Investing in the future has always been a smart move, and one sector that is gaining significant attention is electric vehicles (EVs). As the world shifts towards more sustainable transportation options, the demand for EVs is rapidly increasing.

With this surge in popularity comes a growing need for lithium-ion batteries, making investing in lithium car battery stocks an attractive opportunity for investors. In this article, we will explore the rise of electric vehicles, the dominance of lithium-ion batteries in the EV market, and why investing in this sector holds immense potential.

Understanding Lithium-Ion Batteries

Lithium-ion batteries are essential components that power electric vehicles (EVs), and comprehending their functioning is crucial before delving into the investment aspect. Unlike traditional lead-acid batteries found in gasoline-powered cars, lithium-ion batteries offer numerous advantages that make them the preferred choice for EV manufacturers.

One of the primary benefits of lithium-ion batteries is their lightweight nature, which contributes to improved overall vehicle performance. Additionally, these batteries have a higher energy density compared to lead-acid counterparts.

This means they can store more energy in a smaller volume, allowing EVs to cover longer distances on a single charge.

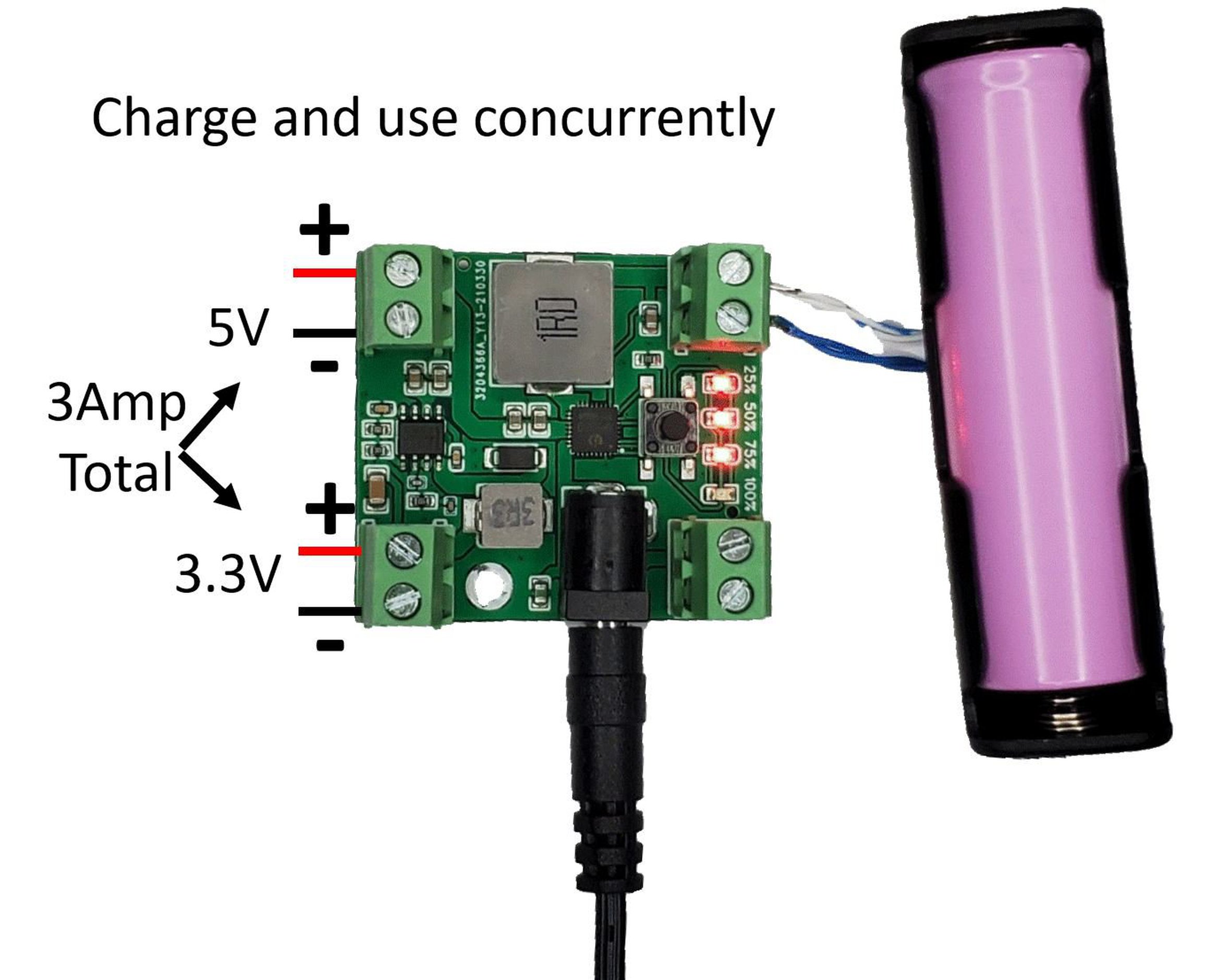

Another significant advantage of lithium-ion batteries is their ability to be charged and discharged multiple times without losing efficiency. This characteristic, known as cycling stability, ensures that the battery retains its capacity and effectiveness over time.

EV owners can recharge their vehicles frequently without worrying about diminishing battery performance.

Despite these notable benefits, it’s important to acknowledge that lithium-ion batteries also have certain drawbacks. To begin with, they can be expensive to manufacture initially due to complex production processes and the need for specific raw materials.

However, as technology continues to advance and economies of scale are achieved through mass production, prices are expected to decrease.

Furthermore, lithium-ion batteries require careful handling due to their sensitivity to extreme temperatures. Exposure to high heat or cold can affect their performance and lifespan.

Manufacturers have implemented various measures like thermal management systems in EVs to regulate battery temperature and ensure optimal operation under different climatic conditions.

Investing in Lithium Car Battery Stocks: An Overview

Investing in lithium car battery stocks offers a unique opportunity to capitalize on the growth potential of electric vehicles (EVs) and renewable energy solutions. As the demand for EVs continues to rise exponentially, so does the need for lithium car batteries.

These batteries are preferred for their high energy density and longer lifespan compared to traditional options.

Lithium car batteries not only power EVs but also play a crucial role in storing energy generated by renewable sources like solar and wind power. Governments worldwide are pushing for cleaner transportation alternatives, making the future outlook for lithium car battery stocks favorable.

When considering investments in this sector, it’s important to evaluate market trends, technological advancements, and key industry players. Thorough research and staying informed about emerging developments will help investors make informed decisions.

While investing in any sector carries risks, the potential rewards of investing in lithium car battery stocks are significant. The continuous growth of the electric vehicle market and increasing adoption of renewable energy sources position this industry with long-term potential.

In summary, investing in lithium car battery stocks provides an opportunity to participate in an industry poised for substantial growth. By staying informed and conducting thorough research, investors can strategically position themselves within this expanding market.

Top Companies in the Lithium Car Battery Sector

The lithium car battery sector is rapidly evolving, driven by the demand for electric vehicles (EVs) and advanced battery technology. Leading this industry are notable companies such as Tesla, Panasonic, LG Chem, CATL, Albermarle, QuantumScape, and Microvast.

Tesla’s groundbreaking EVs and battery advancements have established it as an industry leader. Panasonic’s partnership with Tesla has yielded cutting-edge batteries for their popular models. LG Chem supplies high-capacity batteries to global automakers.

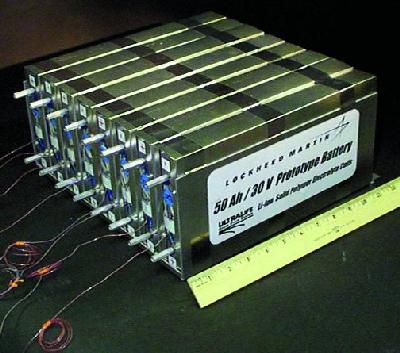

CATL provides technologically advanced batteries to international giants like BMW and Volkswagen. Albermarle ensures a steady supply of lithium chemicals for batteries. QuantumScape pioneers solid-state lithium-metal batteries, while Microvast specializes in high-power lithium-ion batteries for commercial EVs.

These companies are driving innovation and shaping the future of electric transportation.

Factors Affecting Lithium Car Battery Stocks

Government policies and regulations promoting electric vehicles and clean energy solutions, along with technological advancements that enhance battery efficiency and reduce costs, are key factors impacting lithium car battery stocks. Fluctuations in global supply and demand for lithium also play a significant role in influencing stock prices.

Additionally, consumer adoption rates for electric vehicles can affect the demand for lithium car batteries. Staying informed about these market dynamics is essential for investors seeking to navigate the evolving landscape of the electric vehicle industry.

Tips for Investing in Lithium Car Battery Stocks

When investing in lithium car battery stocks, thorough research is crucial. Analyze company fundamentals and focus on long-term potential rather than short-term gains. Diversify your portfolio with established companies like Tesla and Panasonic, as well as emerging players like QuantumScape and Microvast.

Stay updated on government policies promoting electric vehicles, advancements in battery technology, and supply chain dynamics. Consider companies’ environmental and social responsibility practices for sustainable investments. With careful consideration of these factors, you can maximize potential returns in this growing sector.

Risks Associated with Lithium Car Battery Stocks

Investing in lithium car battery stocks involves inherent risks. Market volatility and economic uncertainties can impact stock prices, while competition from alternative energy storage technologies poses a challenge. Additionally, environmental concerns related to lithium mining and disposal need to be addressed for sustainable practices.

Investors should stay informed, consider market trends, and promote industry collaboration to mitigate these risks effectively.

The Future Outlook for Lithium Car Battery Stocks

The future outlook for lithium car battery stocks is promising, driven by the growing electric vehicle market and advancements in battery technology. As more countries commit to reducing carbon emissions, the demand for cleaner transportation options continues to rise.

Improvements in energy density and charging capabilities present exciting opportunities for investors. Staying informed about industry trends and government policies is crucial for making well-informed investment decisions. Overall, the future of lithium car battery stocks looks bright, offering potential for substantial growth.

Case Study: Successful Lithium Car Battery Investments

Investing in lithium car battery stocks has proven to be highly profitable. Tesla, a prime example of success in this sector, has experienced exponential growth over the years. Their foresight and commitment to pushing technological boundaries have played a significant role in their achievements.

Other investors who recognized the potential early on have also enjoyed substantial rewards. The increasing global focus on reducing carbon emissions and government policies supporting electric vehicles further drive the demand for lithium car batteries.

Advancements in technology make these batteries more efficient and cost-effective, making them an attractive investment option. Investing in lithium car battery stocks offers a compelling opportunity to capitalize on evolving market trends and shape the future of the automotive industry.

[lyte id=’msPIWuxKKUg’]