Investing in the oil drilling industry can offer lucrative opportunities for those with an interest in investing and learning about the market. Oil drilling companies play a crucial role in the extraction and production of oil, making them an essential part of the global energy sector.

In this article, we will explore why investing in oil drilling companies is a lucrative endeavor, the potential risks and rewards involved, and provide a comprehensive overview of some top companies to consider for investment.

Understanding the Oil Drilling Industry

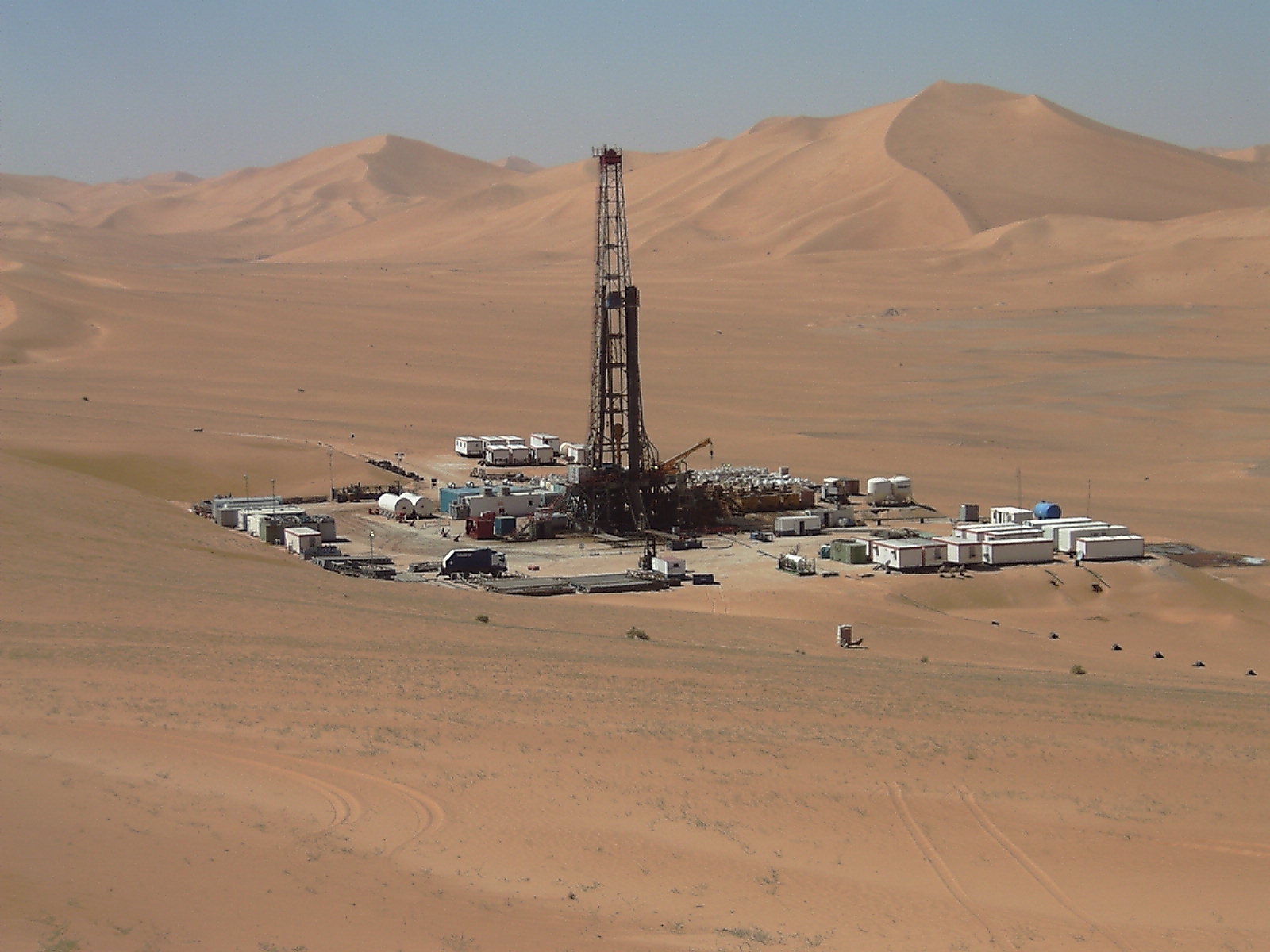

The oil drilling industry involves processes like exploration, drilling, and production to extract crude oil from deep underground. This valuable resource is then refined into products like gasoline, diesel, and jet fuel. Exploration uses advanced technologies to identify potential oil-rich areas.

Drilling creates wells that reach target reservoirs thousands of feet below the surface. Production relies on pumps or natural pressure to bring crude oil to the surface. Refineries separate components through distillation to produce usable products.

Understanding this industry is essential for comprehending how companies operate within it and meeting global energy needs.

Why Investing in Oil Drilling Companies is Lucrative

Investing in oil drilling companies can be highly lucrative due to several factors. Firstly, oil remains a vital global energy source with consistent demand. Technological advancements have enabled more efficient extraction methods, expanding companies’ resource base and revenue streams.

Geopolitical tensions and conflicts create volatility, presenting investment opportunities. Diversification across regions helps mitigate risks. Long-term contracts with major buyers provide stability. Additionally, investing in established oil drilling companies allows participation in the ongoing growth of the energy sector.

However, thorough research and risk evaluation are essential before making investment decisions.

The Potential Risks and Rewards of Investing in Oil Drilling Companies

Investing in oil drilling companies carries both potential risks and rewards. One significant risk is the volatility of oil prices, influenced by geopolitical tensions and global economic conditions. Environmental concerns surrounding fossil fuels also pose a risk due to public perception and government regulations.

However, investing in this sector can offer rewards when oil prices rise and companies provide financial incentives like dividends. Careful consideration of these factors is crucial for investors evaluating opportunities in oil drilling companies.

Top Oil Drilling Companies for Investment

When it comes to investing in the oil industry, XYZ Energy Corporation, ABC Petroleum Inc., and DEF Offshore Drilling Ltd. are top companies worth considering.

XYZ Energy Corporation boasts a rich history and extensive expertise in the oil drilling industry. Their track record of successful projects and strategic partnerships positions them as a promising investment opportunity.

ABC Petroleum Inc. stands out due to its innovative approach to oil drilling operations. They prioritize sustainable practices, minimizing their carbon footprint through advanced technologies.

DEF Offshore Drilling Ltd. specializes in offshore drilling, offering unique investment opportunities in this sector. Their expertise and ability to operate efficiently in complex offshore conditions set them apart.

Investors seeking opportunities in the oil industry should consider these top drilling companies for their strong financial performance, innovative strategies, and specialized expertise.

Factors to Consider When Choosing an Oil Drilling Company for Investment

Investing in oil drilling companies requires careful evaluation of several factors. Understanding the industry landscape and global demand for oil helps identify lucrative opportunities amidst market uncertainties.

Assessing financial stability through analyzing balance sheets, income statements, and cash flows provides insights into growth potential. Reviewing operational efficiency and technological advancements indicates a company’s exploration capabilities and production efficiency.

Considering environmental responsibility demonstrates awareness of regulatory risks and societal expectations. By considering these factors, investors can make informed decisions when choosing an oil drilling company for investment.

VI Tips for Successful Investment in Oil Drilling Companies

To ensure successful investments in oil drilling companies, consider the following tips:

- Diversify across different companies and regions to mitigate risks.

- Stay informed about industry news, oil prices, and market updates.

- Seek advice from financial experts specializing in the oil drilling industry.

- Consider factors like environmental regulations and technological advancements.

- Research the financial health and track record of potential investment companies.

By following these tips, you can make informed decisions and increase your chances of success when investing in oil drilling companies.

Conclusion

[lyte id=’eIC9SmhVn7Q’]

.jpg)