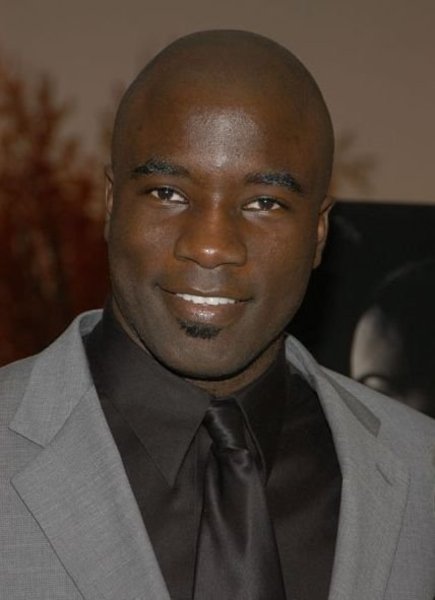

Mike Shorr is a renowned trader in the world of trading and investing. With a strong passion for finance, he quickly made a name for himself with his impressive track record. Born and raised in a small town, Shorr developed his skills in economics before diving into the world of trading.

Shorr’s success can be attributed to his ability to analyze market trends and make calculated decisions. He emphasizes risk management as crucial for long-term success. His expertise extends across different asset classes, including stocks, commodities, and currencies.

In addition to his professional achievements, Shorr is dedicated to sharing his knowledge with aspiring traders. Through workshops and seminars, he empowers individuals with the skills needed to navigate the complexities of financial markets.

Overall, Mike Shorr’s background showcases a remarkable journey from humble beginnings to becoming a trusted name in the trading industry. His dedication, expertise, and commitment to sharing knowledge make him an inspiring figure within the finance community.

Early Experiences and Passion for Trading

Mike Shorr’s passion for trading began at an early age. Fascinated by the financial markets and their potential for growth, he started studying investment strategies and learning about different types of investments. This early exposure ignited a fire within him, driving him to pursue a career in trading.

Through dedication and perseverance, Mike Shorr has built a successful career in trading. His early experiences laid the foundation for his remarkable journey, instilling in him the determination and drive necessary to navigate the complexities of financial markets.

Today, he combines his love for finance with analytical thinking and strategic decision-making to achieve continuous growth and success.

Challenges Faced and Lessons Learned Along the Way

Mike Shorr’s journey as a trader was not without its challenges. He encountered market volatility, economic downturns, and the unpredictable nature of investing. However, instead of giving up, he used these obstacles as opportunities to learn and grow.

Analyzing his mistakes and seeking guidance from experienced traders allowed Mike to develop a deep understanding of market dynamics. Patience, discipline, and adaptability became essential traits for success in trading. He also learned the importance of staying updated with market trends and implementing effective risk management strategies.

Emotional resilience played a significant role in Mike’s ability to overcome setbacks. Rather than dwelling on past mistakes, he focused on improving his strategies moving forward.

Facing these challenges head-on paved the way for Mike Shorr’s growth as a seasoned trader. By embracing them as opportunities rather than roadblocks, he built a solid foundation for future achievements in the world of trading and investing.

Different Types of Investments (Stocks, Bonds, Commodities)

To successfully navigate the world of trading and investing, it’s important to understand the different types of investments available. Stocks represent ownership shares in companies, offering potential growth and profits. Bonds are debt instruments that provide fixed interest payments over time.

Commodities include tangible goods like gold or oil that can be bought or sold on exchanges. Each investment carries its own risks and rewards, so understanding them is crucial for successful trading.

Importance of Diversification in a Portfolio

Diversification is crucial in investing as it helps mitigate risk. By spreading investments across different asset classes, sectors, and regions, investors can reduce their exposure to fluctuations in any single investment. Mike Shorr understands this importance and actively identifies opportunities in various markets and industries.

This approach helps minimize market volatility’s impact and increases the likelihood of consistent returns. Diversifying across asset classes and geographies ensures resilience during economic downturns and exposes investors to diverse growth potential. Embracing diversification is a practical strategy for long-term success in investing.

Analyzing Market Trends and Patterns

Effective analysis of market trends and patterns is a fundamental skill that sets successful traders apart. By closely monitoring economic indicators, news events, and utilizing technical analysis tools, traders can identify potential opportunities for profit.

To begin with, studying historical price movements provides valuable insights into market behavior. Chart patterns are meticulously examined to recognize recurring formations such as double tops or bottoms, head and shoulders, or triangles.

These patterns serve as visual representations of the market’s sentiment and can help predict future price movements.

In addition to chart patterns, indicators like moving averages or the relative strength index (RSI) play a crucial role in analyzing market trends. Moving averages smooth out price fluctuations over a specific period, enabling traders to identify long-term trends.

On the other hand, the RSI measures the strength and speed of price movements to determine whether an asset is overbought or oversold.

By combining these analytical approaches, skilled traders like Mike Shorr can make informed decisions about when to enter or exit trades. Identifying emerging market trends before they become widely recognized allows them to capitalize on potential opportunities early on.

It’s worth noting that this analytical approach requires continuous monitoring and adjustment. Market conditions are ever-changing, so staying up-to-date with current news events and adapting strategies accordingly is essential. This dynamic approach ensures that traders can adapt to shifting market dynamics effectively.

Utilizing technical analysis tools effectively

Technical analysis is vital for Mike Shorr’s trading strategy. He employs various tools to analyze past price movements and predict future trends. These include chart analysis, trend lines, Fibonacci retracements, and candlestick patterns.

Charts help Mike identify patterns and trends, enabling him to make accurate predictions. Trend lines guide him in determining entry and exit points for trades. Fibonacci retracements identify support and resistance levels, allowing him to set appropriate stop-loss levels.

Candlestick patterns provide insights into market sentiment and potential trend reversals.

By effectively utilizing these technical analysis tools, Mike can make informed trading decisions, manage risk, and develop a winning strategy.

Identifying Profitable Opportunities in the Market

To develop a winning trading strategy, it is crucial to identify profitable opportunities in the market. Mike Shorr excels at this by combining fundamental and technical analysis techniques.

Shorr conducts thorough research on companies, industries, and macroeconomic factors to find undervalued or overvalued assets. By aligning his fundamental analysis with technical indicators, he can confirm trade timing and increase success probability.

This integrated approach allows Shorr to capitalize on profitable opportunities while minimizing risk. His expertise in combining fundamental and technical analyses sets him apart as a trusted expert in identifying profitable opportunities in the market.

[lyte id=’F4B6711pEcQ’]

.jpg)

.jpg)

.jpg)

.jpg)