and experience of the management team.

These factors provide valuable insights for investors seeking stable returns, financial strength, and alignment with their investment goals.

Accessing Reliable Real Estate Private Equity Rankings

Accessing reliable real estate private equity rankings is essential for investors seeking accurate information. Several reputable ranking agencies and platforms provide comprehensive assessments that can guide investment decisions.

Investors can access these rankings through the agency’s websites, subscription-based services, or industry publications. By utilizing these resources effectively, investors can navigate the complexities of real estate private equity with confidence and increase their chances of achieving success.

Overview of Reputable Ranking Agencies and Platforms

In the real estate industry, there are several reputable ranking agencies and platforms that evaluate firms and funds based on factors like performance, asset quality, and industry reputation. These rankings provide valuable insights to investors, helping them make informed decisions and identify investment opportunities.

One well-known agency is Preqin, which offers comprehensive rankings covering fund managers’ track records, fundraising success, and overall performance. PERE focuses specifically on private equity real estate investments, assessing firms based on their ability to generate returns.

Real Capital Analytics provides market intelligence and analytics for commercial real estate transactions, analyzing sales volumes, pricing trends, and more. Institutional Real Estate Inc. offers rankings for fund managers as well as service providers in the real estate sector.

These ranking agencies play a vital role in bringing transparency and credibility to the real estate industry. By evaluating crucial factors, they empower investors to maximize their chances of success in this dynamic market.

Exploration of Other Relevant Rankings in the Real Estate Industry

In addition to real estate private equity rankings, there are other important metrics that provide insights into specific sectors within the broader real estate market.

Commercial real estate rankings assess the performance and quality of commercial properties or portfolios, catering to investors interested in office buildings, retail spaces, and industrial properties.

Residential real estate rankings evaluate residential properties or housing markets, helping individuals and institutions make informed decisions about buying, selling, or investing in homes.

These different types of rankings contribute to a comprehensive understanding of the overall real estate market and assist investors in making well-rounded investment choices.

[lyte id=’Vw9zSFBKIyA’]