Investing can be a complex endeavor, requiring careful analysis and decision-making. With so many funds available in the market, finding the right investment opportunities can feel overwhelming. That’s where Morningstar Premium Fund Screener comes in.

This powerful tool is designed to help investors navigate through the vast universe of funds and make informed investment decisions.

Introduction to Morningstar and its Role in Investment Analysis

Morningstar, established in 1984, is a trusted provider of investment research, data, and analytics. Their mission is to empower investors with objective insights into various investment options.

Through rigorous analysis of factors like performance, management, expenses, and risk measures, Morningstar offers comprehensive data on mutual funds, ETFs, stocks, and more. They provide unbiased ratings and expert commentary to help investors make informed decisions.

With a user-friendly platform and educational resources, Morningstar equips investors at every level with the tools they need for successful investing.

Overview of the Premium Fund Screener and its Benefits for Investors

The Morningstar Premium Fund Screener is a subscription-based tool that helps investors find funds that align with their goals and preferences. It offers advanced search filters to narrow down options based on criteria like asset class, investment style, performance metrics, and expense ratios.

The tool provides detailed fund profiles with information on holdings, sector allocations, ratings from Morningstar analysts, historical performance data, risk measures, expense ratios, and more. By utilizing these features, investors can make well-informed decisions and customize their searches.

Morningstar offers various subscription options tailored to different investor needs. Overall, the Premium Fund Screener simplifies the fund selection process for investors.

Subscription Options and Pricing Details

When it comes to accessing premium services, Morningstar offers flexible subscription options that cater to the diverse needs of investors. These subscriptions can be availed on a monthly or annual basis, allowing individuals to choose what suits them best.

Pricing for these subscriptions varies depending on the level of access and the features included. For basic access, prices can start from just a few dollars per month. This option is ideal for those who require essential information and analysis to make informed investment decisions.

However, for investors seeking comprehensive research reports, analyst ratings, and advanced tools, more extensive packages are available at higher price points. These packages offer additional features that provide valuable insights for making sound investment choices.

Before selecting a subscription plan, it is crucial to evaluate your specific needs as an investor. Consider your budget and goals carefully to ensure that you choose a plan that aligns with your requirements. By doing so, you can maximize the value you receive from Morningstar’s premium services.

To assist in decision-making, below is a table summarizing the different subscription options available:

| Subscription Plan | Price Range | Features Included |

|---|---|---|

| Basic Access | Starting at | Essential information |

| a few dollars | ||

| Comprehensive Package | Varies | Research reports, analyst ratings, advanced tools |

| based on | ||

| package |

Remember that investing in higher-priced plans offers access to enhanced features that can provide deeper insights into market trends and potential investment opportunities. Ultimately, choosing the right subscription plan will empower you to make well-informed investment decisions aligned with your financial goals.

Step-by-step guide on creating an account and logging in

To create an account on Morningstar, visit their website and click “Subscribe” or “Sign Up”. Follow the prompts to enter your information, choose a username and password, and select a subscription plan. Once your account is created, log in using your credentials on the website or mobile app.

Logging in grants access to all features based on your chosen subscription plan.

Exploring the Features of Morningstar Premium Fund Screener

The Morningstar Premium Fund Screener helps investors find funds that meet their criteria. Filter funds by asset class, investment style, expense ratios, performance metrics, and more. Detailed fund profiles provide comprehensive information like performance history and holdings. Advanced search options refine results based on specific parameters.

Comparison tools analyze multiple funds for better decision-making. The Premium Fund Screener simplifies the process of finding suitable investments for your portfolio.

Basic Search Filters for Narrowing Down Fund Options

Utilizing basic search filters is crucial in narrowing down your investment fund options. The Premium Fund Screener offers two essential filters to help with this process:

-

Asset class and investment style selection: By filtering funds based on asset class (stocks, bonds, commodities) and investment style (growth, value, blend), investors can focus on funds that align with their risk profile and objectives.

-

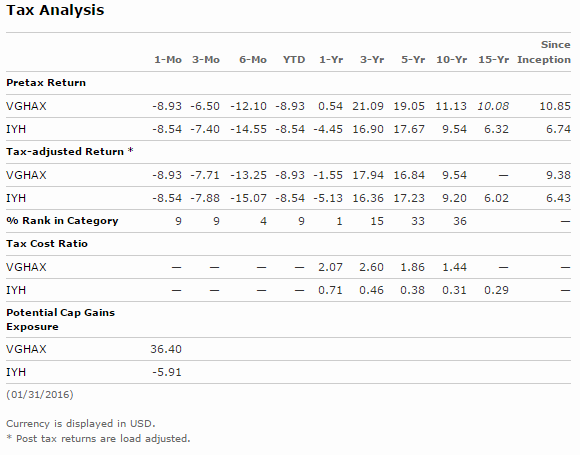

Evaluating expense ratios and performance metrics: The screener allows users to filter funds based on expense ratios, identifying low-cost options that may enhance long-term returns. It also provides performance metrics like total return, alpha, and standard deviation for valuable insights into a fund’s historical performance.

These basic search filters empower investors to make informed decisions by narrowing down their choices based on specific criteria important to them.

Utilizing advanced search filters for specific fund requirements

When it comes to finding the right funds that meet your investment goals, advanced search filters can provide a more tailored selection. The Morningstar Premium Fund Screener offers features like assessing manager tenure and experience, allowing you to focus on funds managed by experienced professionals.

Additionally, you can analyze portfolio characteristics and risk measures such as sector allocations and credit quality. By utilizing these advanced filters, you can find funds that align with your specific preferences and investment goals.

[lyte id=’qRfRqtCMMOE’]