Investing in precious metals, particularly gold, has always been a popular choice for investors looking to diversify their portfolios and safeguard their wealth. Gold, often referred to as PM Bull Gold in investment circles, holds a special allure due to its historical significance and ability to retain value over time.

In this article, we will delve into the world of PM Bull Gold investing, exploring its basics, historical significance, benefits, as well as strategies for successful investing.

Whether you’re a seasoned investor or just starting out on your investment journey, this article will provide you with valuable insights to navigate the exciting world of PM Bull Gold.

Understanding the Basics

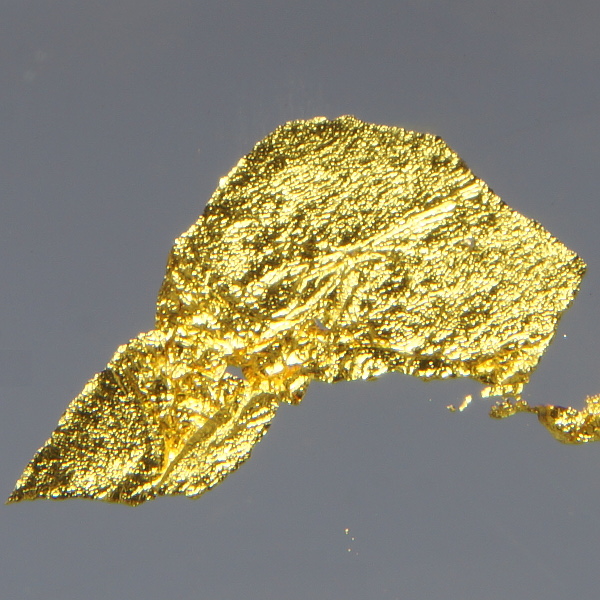

PM Bull Gold refers to investment-grade gold traded on commodities exchanges or owned physically, such as gold bars, coins, and bullion. It is highly sought after due to its purity and liquidity. Gold is considered a valuable investment because it maintains its intrinsic value, unlike fiat currencies that can be easily manipulated.

It is recognized globally as a store of wealth and offers diversification benefits to portfolios. Investing in gold provides stability, acts as a hedge against uncertainty, and preserves wealth over time.

The Historical Significance of Gold

Gold has held a significant role in human civilization for thousands of years. From ancient civilizations using it as currency to modern times where it symbolizes wealth and power, gold’s allure remains unchallenged. Its scarcity and durability make it an ideal medium for trade and commerce.

Unlike paper currencies, gold has maintained its purchasing power throughout history due to its limited supply and high demand. It often acts as a safe-haven asset during economic uncertainty, providing stability and security for investors.

Benefits of Investing in PM Bull Gold

Investing in PM Bull Gold offers diversification and protection against market volatility. While traditional investments can be volatile, gold often moves in the opposite direction, providing a cushion for your portfolio during market downturns.

Gold is also a hedge against inflation. Unlike fiat currencies that lose value over time, the purchasing power of gold remains stable. During economic uncertainty or geopolitical tensions, gold tends to outperform other assets as investors seek its perceived safety.

In summary, investing in PM Bull Gold helps diversify your portfolio and protects against market volatility and inflation. Consider incorporating it into your investment strategy for long-term growth potential.

Getting Started with PM Bull Gold Investing

Investing in PM Bull Gold can be a smart strategy for diversifying your portfolio and safeguarding against economic uncertainties. To begin, research current market trends and analyze global economic indicators to gain insights into potential gold price movements.

Understand the supply and demand dynamics that influence gold prices, such as mining production, central bank reserves, jewelry demand, and investor sentiment. Choose the right investment vehicles, like physical ownership (bullion, coins, bars) or paper-based investments (ETFs, futures, mining stocks), considering their pros and cons.

Ensure authenticity verification when purchasing physical gold and select secure storage options with adequate insurance coverage. Evaluate advantages, disadvantages, and risk factors associated with each option before making informed investment choices.

In summary, start your PM Bull Gold investing journey by researching market trends, understanding supply-demand dynamics, choosing suitable investment vehicles, verifying authenticity when buying physical gold, securing proper storage options, and evaluating risks for informed decision-making.

Navigating Risks and Challenges in PM Bull Gold Investing

Investing in PM bull gold comes with risks and challenges that investors should be aware of. One major challenge is the volatility of the gold market, influenced by economic indicators, investor sentiment, and geopolitical events.

Understanding price fluctuations and market cycles is crucial for developing an investment strategy based on risk tolerance.

Economic factors like interest rates and central bank policies also affect PM bull gold prices. Rising interest rates reduce the appeal of non-interest-bearing assets like gold. Changes in monetary policies can impact investor sentiment towards gold, with expansionary policies driving up demand as a hedge against inflation.

In addition to economic factors, investors must be cautious about scams and fraudulent schemes in the gold investment industry. Conducting thorough research, verifying certifications, reading customer reviews, and seeking professional advice are essential precautions.

Navigating these risks requires staying informed and making informed decisions to increase chances of success in PM bull gold investing.

Strategies for Successful PM Bull Gold Investing

Investing in PM Bull Gold requires a well-thought-out strategy that is tailored to individual investment goals. To navigate this market successfully, it is important to consider various strategies that can help maximize returns and mitigate risks.

One key consideration is the choice between a long-term or short-term approach. Each has its advantages and disadvantages, so determining the best strategy depends on factors such as risk tolerance, investment goals, and market conditions.

Long-term investing allows for potential capital appreciation over time, while short-term trading takes advantage of price fluctuations. By understanding these approaches and aligning them with your specific circumstances, you can make informed decisions that suit your investment objectives.

Another effective strategy to consider is dollar-cost averaging. This involves investing a fixed amount regularly, regardless of the current price of gold. By doing so, you mitigate the risk of making large investments during periods of high prices and minimize the impact of short-term market volatility.

Dollar-cost averaging spreads out your investments over time, potentially reducing risks and maximizing returns in PM Bull Gold investing.

Regularly monitoring and adjusting your PM Bull Gold portfolio is crucial for maintaining optimal performance. Keep an eye on key indicators such as gold prices, economic trends, or geopolitical events that may impact your investments.

By staying informed about market conditions and being proactive in adjusting your portfolio allocation accordingly, you can ensure that your investments align with your investment goals.

In summary, successful PM Bull Gold investing requires thoughtful strategies tailored to individual circumstances. Consider the pros and cons of long-term versus short-term approaches, utilize dollar-cost averaging as a risk mitigation tool, and regularly monitor and adjust your portfolio based on relevant indicators.

By implementing these strategies effectively, you can increase the likelihood of achieving success in PM Bull Gold investing.

Conclusion: Embracing the Journey of PM Bull Gold Investing

Live Gold Price

The live gold price is critical for market awareness and informed investment decisions. It reflects real-time changes in gold’s value, driven by supply and demand dynamics. Investors can track it online or through financial news sources to make well-informed investment choices.

The live gold price allows individuals to capitalize on opportunities and mitigate risks during market volatility. By incorporating gold into their portfolios, investors can diversify and safeguard their wealth. Monitoring the live gold price provides valuable insights for optimizing investment strategies in a dynamic market.

[lyte id=’F2ZkeMR57uU’]