Investing can be intimidating for beginners. The complex jargon, fear of losing money, and lack of knowledge make it seem insurmountable. However, with guidance and resources, even novices can navigate investing successfully.

Starting small is important for beginners. By beginning with a modest investment, individuals can learn risk management and market dynamics without risking their savings. This helps build confidence over time.

Despite the challenges, beginners are not alone. Online platforms offer educational materials tailored to help them grasp fundamental concepts and develop essential skills. With perseverance and a proactive approach, beginners can overcome these struggles and pave the way for financial success.

Introducing Novo Minimum Balance

Novo Minimum Balance is a revolutionary feature offered by Novo, an investment platform dedicated to making investing accessible for everyone. It eliminates the high minimum balance requirements found on traditional platforms, allowing even those with limited funds to start their investment journey.

By breaking down this barrier, Novo empowers individuals from all financial backgrounds to grow their wealth and achieve their financial goals. Whether you’re a beginner or an experienced investor, Novo Minimum Balance opens doors and creates opportunities for financial success.

Breaking Down Novo Minimum Balance

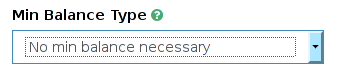

Novo Minimum Balance refers to the minimum amount of funds required to open an investment account on Novo’s platform. Unlike traditional investment platforms that often demand thousands of dollars as a minimum balance, Novo Minimum Balance provides a more accessible option for individuals with limited funds.

One of the key advantages of Novo Minimum Balance is its significantly lower entry point compared to traditional investment platforms. While many other platforms require substantial initial investments, Novo allows individuals to start investing with as little as a few hundred dollars.

This lowered financial requirement enables beginners to take their first steps into the world of investing without feeling overwhelmed.

By offering a lower minimum balance, Novo aims to bridge the gap between financial limitations and investment opportunities. This initiative opens doors for individuals who may have previously found it challenging to enter the investment market due to high financial requirements.

Novo’s approach recognizes that not everyone has access to large sums of money for investing purposes. By making investing more affordable and attainable, Novo Minimum Balance empowers individuals from diverse backgrounds and income levels to participate in wealth-building activities.

It is important to note that while Novo Minimum Balance reduces the barrier for entry, it does not compromise on the quality or range of investment options available on its platform. Users can still access a variety of investment opportunities tailored to their risk appetite and financial goals.

Benefits of Novo Minimum Balance for Beginners

Novo Minimum Balance offers accessibility and flexibility for beginners looking to start investing, particularly those with limited funds. By breaking down financial barriers, Novo empowers individuals to capitalize on compounding returns and potentially build long-term wealth.

Novo’s low minimum balance requirement makes it accessible to beginners with limited funds, allowing them to participate in investing early on. Additionally, the option of fractional shares enables investors to purchase a portion of a share, making high-priced stocks or ETFs more affordable and within reach.

By providing affordable and accessible investment options, Novo Minimum Balance is an excellent platform for beginners seeking to enter the world of investing. It allows them to overcome financial hurdles and take control of their finances at an early stage, setting them on a path towards long-term wealth accumulation.

Realizing Financial Goals with Novo Minimum Balance

When it comes to achieving our financial goals, understanding our personal objectives and developing a sound investment strategy is crucial. Novo Minimum Balance recognizes the importance of aligning investments with individual financial goals, providing the flexibility required to accommodate different objectives and timeframes.

To begin, setting short-term objectives while planning for the future is key. Whether it’s saving for a down payment on a house, funding education expenses, or planning for retirement, Novo acknowledges that each investor has unique aspirations.

With Novo Minimum Balance, investors can effectively set short-term goals while also ensuring long-term financial security.

Moreover, investing goes beyond solely making money; it involves supporting companies and industries that align with our personal values and interests. Novo Minimum Balance allows investors to customize their portfolios by selecting investments that reflect their beliefs and passions.

This level of customization empowers individuals to not only grow their wealth but also make a positive impact in areas they are truly passionate about.

By providing a platform for personalized investment strategies, Novo Minimum Balance enables individuals to actively work towards realizing their financial goals.

Whether it’s through short-term objectives or aligning investments with personal values, this innovative approach ensures that investors have the tools necessary to achieve success and build a secure financial future.

In summary, Novo Minimum Balance offers investors the opportunity to tailor their investment portfolios in accordance with their unique financial goals and values. By recognizing the importance of both short-term objectives and long-term planning, individuals can confidently pursue their aspirations while ensuring future financial security.

With Novo Minimum Balance at their disposal, investors are empowered to take control of their finances and realize their true potential.

Tailoring Investments to Individual Goals with Novo Minimum Balance

Novo Minimum Balance offers a range of investment options tailored to help investors achieve their specific financial goals. By creating a diversified portfolio based on individual risk tolerance, investors can manage risk and optimize returns.

Novo provides tools and resources that empower investors to make informed decisions and maximize their investment returns. With personalized goal-setting features, Novo ensures that investments align with individual objectives. Start your journey towards financial success with Novo Minimum Balance today.

Building Knowledge and Confidence with Novo Minimum Balance

Novice investors often lack the knowledge and confidence needed to make informed investment decisions. To address this, Novo Minimum Balance offers a range of educational resources tailored for beginners.

Their materials include interactive tools and tutorials that cover the basics of investing, such as understanding market trends, evaluating company fundamentals, and developing an investment strategy.

Novo’s resources also provide tips on diversifying investments for long-term success, helping investors mitigate risks associated with individual stocks or sectors. Additionally, their educational materials offer insights into risk management techniques to boost investor confidence.

Beyond foundational concepts, Novo’s resources delve into advanced topics like technical analysis and fundamental analysis, enabling investors to deepen their understanding and analytical skills.

Expert Advice: Navigating Risks and Building Confidence with Novo Minimum Balance

Novice investors often harbor fears and concerns when it comes to investing, particularly the risk of losing money. Novo Minimum Balance understands these apprehensions and aims to address them by providing expert advice tailored specifically to the needs of beginners.

One common fear that novice investors have is the fear of losing money and the need to mitigate risks. It is important to acknowledge that investing always carries a certain degree of risk. However, Novo offers a range of tools and resources designed to help investors understand and manage these risks effectively.

By diversifying their portfolios, setting realistic expectations, and staying informed about market trends, beginners can minimize their fear of financial loss.

Building confidence in investing requires gradual learning and gaining hands-on experience over time. Novo Minimum Balance recognizes this process and encourages beginners to start small, learning from their investments as they go along.

By taking calculated steps and gradually increasing their knowledge and exposure to different investment strategies, individuals can build confidence in their decision-making abilities.

To support novice investors on their journey toward financial success, Novo Minimum Balance provides personalized guidance tailored to each individual’s goals and risk tolerance.

By offering comprehensive educational resources, access to expert advisors, and interactive tools for tracking progress, Novo empowers beginners to make informed investment decisions confidently.

[lyte id=’sy8o9Z5_5RQ’]