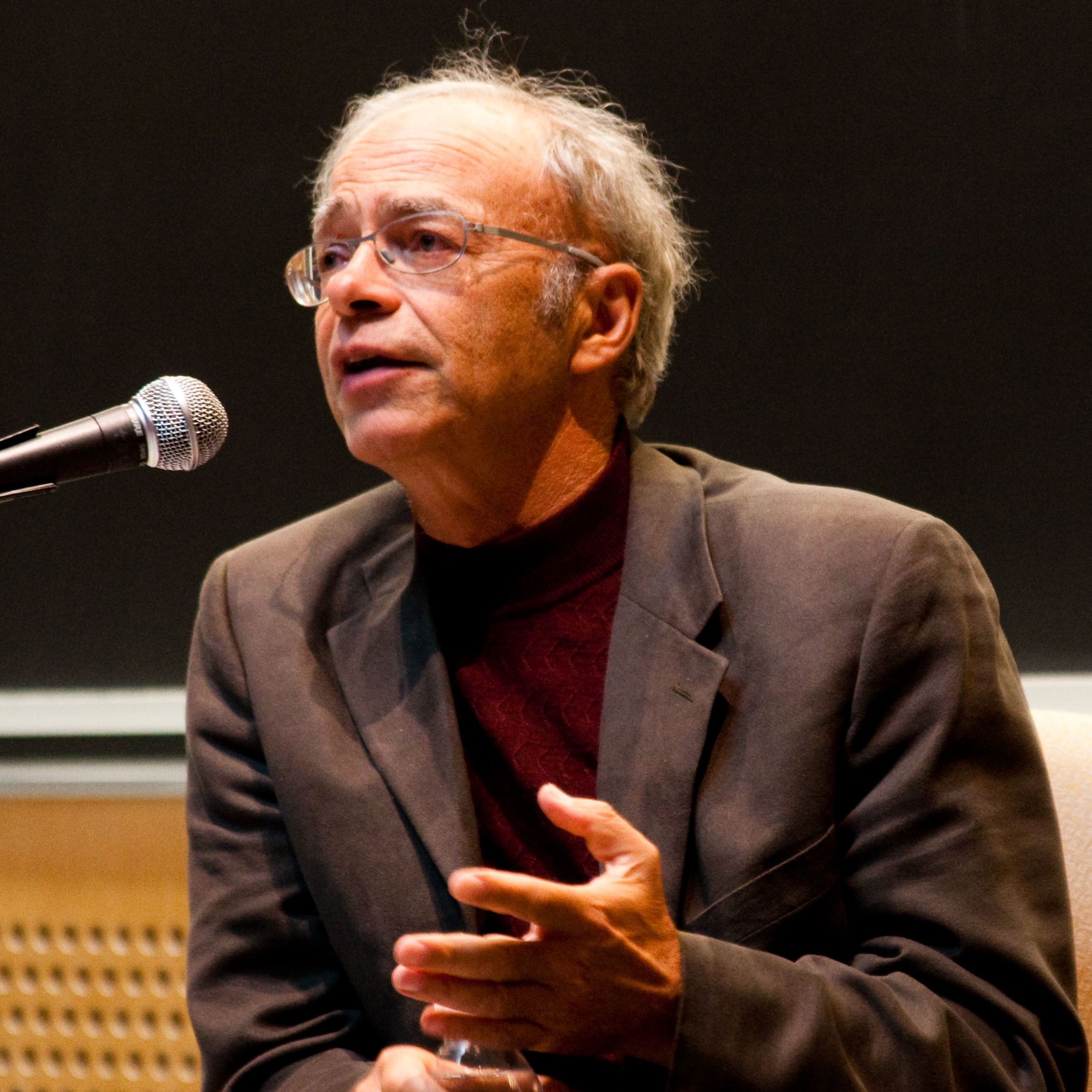

Peter Schiff is a renowned investor known for his unique perspectives and strategies. With a strong finance background and keen market insights, Schiff has become an expert in the field. Growing up in a family deeply involved in finance, he developed a passion for understanding market dynamics from an early age.

With a degree in finance and accounting from the University of California, Berkeley, Schiff combined academic knowledge with practical experience gained through various roles in the financial industry. His contrarian approach to investing and accurate predictions of major economic events have garnered him widespread attention and credibility.

As founder and CEO of Euro Pacific Capital Inc., Schiff continues to provide valuable insights into global markets through media appearances and his own podcast. Overall, Peter Schiff’s background and expertise make him a notable figure in the investment world.

The Unconventional Approach that Sets Him Apart

Peter Schiff’s investment strategy stands out due to his unconventional approach. While most experts focus on stocks and bonds, Schiff advocates for precious metals, particularly silver. His contrarian views have raised eyebrows among mainstream investors, but he consistently proves himself right.

Schiff’s belief in the value of silver sets him apart. He sees it as a safe haven asset and hedge against inflation, not just an industrial metal. His ability to challenge prevailing market sentiment and make accurate predictions has earned both admiration and skepticism.

Despite initial criticism, Schiff accurately predicted the 2008 housing bubble collapse. His outspoken nature and willingness to engage in debates refine his ideas while challenging prevailing wisdom.

Peter Schiff’s Expertise in Investing and Its Attention-Grabbing Impact

Peter Schiff’s investing prowess has garnered significant attention and established him as a reputable figure in the industry. Known for his accurate predictions of economic downturns and market crashes, Schiff has cultivated a loyal following of investors who trust his insights.

His ability to uncover hidden opportunities and provide valuable insights beyond surface-level information has made him a sought-after speaker at investment conferences and a regular guest on financial news shows.

Schiff’s track record of accurately forecasting market trends and identifying potential investment pitfalls speaks volumes about his expertise. Investors, both seasoned and new, turn to Schiff for guidance in navigating the complexities of the market.

His meticulous research, thorough analysis of financial data, and awareness of global events ensure that he stays ahead of the curve, enabling him to capitalize on lucrative investment opportunities.

With extensive knowledge and an astute understanding of economic indicators, Schiff’s reputation as a trusted authority on investing continues to grow. His accomplishments have not only captured attention within the industry but also established him as a reliable source for individuals seeking clarity and direction in their investment pursuits.

In summary, Peter Schiff’s expertise in investing has earned him widespread recognition. His accurate predictions, comprehensive research, and knack for uncovering hidden opportunities have solidified his position as a respected figure in the investment community.

As he shares his insights through various platforms, Schiff remains an influential presence in guiding investors towards success.

Exploring the Allure of Precious Metals for Investors

In recent years, more investors have turned to precious metals as an alternative investment option. This growing interest can be attributed to concerns about inflation, geopolitical tensions, and the desire for portfolio diversification.

Precious metals like gold and silver are seen as hedges against inflation because they have a history of retaining their value. During times of uncertainty, such as political instability or global conflicts, these metals serve as safe-haven assets.

Investing in precious metals also provides portfolio diversification since their value is not solely dependent on traditional markets. Their tangible nature and aesthetic appeal further attract investors who appreciate physical assets.

However, investing in precious metals requires careful consideration of market dynamics, including supply and demand fluctuations and currency movements. Thorough research and expert consultation are recommended before venturing into this asset class.

Overall, the allure of precious metals lies in their ability to hedge against inflation, provide stability during uncertain times, diversify portfolios, and offer a tangible investment experience. By exploring their potential benefits and understanding market intricacies, investors can make informed decisions to safeguard and grow their wealth.

Why Silver Stands Out Among Other Investment Choices

Silver offers unique advantages that make it an attractive investment option. It is more affordable than gold, making it accessible to a wider range of investors. Additionally, silver has numerous industrial applications, which drive demand and provide additional support for its price.

The potential for higher returns due to its price volatility makes silver appealing for those seeking dynamic investment options within the precious metals sector. By diversifying one’s portfolio with silver alongside other assets, investors can position themselves strategically to benefit from both stability and market fluctuations.

Market Trends Indicating a Surge in Silver’s Popularity

Silver’s popularity is on the rise due to several market trends. The increasing demand for renewable energy sources, such as solar panels, has led to a surge in the need for silver, which is used in their production. As the world prioritizes sustainability and green technologies, the demand for silver is expected to grow exponentially.

Electric vehicles also contribute to silver’s popularity, as it is used in batteries and electrical connections. Furthermore, silver finds applications in various industries due to its exceptional properties. Additionally, silver serves as a reliable investment asset during times of market volatility.

Overall, these trends indicate a bright future for silver’s popularity and demand.

Understanding Peter Schiff’s Investment Philosophy

Peter Schiff believes that traditional fiat currencies are at risk of losing value due to excessive government spending and monetary policies. To hedge against inflationary risk, Schiff advocates holding physical silver as part of a well-diversified investment portfolio.

He emphasizes silver’s limited supply, intrinsic value, and industrial demand as reasons behind its growing popularity as an investment option. In summary, Schiff’s philosophy centers around using silver as a means to protect against potential currency devaluation and preserve wealth in the face of economic uncertainty.

Why Silver is Essential for Your Portfolio

Renowned investment expert Peter Schiff firmly believes that silver is an essential asset for long-term investment strategies. Its historical track record as a reliable store of value, coupled with the potential for significant price appreciation, makes it a vital component to include in any portfolio.

By adding silver to your investments, you can protect your wealth and capitalize on future market opportunities.

[lyte id=’coaLbBk6rxg’]