Investing in the stock market can be an exciting and profitable endeavor, but it’s important to diversify your portfolio and explore different sectors. One often overlooked area is the paper stock market, which offers unique investment opportunities.

In this article, we will delve into the world of paper stocks and provide valuable insights for investors interested in this industry.

Definition and Explanation of Paper Stocks

Paper stocks refer to shares in companies involved in producing and distributing paper products. This includes manufacturers of printing paper, packaging materials, tissue products, and more. Investing in paper stocks allows individuals to capitalize on the growing demand for these essential products.

With factors like population growth and e-commerce driving the need for paper goods, this sector offers potential investment opportunities. However, it’s important to consider market trends, company performance, and sustainability efforts when making investment decisions in this industry.

Overall, investing in paper stocks provides a chance to participate in a sector that supplies essential goods with increasing demand.

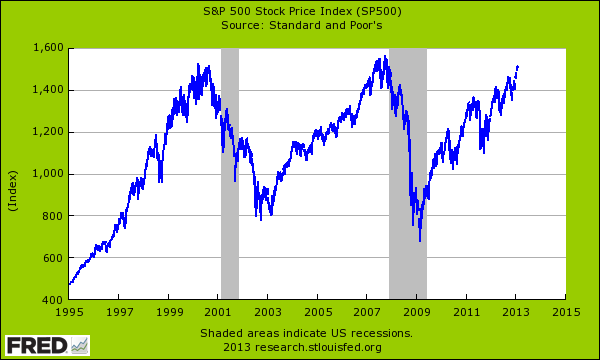

Historical Background of the Paper Stock Market

The paper stock market has a long and storied history, originating in ancient civilizations like Egypt and China. However, it was during the industrial revolution that the industry experienced significant growth. Today, advancements in technology have transformed the sector, making it a promising field for investors.

The rise of digital printing and sustainability initiatives have further shaped the paper stock market, ensuring its relevance in our modern world.

Overview of the Top Paper Companies in the Market

The paper industry is home to leading companies such as Suzano, Schweitzer-Mauduit, and International Paper. These companies have strong financials, a global presence, and diverse product portfolios. Suzano excels in sustainable pulp and paper products, while Schweitzer-Mauduit specializes in specialty papers for various industries.

International Paper offers a wide range of packaging materials and printing papers across 40 countries. These top players consistently deliver quality products, innovate to meet market demands, and maintain a competitive edge in the industry.

Factors to Consider When Choosing Which Companies to Invest In

When investing in the paper stock market, there are key factors to consider. Evaluate financial performance metrics like revenue growth and profitability ratios. Analyze industry trends and competitive advantages of specific companies. Also, assess sustainability practices and regulatory adherence.

These factors help determine potential for growth, long-term viability, and risks associated with investing in a company. By considering these aspects, investors can make informed decisions aligned with their goals and risk tolerance levels.

Benefits and Considerations of Investing in International Paper Stocks

Investing in international paper stocks offers several advantages for investors. By tapping into emerging markets with increasing demand for paper products, there is potential for higher returns compared to domestic investments alone.

However, it is crucial to consider factors such as currency fluctuations, political stability, and cultural differences that may impact these investments.

International paper stocks provide access to emerging markets where the demand for packaging materials, printing papers, and tissue products is growing. This presents an opportunity to benefit from the rising global demand for paper products.

Diversifying portfolios geographically through international investments helps reduce risks associated with relying solely on domestic markets. It mitigates exposure to political or economic fluctuations in any one market. However, careful consideration of currency fluctuations and political stability is essential before investing overseas.

Currency fluctuations can affect investment returns when converting back to the investor’s home currency. Political instability can disrupt business operations and impact the performance of invested companies.

Moreover, understanding cultural differences is crucial when investing internationally. Adapting strategies based on local customs and preferences can contribute to successful investments in foreign markets.

Tips for Navigating International Markets

When venturing into international markets, it is crucial to conduct thorough research on the targeted country’s economic climate, industry regulations, and competitive landscape. This due diligence is essential to make informed decisions and mitigate risks associated with investing abroad.

To begin with, understanding the economic climate of the target country is paramount. Factors such as GDP growth rate, inflation rate, and currency stability can significantly impact investment opportunities. By analyzing these indicators, investors can gain insights into the market’s potential for growth and stability.

Moreover, familiarizing oneself with industry regulations is vital when entering international markets. Each country has its own set of rules and regulations governing various sectors. Being well-versed in these regulations helps investors navigate legal complexities, stay compliant, and avoid any unforeseen legal pitfalls that may arise.

Additionally, assessing the competitive landscape is necessary to identify potential challenges and opportunities. Studying competitors’ market share, product offerings, pricing strategies, and marketing tactics can provide valuable insights into positioning oneself effectively in the market.

This analysis enables investors to develop a strategy that differentiates their products or services from competitors and appeals to the target audience.

Working with a knowledgeable financial advisor or conducting independent research further enhances decision-making capabilities when investing internationally. A trusted advisor can offer valuable guidance based on their expertise in global markets.

They can provide insights into emerging trends, potential risks, and investment opportunities that might be overlooked otherwise.

Overview of Suzano as a Company

Suzano, a Brazilian multinational corporation, has emerged as a leader in the global pulp and paper industry. With a rich history spanning over nine decades, Suzano has continually expanded its operations through strategic acquisitions and investments in cutting-edge technology.

Founded in 1924 as a small paper mill in Brazil, Suzano quickly grew into one of the largest pulp and paper producers worldwide. Its commitment to innovation and sustainability has propelled the company forward, enabling it to meet ever-evolving market demands while minimizing its environmental impact.

Suzano offers an extensive range of products that cater to diverse customer needs. These include eucalyptus pulp, printing paper, packaging solutions, and tissue paper. By prioritizing sustainability throughout its production processes, Suzano ensures that its products are not only of high quality but also environmentally responsible.

One of Suzano’s key strengths lies in its ability to adapt to changing market trends. The company continuously invests in state-of-the-art technology and research and development initiatives to stay ahead of the curve.

This commitment to innovation allows Suzano to remain at the forefront of the industry and offer cutting-edge solutions to its customers.

Moreover, Suzano’s global presence positions it strategically within the international market. By expanding its operations beyond Brazil’s borders, the company leverages diverse markets and establishes strong relationships with customers worldwide.

This international reach allows Suzano to navigate economic fluctuations effectively while unlocking new opportunities for growth.

In summary, Suzano is a renowned player in the pulp and paper industry with a long-standing history rooted in innovation and sustainability.

Through its diverse product offerings, commitment to technological advancement, and global reach, Suzano continues to shape the future of this dynamic sector while meeting customer needs both effectively and responsibly.

Investment Potential of Suzano

Suzano, a Brazilian company, holds great investment potential in the paper stock market. To fully comprehend the scope of this potential, it is crucial to delve into an analysis of its financial performance and growth prospects, as well as the prevailing industry trends that may exert influence on its trajectory.

Suzano has consistently showcased robust financial performance in recent years, boasting steady revenue growth and healthy profit margins. The company’s strategic initiatives, including expanding its production capacity and diversifying its product offerings, position it favorably for sustained growth within the paper stock market.

By capitalizing on these opportunities, Suzano can strengthen its presence and tap into a wider customer base.

The evolving landscape of the paper industry is witnessing significant shifts driven by factors such as digitalization and sustainability concerns. However, Suzano has proven itself adaptable to these trends by investing substantially in research and development.

This proactive approach enables them to develop innovative solutions that cater to changing consumer preferences. By staying ahead of the curve, Suzano enhances its competitive advantage within the industry.

Considering both Suzano’s impressive financial performance and their ability to adapt to industry trends allows investors to make a more informed evaluation of the company’s potential as an investment opportunity.

By carefully analyzing these key aspects, investors can gain valuable insights into how Suzano is positioned for future success in the dynamic paper stock market.

Schweitzer-Mauduit – Another Strong Contender

Another noteworthy player competing in the paper stock market is Schweitzer-Mauduit. Let us explore an introduction to this company, elucidate their business operations, highlight unique factors that set them apart from competitors, and finally evaluate their standing as an investment opportunity.

[lyte id=’E-ZrTXtsDjw’]