Investing in the stock market can be an exciting and rewarding journey. With countless investment opportunities available, it’s important to explore different sectors and industries to find the best options for your portfolio. One such sector that has historically been a favorite among investors is the oil industry.

In this article, we will delve into the world of investing in oil company stocks, understanding their allure, and how they can present lucrative investment opportunities.

Exploring the World of Investing

Investing involves allocating money into assets with the expectation of generating income or profit over time. One popular investment option is stocks, which represent ownership shares in a company. By investing in stocks, you become a partial owner and have the potential to benefit from a company’s growth and success.

Before diving into specific sectors like oil company stocks, it’s crucial to understand key concepts such as risk tolerance, diversification, and valuation techniques. Risk tolerance determines how comfortable you are with investment fluctuations. Diversification spreads investments across different asset classes and sectors to reduce risk.

Valuation techniques analyze a company’s financial health and predict stock price movements.

Remember that investing carries risks, but with careful research and a long-term perspective, you can navigate this exciting world and work towards financial prosperity.

Understanding the Allure of Oil Company Stocks

Investing in oil company stocks holds immense appeal for those looking to capitalize on the value of this essential commodity. These companies explore, extract, refine, and distribute petroleum products globally. By investing in their stocks, individuals gain exposure to a profitable industry driven by consistent demand for energy.

The stability, potential for substantial returns, and resilience during economic downturns make oil company stocks an attractive investment option.

How Oil Company Stocks Can Be a Lucrative Investment Opportunity

Investing in oil company stocks can be highly profitable for several reasons. The consistent demand for oil in transportation, manufacturing, and energy production ensures stable revenue streams for these companies.

Many oil companies also pay regular dividends to shareholders, providing a steady income even during periods of stock price fluctuations. Industry consolidation has led to increased efficiency and potential profitability.

Additionally, the volatility of the oil market presents opportunities for investors to benefit from short-term gains by timing their investments strategically. However, thorough research and analysis are crucial before investing in oil company stocks to mitigate risks and maximize returns.

Consider factors such as geopolitical events, regulatory changes, technological advancements, and environmental concerns when making investment decisions in this industry.

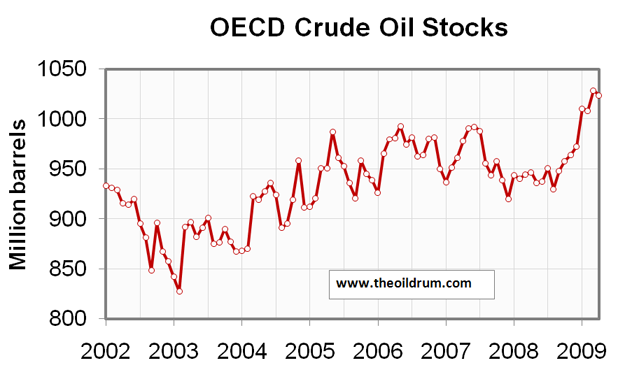

Current Market Trends and Fluctuations

To evaluate potential investment opportunities, it is crucial to understand the current market trends and fluctuations in oil prices. Various factors, including global supply and demand dynamics, geopolitical tensions, natural disasters, and regulatory changes, can influence oil prices.

By closely monitoring these trends, investors can anticipate risks or opportunities associated with investing in oil company stocks. Staying informed through industry news, reputable reports, and expert analysis is essential for navigating the volatile oil market effectively.

Evaluating the Financial Health and Stability of Oil Companies

When investing in oil companies, it’s crucial to assess their financial health and stability. Look for strong balance sheets, consistent revenue growth, manageable debt levels, positive cash flow generation, and favorable financial ratios like return on equity (ROE) and earnings per share (EPS).

These factors provide valuable insights into a company’s performance and help make informed investment decisions.

Analyzing Geopolitical Factors Affecting Oil Prices

Geopolitical events have a significant impact on oil prices. Political instability, conflicts, and trade disputes can disrupt supply chains and lead to changes in production levels across regions. Such factors affect the price and availability of oil.

Staying updated on global events and analyzing geopolitical risks helps assess their potential impact on oil company stocks.

ExxonMobil Corporation (XOM)

ExxonMobil is a formidable player in the oil and gas industry, boasting its position as one of the largest publicly traded international companies. With operations spanning exploration, production, refining, and marketing, ExxonMobil has established a strong global presence and possesses a diversified portfolio of valuable assets.

Despite the recent challenges faced by the industry, ExxonMobil has consistently showcased its financial resilience. The company’s robust balance sheet, coupled with extensive research capabilities and ongoing cost management initiatives, positions it favorably for growth opportunities in both conventional and unconventional energy sources.

ExxonMobil’s financial performance remains impressive even amidst market uncertainties. By effectively managing its resources and investing in cutting-edge technologies, the company has proven its ability to adapt to changing market dynamics.

This adaptability further enhances ExxonMobil’s growth prospects by allowing them to capitalize on emerging trends within the industry.

Furthermore, ExxonMobil’s commitment to innovation and sustainability provides an additional competitive advantage. As the demand for cleaner energy continues to grow, the company strives to develop more environmentally friendly solutions while maintaining profitability.

This dedication to sustainable practices not only addresses societal concerns but also positions ExxonMobil as a responsible corporate citizen in today’s ever-evolving energy landscape.

Chevron Corporation (CVX)

Chevron Corporation, also known as Chevron, is a leading global player in the oil industry. With a diverse portfolio of upstream and downstream assets worldwide, Chevron focuses on efficient operations, advanced technologies, and sustainable practices to drive long-term value creation.

The company boasts a strong financial position supported by disciplined capital allocation strategies and a commitment to shareholder returns. Through strategic investments in high-quality projects and continued focus on operational excellence, Chevron aims to deliver sustainable growth over time.

Additionally, Chevron embraces advanced technologies to improve efficiency and reduce environmental impact. The company’s dedication to sustainability extends to community engagement and social responsibility, making positive contributions wherever it operates.

With decades of experience and a steadfast commitment to delivering long-term value, Chevron remains well-positioned for success in the dynamic global energy landscape.

| Name: | Chevron Corporation (CVX) |

| Industry: | Oil and gas |

| Portfolio: | Upstream and downstream assets worldwide |

| Focus: | Efficient operations, advanced technologies, sustainable practices |

| Financial Standing: | Strong financial position, disciplined capital allocation |

| Future Plans: | Strategic investments, operational excellence, sustainable growth |

Note: The above table provides a summary of Chevron Corporation’s key attributes.

[lyte id=’VuCXVznO3hw’]

.jpg/120px-Anglo-Persian_Oil_Company_workers_(6).jpg)

.jpg/120px-Anglo-Persian_Oil_Company_workers_(1).jpg)

.jpg/120px-Anglo-Persian_Oil_Company_workers_(8).jpg)

.jpg/120px-Anglo-Persian_Oil_Company_workers_(4).jpg)