Investing in the stock market is all about identifying opportunities that can generate substantial returns. One such strategy that has gained popularity among investors is investing in quick turnaround stocks.

These stocks have the potential to deliver impressive gains in a short period of time, making them an attractive option for those looking to maximize their profits. In this article, we will delve into the world of quick turnaround stocks and explore key factors to consider when identifying these potential gems.

Additionally, we will analyze three specific stocks – Make My Trip (MMYT), Cronos Group (CRON), and Borr Drilling (BORR) – to gauge their prospects as quick turnaround investments. So, let’s dive right in and unlock the doors to lucrative investment opportunities.

Introduction to Quick Turnaround Stocks

Quick turnaround stocks are companies that have experienced significant declines in their stock prices but have the potential for a swift recovery. These stocks may be undervalued due to temporary setbacks or market sentiment.

With careful analysis and decision-making, investors can capitalize on these opportunities and benefit from subsequent price appreciation.

Investing in quick turnaround stocks requires strategic thinking and understanding underlying factors causing the decline. By conducting thorough research, investors can identify catalysts for recovery such as new products or improved financial performance.

These stocks offer the potential for substantial gains within a short period, but they also carry risks. Timing the recovery is unpredictable, and not all companies will bounce back successfully. Diversification across sectors helps spread risk, while clear entry and exit strategies provide discipline.

Key Factors in Identifying Quick Turnaround Stocks

Identifying potential quick turnaround stocks requires considering key factors that contribute to their success. These include catalysts for change, financial health, competitive advantage, and industry trends.

Catalysts for change can trigger positive shifts within the company or industry, such as new product launches or strategic partnerships. Assessing a company’s financial health involves evaluating revenue growth, profitability, debt reduction strategies, and cash flows.

A sustainable competitive advantage, like unique technology or strong brand recognition, can help a company bounce back quickly.

Considering industry trends is crucial. Look for industries with growth potential and favorable market conditions that support recovery. By analyzing these factors thoroughly, investors increase their chances of finding stocks with rapid growth and recovery potential.

Make My Trip (MMYT): A Potential Quick Turnaround Stock

Make My Trip (MMYT) is a leading online travel company in India that has faced challenges due to the COVID-19 pandemic. However, with vaccination rates rising and travel restrictions easing, there is strong potential for a rebound in the sector.

MMYT has taken strategic steps to adapt, including cost optimization measures and expanding their offerings beyond traditional travel services. By strengthening their domestic market presence and diversifying revenue streams, MMYT is well-positioned for a potential resurgence as travel demand recovers.

Investing in Make My Trip could be a strategic move for those looking to capitalize on the rebounding travel industry.

Cronos Group (CRON): Analyzing Its Quick Turnaround Potential

Cronos Group (CRON) is a leading cannabis producer and distributor with strong potential for a quick turnaround. Despite facing regulatory challenges and slower industry growth, CRON has expanded its global footprint through strategic partnerships and acquisitions.

Regulatory changes in key markets like the United States also present opportunities for CRON to capitalize on the growing legal cannabis market. With improving financials and increased investor interest, CRON shows promising signs of a quick turnaround.

| Factors Contributing to Quick Turnaround Potential |

|---|

| – Expanding global footprint through partnerships and acquisitions |

| – Favorable regulatory changes in key markets |

| – Improving financials and increased investor interest |

Examining Borr Drilling (BORR) as a Quick Turnaround Stock

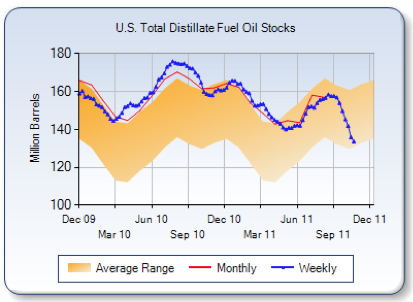

Borr Drilling (BORR), an offshore drilling contractor, has faced challenges in recent years due to the oil and gas industry downturn. However, with the recovery of oil prices and increased drilling activity, BORR’s potential as a quick turnaround stock is worth exploring.

The company has taken proactive measures to strengthen its financial position by reducing debt and optimizing its fleet. By focusing on high-specification jack-up rigs, BORR is well-positioned for market opportunities as demand for offshore drilling services rebounds.

The recovery of oil prices serves as a catalyst for BORR’s potential turnaround. Additionally, the company’s strategic approach to managing its fleet gives it a competitive advantage in meeting customer demands for complex drilling projects.

Investors considering quick turnaround stocks should evaluate factors such as financial health and industry trends. Borr Drilling demonstrates promising signs with its efforts to reduce debt and focus on high-specification rigs.

[lyte id=’DYyLrrQ0Os4′]