Investing in finance can be daunting, especially for newcomers. To succeed, it’s crucial to find a reliable partner. Phoenix Capital Group is an esteemed company in the investment industry. In this article, we’ll explore their rise and why their high rating makes them attractive to investors.

Phoenix Capital Group has gained recognition by prioritizing client satisfaction and offering a comprehensive range of services. Their team of seasoned professionals provides valuable insights and personalized support. With their commitment to excellence, Phoenix Capital Group is a top choice for investors seeking reliable guidance.

Background of the Company and Its Founders

Founded by a team of experienced professionals with a deep understanding of investing, Phoenix Capital Group embarked on a mission to provide exceptional returns while mitigating risks for their clients. The founders’ vision was to create an investment firm that prioritized trust, transparency, and personalized solutions.

Through continuous learning, adaptability to market trends, and a collaborative culture, Phoenix Capital Group has established itself as a trusted partner in achieving financial success.

Overview of the Company’s Growth and Achievements

Phoenix Capital Group has experienced significant growth since its establishment. Through innovative strategies and a commitment to excellence, they have set themselves apart from competitors in the finance industry. Clients trust them for consistently delivering impressive returns on investments.

Phoenix Capital Group’s achievements can be attributed to their client-centric approach, focus on innovation, and commitment to transparency. Their remarkable growth trajectory makes them a leader in wealth management.

Explanation of Investment Ratings and Their Significance

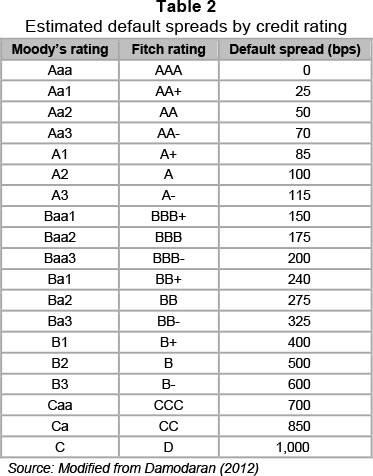

Investment ratings are crucial for informed decision-making. Independent rating agencies evaluate companies based on financial stability, performance history, and management quality. Ratings, represented by letter grades or numerical scales, indicate investment risk levels. Higher ratings suggest lower risks, making them safer investments.

However, investors should consider additional factors such as risk tolerance and market conditions before making decisions solely based on ratings. Understanding investment ratings helps investors assess creditworthiness and manage risks effectively.

Importance of Considering Ratings When Making Investment Decisions

Investment ratings are crucial for informed investment decisions. They provide insights into a company’s financial health and stability, allowing investors to assess risks. Higher-rated companies offer more stable returns, ensuring long-term financial security.

Ratings also indicate creditworthiness, influencing interest payments and debt repayment. By considering ratings, investors can diversify their portfolios effectively, balancing risk and maximizing returns. Incorporating these ratings is essential for making sound investment choices based on comprehensive information.

How Ratings Impact Investors’ Confidence in a Company or Group

Investors’ confidence in a company or group is significantly influenced by investment ratings. These ratings play a crucial role in instilling trust and reassurance among potential investors. A high rating conveys the message that the company has a strong track record of delivering consistent returns, making it an attractive option for investment.

It also signifies that the company has implemented robust risk management practices, reducing the likelihood of unexpected losses.

When a company receives a high rating, it serves as a testimony to its excellence and competence in managing financial matters. This not only attracts investors but also enhances their confidence in the potential for substantial returns on their investments.

Such positive ratings reflect the market’s perception of the company’s stability and ability to generate profits over time.

On the flip side, low investment ratings can raise concerns about financial instability and increase perceived risk associated with investing in a particular company or group. A low rating may indicate weaknesses in financial management, poor performance, or potential risks that could lead to suboptimal returns for investors.

Investors rely heavily on these ratings to make informed decisions about where to allocate their funds. They consider them as indicators of a company’s credibility and reliability, allowing them to assess whether investing in a particular business or group aligns with their risk tolerance and financial goals.

Introduction to Phoenix Capital Group’s Rating

Phoenix Capital Group consistently receives high ratings from reputable agencies, affirming their commitment to excellence and superior investment opportunities. In this section, we will explore the rating process and criteria used by these agencies to assess Phoenix Capital Group’s standing in the industry.

Rating agencies play a vital role in evaluating investment firms like Phoenix Capital Group. They analyze factors such as financial stability, track record, transparency, and management expertise.

Phoenix Capital Group stands out with its strong financial stability, impressive performance history, transparent practices, and experienced management team.

The agency ratings serve as valuable indicators for investors, guiding them in making informed decisions. These ratings highlight Phoenix Capital Group’s ability to deliver consistent returns while managing risks effectively.

With their track record of success and commitment to transparency, Phoenix Capital Group has earned the confidence of investors seeking reliable long-term partners.

Overview of the Rating Process and Criteria Used by Rating Agencies

Rating agencies evaluate companies based on financial performance, management quality, industry trends, and market conditions. They use quantitative analysis and qualitative judgment to assess overall strength and potential risks. The rigorous evaluation process ensures only deserving companies receive high ratings.

[lyte id=’8TyG3Cc6iGo’]