Private equity has become a prominent player in the world of investing, with companies across various industries turning to this form of ownership. In this article, we will explore the concept of private equity and delve into the largest private equity owned companies.

We will also discuss the benefits and drawbacks for investors in these companies, as well as the impact on employees and operations. Furthermore, we will examine success stories, challenges faced by these companies, and future trends in private equity ownership. So, let’s dive in and uncover the fascinating world of private equity.

The Rise of Private Equity Ownership

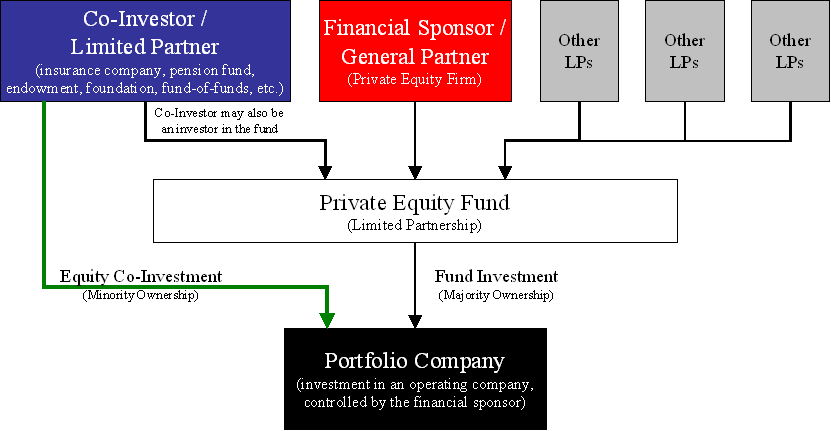

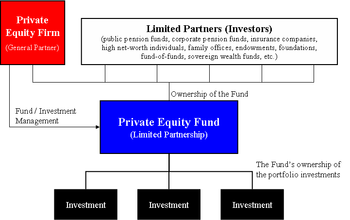

Private equity ownership has experienced significant growth, becoming a prominent investment strategy. It refers to investments made in privately held companies not traded on stock exchanges.

Historically, private equity gained traction in the 1970s through leveraged buyouts (LBOs), allowing investors to acquire businesses with minimal capital investment.

Companies choose private equity ownership for various reasons. It provides funding for expansion or restructuring initiatives that traditional lenders may avoid due to perceived risks. Additionally, it serves as an attractive exit strategy for business owners looking to retire or transition out of their roles.

Understanding the Largest Private Equity Owned Companies

Private equity ownership has become a force to be reckoned with in business. Major firms acquire and invest in companies across industries, managing them as part of their portfolios. These largest private equity owned companies benefit from substantial resources and strategic guidance.

Determining a company’s size in the private equity sector involves considering factors like investment capital, growth potential, and profitability. Firms prefer businesses with strong financial performance and promising prospects for future success.

Notable examples of largest private equity owned companies include:

- The Carlyle Group: Holdings in aerospace, defense, energy, healthcare, and technology sectors.

- Blackstone Group: Investments in real estate, infrastructure, energy, and retail sectors.

- KKR & Co.: Focus on healthcare, technology, media, and financial services.

These firms provide expertise and resources to enhance their portfolio companies’ competitive positions and drive long-term success.

Benefits and Drawbacks for Investors in Private Equity Owned Companies

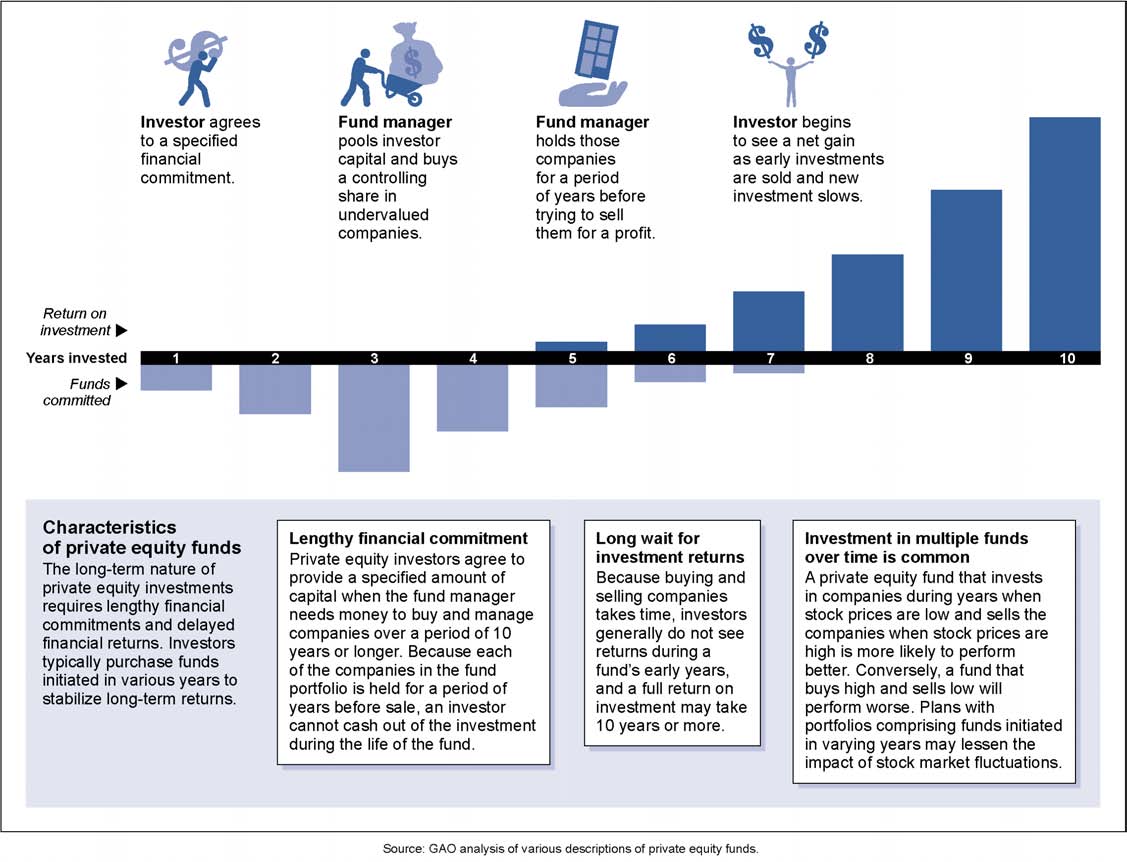

Investing in private equity owned companies has its advantages and drawbacks. On the positive side, it offers potential for high returns due to active involvement by private equity firms in improving company performance. Investors also gain access to exclusive investment opportunities not available elsewhere.

Additionally, they have a say in strategic decisions and can actively contribute to company growth. However, there are drawbacks to consider. Investments in private equity are illiquid and require longer commitment periods.

Fees are typically higher compared to traditional funds, and there is a higher risk associated with concentration in a single investment. Diversification is crucial but may not always be achievable for individual investors.

It’s important for investors to carefully weigh these factors before making decisions about investing in private equity owned companies.

Impact on Employees and Operations within Private Equity Owned Companies

Private equity firms acquiring companies often bring about changes in management structure, operational strategies, and financial targets to enhance operational efficiency and profitability. These changes may result in increased job stability, growth opportunities, and improved compensation packages for some employees.

However, others may experience job cuts or changes due to efforts to streamline operations. Private equity-owned companies align employee incentives with company goals through performance-based compensation structures or stock options.

Successful case studies include Bain Capital’s turnaround of Dunkin’ Brands, which led to increased job stability through strategic initiatives, and The Carlyle Group’s investment in Beats Electronics, resulting in brand growth and new opportunities for employees.

Private equity ownership aims to optimize performance while prioritizing employee engagement.

Success Stories: Notable Private Equity Investments

Private equity firms have a strong track record of making successful investments that reshape industries and generate substantial returns. One example is the acquisition of Toys “R” Us by KKR, Bain Capital, and Vornado Realty Trust. Despite financial challenges, these firms turned the company around before its eventual bankruptcy.

Another notable investment is TPG’s early involvement in Airbnb, which propelled its growth in the hospitality industry.

Key factors contributing to success include strategic vision, operational expertise, and access to capital. Thorough due diligence helps identify risks and opportunities in target companies. Active involvement by private equity firms drives operational improvements, while adaptability to changing market dynamics is crucial for long-term success.

These success stories offer valuable lessons for aspiring investors, emphasizing the importance of research, active involvement, and adaptability. By applying these principles, investors can navigate the world of private equity with confidence and aim for similar achievements.

[lyte id=’U51ks4BqJBU’]