In the world of investing, keeping track of your trades is crucial for success. That’s where a trading journal comes in. A trading journal is a powerful tool that allows you to record and analyze your trades, helping you identify strengths, weaknesses, and patterns in your strategy.

In this article, we’ll explore the importance of using a trading journal, its key features, and how it can improve your performance as an online forex trader.

What is a Trading Journal?

A trading journal is a detailed record of all your trades, capturing essential information such as entry and exit points, position sizes, profit or loss outcomes, and other relevant data. Unlike other trading tools focused on market data or analysis techniques, a trading journal centers on your actions and decisions as a trader.

It provides an organized way to review past trades, gain valuable insights into your trading behavior, and learn from both mistakes and successes. By fostering discipline, accountability, and self-reflection, a well-kept trading journal becomes an invaluable companion for continuous improvement in the world of trading.

Why is it so important to use a trading journal?

Keeping a trading journal is crucial for traders at all levels, as it offers numerous benefits that can significantly impact their success in the financial markets.

By consistently recording and analyzing trades, traders can identify strengths and weaknesses in their strategies, learn from past mistakes and successes, enhance decision-making through data analysis, and improve discipline and consistency.

A trading journal acts as a valuable tool for self-reflection and improvement, ultimately leading to more informed decisions and increased profitability.

Trading Journal Features for Detailed Reporting

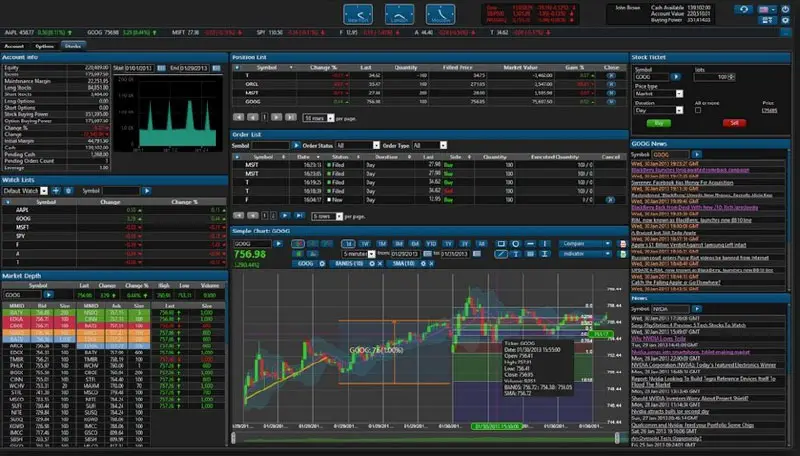

Trading journal software or platforms offer various features to facilitate detailed reporting. These features include:

- Trade entry forms: Record all relevant trade details such as entry and exit prices, stop-loss levels, take-profit levels, and other parameters.

- Performance metrics tracking: Automatically calculate metrics like win rate, average profit/loss per trade, maximum drawdowns, and more.

- Chart integration: Integrate charts into journal entries for visual analysis of price movements.

- Notes and comments section: Add additional context or observations regarding specific trades.

Customization options are available for organizing records effectively, with different categories or sections for currency pairs, trading strategies, or timeframes. Customizable fields can capture specific trade details like technical indicators used or news events impacting the trade.

Trading journal software empowers traders to analyze their performance and make informed decisions based on data-driven insights. By utilizing these features effectively, traders can continuously improve their trading strategies over time.

Finding the Right Trading Journal Software to Help You Find Your Edge

To improve your trading performance, a reliable trading journal software is essential. It helps you track trades, analyze strategies, and gain valuable insights. When choosing the right software, consider factors like user-friendliness, compatibility with your trading platform, and data security.

Popular options include TradeBench, Edgewonk, Tradervue, and Forex Smart Tools. Ensure the software offers essential features, integrates with your preferred platform, provides comprehensive reporting capabilities, and is user-friendly.

By considering these factors and conducting thorough research, you can find the perfect trading journal software to enhance your trading strategies and gain an edge in the market.

Improve Your Performance and Trading Experience with Our Comprehensive Trading Journal

Our comprehensive trading journal is a valuable tool for traders aiming to enhance their performance and trading experience.

It offers accurate record-keeping, analysis tools for performance metrics, tracking risk management parameters, identifying recurring mistakes or patterns, and adapting and refining your trading strategy based on journal insights.

By utilizing our trading journal, you can optimize your decision-making process and increase the profitability of your trades. Start using our trading journal today to unlock your full potential in the forex market.

Establishing Discipline: Use Our Trading Journal to Boost Performance & Experience Consistency

To enhance your trading performance and maintain consistency, it is essential to establish discipline through the use of a trading journal. By integrating a trading journal into your routine, you can track your trades, reflect on past performances, and make informed decisions for continuous improvement.

Here are some tips for effectively utilizing a trading journal:

- Make it a part of your daily routine: Set aside dedicated time each day to update your journal.

- Be disciplined: Record all relevant trade details accurately.

- Reflect on past trades: Regularly review and analyze your entries for continuous improvement.

If maintaining consistency is challenging for you, consider setting reminders or alerts on your phone or computer to prompt you to update your journal regularly. Consistency is crucial when reaping the benefits of a trading journal.

Make it a habit to regularly review and analyze your trading journal entries. Look for patterns, mistakes, or areas where you can improve. By actively using the insights gained from your journal, you’ll continuously refine your strategy and boost your overall performance.

The Benefits of Sharing and Discussing Your Trading Journal

Sharing your trading journal with others can provide valuable insights, feedback, and benefits that enhance your trading strategy. Joining trading communities or forums allows you to connect with like-minded individuals who may spot patterns or offer different perspectives, helping refine your approach.

Seeking advice from experienced traders opens up opportunities to gain knowledge, learn new strategies, and improve your forex trading approach. Additionally, sharing progress with peers builds accountability and motivation, keeping you disciplined and focused on achieving better results.

Embrace this collaborative mindset to elevate your trading performance.

Improve Your Results with a Comprehensive Trading Journal

Keeping a trading journal is crucial for online forex traders seeking to enhance their results. By systematically recording and analyzing trades, traders gain valuable insights into their strengths, weaknesses, and growth opportunities.

This comprehensive journal offers essential features to enhance performance, manage risk effectively, and make data-driven decisions. It allows you to track progress over time, manage risk more efficiently, learn from past mistakes, and benefit from community engagement.

Start using a trading journal today to unlock better results in online forex trading.

[lyte id=’qefG3V0qfck’]